CBI Net Banking Login: Online banking has become a crucial part of handling personal finances in the digital world, where convenience and accessibility are paramount. CBI net banking, offered by the Central Bank is one such platform that provides seamless banking services. The Central Bank of India (CBI) was established in 1911 and it was the first commercial bank in India that was fully owned and managed by Indians.

Using CBI Net BankingCustomers can conduct various banking services from the convenience of their homes or offices. It is a user-friendly and secure online service. Though CBI Net Banking customers can access their accounts, check balances, transfer funds, pay bills, and perform a range of other transactions with just a few clicks, without visiting the branch. This article will explain CBI Net Baking Personal & Corporate Login & Registration Process, Available services, and other information.

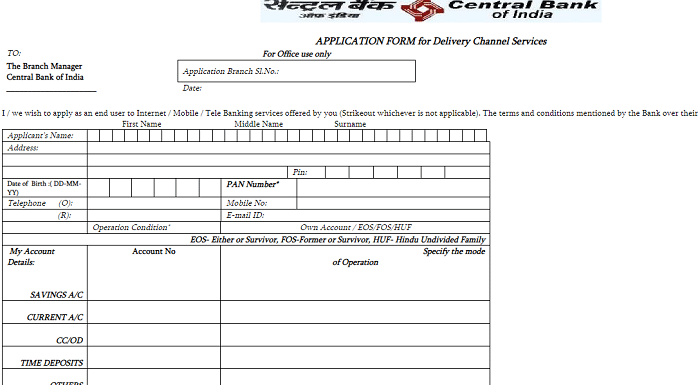

CBI Personal Net Banking Registration Process:

If any customer wants to register for the Central Bank of India (CBI) Internet Banking facility, they must follow the below steps.

- The customer should visit the nearest branch of CBI and collect the application form for the Internet banking facility.

- Or you can directly download the application form from the official website of the Central Bank of India (CBI) at https://www.centralbank.net.in/jsp/Register.htm.

- Now, you can take the printout of the form and fill out all the details accurately and submit the form to the home branch.

- Once the branch activates the Internet Banking facility, then you will visit the branch to collect the User ID (CIF Number).

- Using this CIF number, you can activate your CBI Net Banking facility.

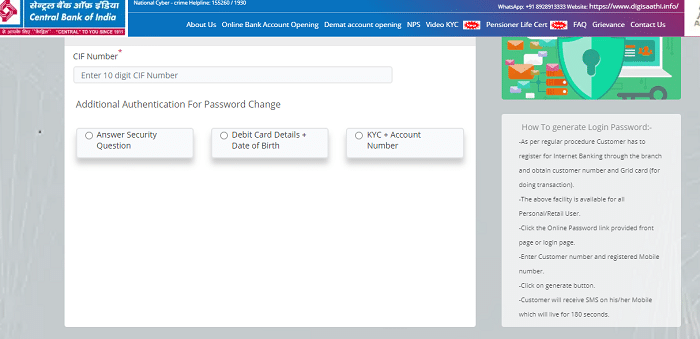

How To Create Online Login Password On CBI Net Banking Portal?

After submitting the application form, the bank will provide your CIF number. Using this number you can create your login password through the Central Bank of India (CBI) official website. The following are the steps to create a login password on the Central Bank of India (CBI) Internet banking portal.

- The applicant should visit the official website of the Central Bank of India (CBI) at https://www.centralbank.net.in/.

- The home page will appear on the screen. Here click on the ‘Login’ tab under the ‘Personal Banking’ section on the left side of the home page.

- The login page will open, here click on the “Online Password Generation” link below the login field.

- The online login password generation page will open, here enter your ‘CIF Number’ and complete the authentication process for password change.

- You can complete the authentication process in 3 options. Ie., either ‘Answer Security Question’, ‘Debit Card Details + Date of Birth’, or ‘KYC + Account Number”

- You can select any one option from the above choices and complete the process.

- After that, enter the ‘Registered Mobile Number’ and click on the ‘Generate’ option.

- Now, you will receive an OTP (One Time Password). Using the OTP set a new password immediately.

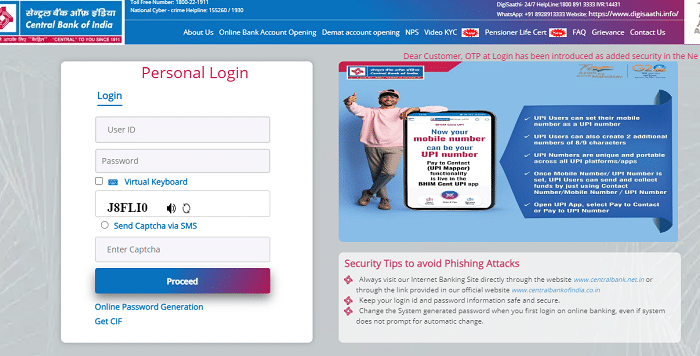

How To Login Into CBI Personal Net Banking?

Once you have completed the Online Login Password generation process, you can log in using CIF Number as a User ID and password generated by you. The following are the steps to login into the CBI Net Banking Portal.

- Open the official website of the Central Bank of India (CBI) at https://www.centralbank.net.in/.

- Click on the ‘Login’ tab under the ‘Personal Banking’ section on the left side of the home page.

- The Personal Login page will open, here you need to enter your “User ID”, “Password” and “Captcha Code” and then click on the “Proceed” button.

