Application Process for Bank of Baroda SO Recruitment

The application process for the Bank of Baroda SO Recruitment 2025 typically involves the following steps:

- Notification and Advertisement: Bank of Baroda will release a detailed notification or advertisement outlining the specific roles, eligibility criteria, and the application process.

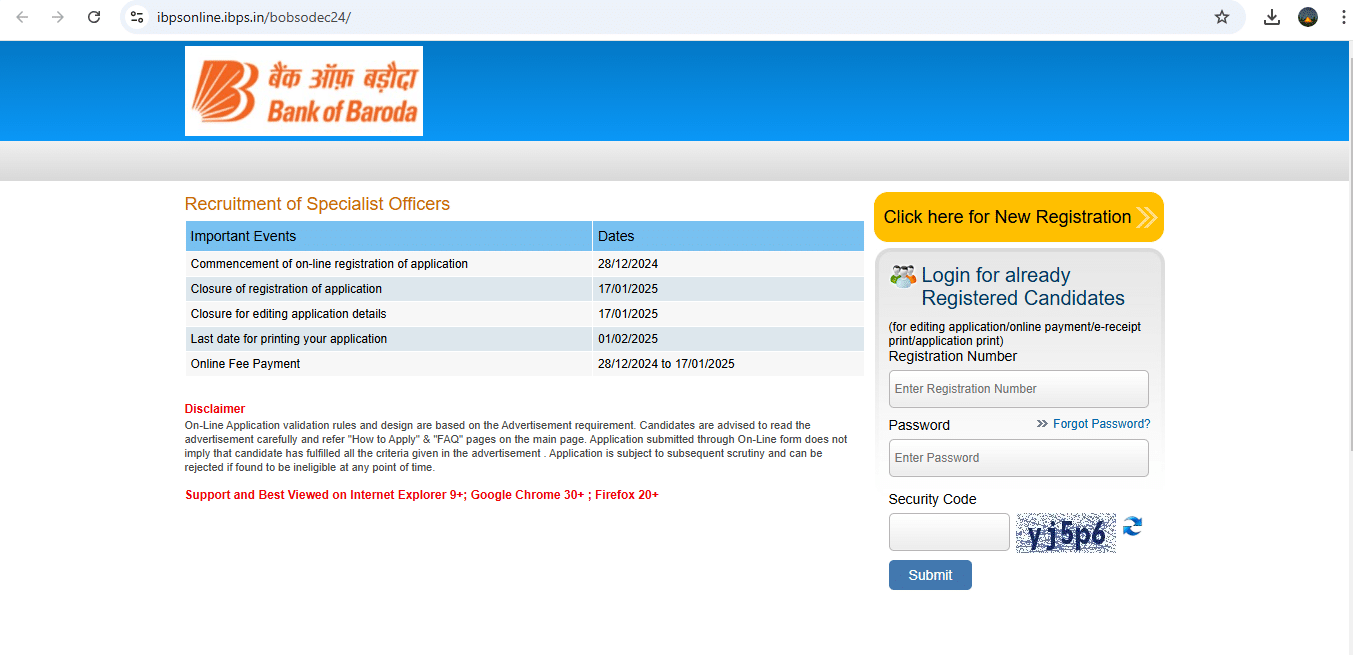

- Online Application: Candidates will be required to submit their applications online through the Bank of Baroda’s official website or the designated recruitment portal.

- Payment of Application Fee: Applicants will need to pay the required application fee, which may vary depending on the category (general, SC/ST, etc.).

- Document Verification: Shortlisted candidates will be called for document verification, where they will need to submit copies of their educational certificates, identity proofs, and other relevant documents.

- Preliminary Exam: Candidates who meet the eligibility criteria will be required to appear for a preliminary exam, which may consist of multiple-choice questions testing their reasoning ability, quantitative aptitude, and English language proficiency.

- Main Exam: Candidates who clear the preliminary exam will be invited to appear for the main exam, which will assess their subject knowledge, analytical skills, and overall suitability for the Specialist Officer role.

- Interview and Selection: Successful candidates in the main exam will be called for a personal interview, where they will be evaluated on various aspects, including their communication skills, problem-solving abilities, and overall fit for the role.