- Then you will be logged into the CBI Personal Net Banking portal successfully and you can access all the services available on it.

CBI Corporate Net Banking Registration Process:

To register on CBI Corporate Net Banking, you must follow the below steps.

- The applicant should visit the nearest branch of CBI and collect the application form for the Internet banking facility.

- Once you have the registration form, fill in the necessary details currently. The form will require information about your company, authorized signatories, account details, and other relevant information.

- Make sure to provide all the necessary documents and supporting information as mentioned in the form.

- After completing the registration form, submit it along with the mandatory documents to the Central Bank of India branch where your company holds the account.

- Ensure that all the documents are properly signed and attested as per the bank’s instructions.

- Once your registration is approved, you will receive a Corporate ID, Personal ID (CIF Number), and password from the bank.

- Using these Corporate ID, and Personal ID, you can generate an online login password for CBI Corporate Net Banking Login.

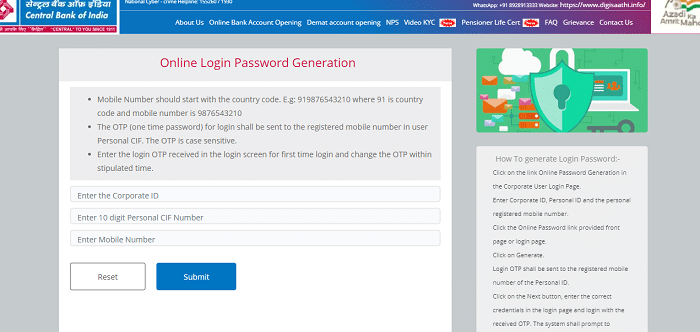

How To Generate Online Login Password On CBI Corporate Net Banking?

After submitting the registration form, the bank will provide your Corporate ID, Personal ID (CIF) number. Using these you can create a Corporate login password through the Central Bank of India (CBI) official website. The following are the steps to create a Corporate login password on the Central Bank of India (CBI) Internet banking portal.

- Go to the official website of the Central Bank of India (CBI) at https://www.centralbank.net.in/.

- On the home page, click on the “Login” tab under the “Corporate Banking” section on the right side of the home page.

- On the corporate login page, click on the “Online Password Generation” link below the login field.

- The online login password generation page will open, here you must enter “Corporate ID”, “10-digit Personal CIF Number” and “Mobile Number” and then click on the “Submit” button.

- An OTP will be sent to the registered mobile number of the Personal ID.

- Click on the next button, enter the correct credentials on the login page, and log in with the received OTP.

- Then the system shall prompt to change the login OTP and set the login password.

- Now, you have to enter the new password and confirm the password.

- The newly generated password shall be effective from the next login.

- In this way, you can generate a corporate online login password on the CBI Net Banking portal.

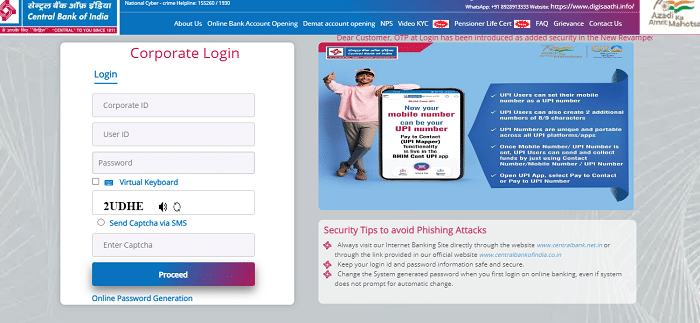

How To Login Into CBI Corporate Net Banking?

After completing the Corporate Online Login Password generation process, you can log in using your Corporate ID, Personal ID (CIF Number) as a user id, and password generated by you. The following are the steps to login into the CBI Corporate Net Banking Portal.

- Visit the official website of the Central Bank of India (CBI) at https://www.centralbank.net.in/.

- Click on the ‘Login’ tab under the ‘Corporate Banking’ section on the right side of the home page.

- The Corporate Login page will open, here you need to enter your “Corporate ID”, “User ID”, “Password” and “Captcha Code” and then click on the “Proceed” button.

- Then you will be logged into the CBI Corporate Net Banking portal successfully and you can access all the services available on it.

Facilities Available On CBI Net Banking Portal:

The following are the facilities available through CBI Net Banking.

- Online deposit account opening.

- Fund Transfer: Own account, within Bank, Other Bank through NEFT/RTGS/IMPS.

- Tax Payments.

- Online payment of Bills/recharges/fees etc.

- Online application of IPO using ASBA.

- DeMAT inquiry.

- Online Aadhaar Registration.

- Multi-utility fee collection.

- E-Filling of ITR returns.

- Transaction profile setting (Limits on service and beneficiaries) to secure transactions.

- NEFT/IMPS/RTGS transfers.

- Hotlisting/Control of ATM Cards.

- Online Locker Request.

- Registration for PMJBY/PMSBY.

- Registration for Atal Pension Yojana.

- PMNRF Donation.

- Chequebook request.

- Stop cheque requests.

The Central Bank of India offers a user-friendly and secure Net Banking platform which permits customers to take care of their personal and business banking requirements with ease from any place. It offers a range of features like checking account balances, transferring funds, paying bills, and accessing transaction history, all in a hassle-free manner. Using CBI Net Banking, customers can save time, reduce paperwork, and enjoy the benefits of digital banking with ease and peace of mind.