- Final Selection: Based on the performance in the interview and the overall assessment, the Bank of Baroda will release the final list of selected candidates for the Specialist Officer positions.

Eligibility Criteria for Bank of Baroda SO Recruitment

To be eligible for the Bank of Baroda SO Recruitment 2025, you must meet the following criteria:

- Educational Qualifications:

- Graduation in any discipline from a recognized university or institution

- Candidates with postgraduate degrees or professional qualifications (such as MBA, CA, CS, CFA) will be given preference

- Age Limit:

- Based on the Post Applied for visit official notification for more details.

- Nationality:

- Only Indian nationals are eligible to apply

- Language Proficiency:

- Fluency in English and the regional language of the state/UT where the bank has a vacancy

- Other Requirements:

- Candidates should have a clean record, with no criminal convictions or disciplinary actions

- Physically fit and able to perform the duties of the Specialist Officer role

It’s important to note that the eligibility criteria may be subject to change, so be sure to refer to the official recruitment notification for the most up-to-date information.

Roles and Responsibilities of a Bank of Baroda Specialist Officer

As a Specialist Officer at Bank of Baroda, you will have the opportunity to contribute to various aspects of the bank’s operations and play a crucial role in its growth and success. The primary responsibilities of a Bank of Baroda Specialist Officer may include:

1. Agriculture Marketing Officer (Scale I) & Manager (Scale II):

- Handles agricultural loans and rural banking initiatives

- Develops relationships with farming communities

- Assesses loan applications from agricultural sector

- Monitors crop patterns and provides financial advice to farmers

- Implements agricultural banking schemes

2.Liabilities Manager – Sales (Scale II)

- Manages deposit portfolio and liability products

- Leads sales teams for retail banking products

- Develops strategies to increase deposit base

- Maintains client relationships

- Ensures achievement of business targets

3.Credit Analysts (Scale II & III):

- Analyzes credit applications from MSME sector

- Assesses business viability and risks

- Prepares credit assessment reports

- Monitors loan performance

- Makes recommendations on loan approvals

4.MSME Relationship Manager (Scale III):

- Manages portfolio of MSME clients

- Develops new business opportunities

- Ensures compliance with banking guidelines

- Monitors account performance

- Provides business advisory services

5.Head SME Cell (Scale IV):

- Leads SME banking division

- Develops policies and procedures

- Manages team performance

- Ensures portfolio quality

- Strategic planning for SME growth

6.Security Analysts (Scale I, II & III):

- Monitors bank’s cybersecurity systems

- Implements security protocols

- Conducts security assessments

- Manages incident response

- Ensures compliance with security standards

7. Civil/Electrical Engineers (Scale I, II & III):

- Manages bank’s infrastructure projects

- Oversees maintenance of facilities

- Ensures compliance with safety standards

- Manages vendors and contractors

- Cost estimation and budgeting

8. Architect (Scale II):

- Designs bank branches and facilities

- Plans renovations and upgrades

- Ensures compliance with building codes

- Coordinates with contractors

- Manages project documentation

9. Relationship Managers (Scale III & IV):

- Manages large corporate accounts

- Develops new business relationships

- Structures complex financial solutions

- Monitors portfolio performance

- Ensures compliance with credit policies

10. Business Finance Managers (Scale III, IV & V):

- Manages bank’s financial planning

- Prepares financial reports

- Analyzes business performance

- Budgeting and forecasting

- Financial strategy development

11. Full Stack JAVA Developers:

- Develops banking applications

- Maintains existing systems

- Implements new features

- Ensures system security

- Performance optimization

12.Mobile Application Developers:

- Develops mobile banking apps

- Updates existing applications

- Ensures app security

- User interface development

- Performance optimization

13. Cloud Engineers:

- Manages cloud infrastructure

- Implements cloud solutions

- Ensures data security

- Performance optimization

- Disaster recovery planning

14.AI/ML Engineers:

- Develops AI/ML solutions

- Implements machine learning models

- Data analytics

- Process automation

- Performance optimization

15. Database/Network Administrators:

- Manages database systems

- Ensures data security

- Performance monitoring

- Backup and recovery

- Network maintenance

16. Data Scientists:

- Analyzes complex data sets

- Develops predictive models

- Creates data visualization

- Business intelligence

- Statistical analysis

17. Data Privacy Officers:

- Ensures data protection compliance

- Develops privacy policies

- Manages data security

- Conducts privacy assessments

- Training and awareness

Exam Pattern and Syllabus for Bank of Baroda SO Recruitment

The Bank of Baroda SO Recruitment exam typically consists of the following sections:

- Reasoning Ability: This section tests your logical reasoning, analytical skills, and problem-solving abilities. It may include questions on data interpretation, logical reasoning, and verbal reasoning.

- Quantitative Aptitude: This section evaluates your numerical and quantitative skills. It may include questions on arithmetic, algebra, geometry, and data analysis.

- General Awareness: This section assesses your knowledge of current affairs, banking and financial awareness, and general topics related to the banking industry.

- English Language: This section tests your proficiency in the English language, including vocabulary, grammar, reading comprehension, and verbal communication.

Career Growth Opportunities in Bank of Baroda

Joining Bank of Baroda as a Specialist Officer can open the door to a diverse range of career growth opportunities. As you progress in your career, you may have the chance to explore various paths, including:

- Managerial Roles: With your expertise and experience, you can climb the corporate ladder and take on managerial positions, such as branch manager, zonal manager, or regional manager.

- Specialized Roles: You may have the opportunity to specialize in areas like credit appraisal, risk management, treasury operations, or digital banking, further enhancing your skills and value to the organization.

- Leadership Positions: Exceptional performers may be considered for senior leadership roles, such as chief manager, assistant general manager, or even general manager, where you can contribute to the bank’s strategic decision-making.

- Cross-Functional Opportunities: The banking sector offers the flexibility to explore different domains, allowing you to gain diverse experience and expand your skill set. You may have the chance to work in areas like human resources, compliance, or business development.

- International Assignments: Depending on your performance and the bank’s expansion plans, you may be offered opportunities to work in the bank’s overseas branches or subsidiaries, broadening your global exposure and career horizons.

- Training and Development Programs: Bank of Baroda invests in the continuous learning and development of its employees, providing access to various training programs, workshops, and industry-leading resources to enhance your professional capabilities.

- Entrepreneurial Ventures: Some experienced bankers may choose to leverage their industry knowledge and network to venture into entrepreneurial opportunities, such as starting their own financial services or consulting firms.

Frequently Asked Questions (FAQs)

Q1: What is the application process for Bank of Baroda SO Recruitment? A: Candidates need to apply online through the official Bank of Baroda website. The process includes registration, form filling, document upload, and fee payment.

Q2: Are fresher eligible for Bank of Baroda SO positions? A: Yes, fresher can apply for Scale I positions in some departments, while higher scales require relevant experience.

Q3: What is the selection criteria for Bank of Baroda SO Recruitment? A: Selection is based on educational qualification, relevant experience, interview performance, and medical fitness.

Q4: Does Bank of Baroda provide training to selected candidates? A: Yes, selected candidates undergo comprehensive training programs specific to their roles and departments.

Q5: What are the career growth opportunities in Bank of Baroda for Specialist Officers? A: Specialist Officers have excellent career growth opportunities through regular promotions, specialized roles, and leadership positions.

Conclusion

The Bank of Baroda SO Recruitment represents a prestigious opportunity to join one of India’s leading public sector banks. With diverse positions across multiple domains and scales, it offers excellent career prospects for both fresh graduates and experienced professionals. The competitive pay scales, comprehensive benefits package, and clear career progression path make these positions highly attractive for banking professionals.

The Bank of Baroda SO Recruitment drive demonstrates the bank’s commitment to hiring specialized talent across various domains. Interested candidates should carefully review the eligibility criteria, prepare thoroughly for the selection process, and submit their applications within the specified timeline.

For aspiring banking professionals, this recruitment offers not just a job but a chance to build a rewarding career in one of India’s most respected financial institutions. The diverse roles available through this Bank of Baroda SO Recruitment ensure that professionals from various backgrounds can find their niche in the banking sector.