YONO SBI is a comprehensive digital Login platform offered by the State Bank of India, where YONO means ‘You Only Need One”. It aims to provide a unified and convenient banking experience for its customers. Using SBI Yono, customers can access a wide range of financial services, including account management, bill payments, online shopping, investment options, and much more, all through a single, user-friendly interface.

SBI Yono Mobile Banking is a feature-rich application that allows SBI customers to access a wide range of banking services directly from their mobile devices. This platform lets customers conveniently perform various banking activities such as account management, fund transfers, bill payments, investments, etc. This app allows customers to access their accounts and perform banking transactions at their convenience, whether at home, work, or traveling.

This article will explain SBI Yono Mobile Banking Registration Process, available service details, Transaction limits, and other information.

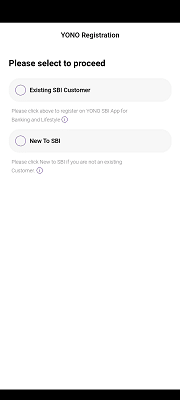

YONO SBI Mobile Banking Registration Process For Android:

- First, to login into your SBI account, open the Google Play Store, and in the search bar, type “YONO Lite SBI – Mobile Banking” and click on it.

- Now, you have to install the app on your mobile device.

- After installing the app, open it. Now you must select SIM1 or SIM2, registered with SBI, to complete the Registration process. No SIM selection is required in the case of a single SIM.

- A message will be shown on the screen regarding sending an SMS from the device to validate the mobile number.

- Click on the “Proceed” button, and an SMS containing a unique code will be sent to a pre-defined number from the device.

- Kindly note that the number for sending the SMS standard SMS charges is applicable per your SMS plan.

- On the registration screen, enter “User Name” and “Password”, and click on the “Register” button.

- Accept the ‘Terms & Conditions” for registration by selecting the check box and clicking the “OK’ button.

- After that, an activation code will be sent to the registered mobile number. This activation code will be valid for 30 minutes.

- A customer has to complete the activation by inputting the Activation Code in the app.

- Now, the user can log in to SBI YONO Mobile Banking App.

Registration Process For iOS – SBI Yono Mobile Banking:

- First, you must download and open YONO Lite SBI – Mobile Banking app from App Store to login to your account.

- A message will be displayed regarding sending an SMS from the device to validate the mobile number.

- Click the “Proceed” button and a unique code will be auto-filled in the default SMS app with a pre-defined number.

- To proceed, the user must send the SMS within 30 seconds from the phone number linked with SBI Account.

- You must note that for sending the SMS, standard SMS charges are applicable as per your SMS plan.

- Now, the registration screen will appear; here, enter “User Name” and “Password” and then click on the “Register” button.

- You must accept the “Terms & Conditions” for registration by selecting the check box and clicking the “OK” button.

- After that, we will send an activation code to your registered mobile number, and you need to complete the activation process by entering the code in the app.

- You can complete the registration process and log in to SBI YONO Mobile Banking App.

Services Available On YONO SBI Login Mobile Banking App:

Financial Transactions:

- Funds transfer to accounts in SBI and other Banks to registered beneficiaries.

- Credit Card (VISA) transfer.

- RTGS Funds transfer.

- Quick Transfer using IMPS for unregistered beneficiaries.

- mCash facility.

- Instant opening and closure of Term and Recurring Deposits.

- IMPS Funds Transfer.Top-Uo and DTH Recharge.

- Post-paid bill payment.

- Bill pay for registered billers.

- Voice Assisted Banking.

- UPI

Non-Financial Transactions:

- Manage Debit Cards Access and Transaction Limits.

- ATM cum Debit Card hot listing.

- m-Passbook.

- Cheque Book Request.

- Online Nomination.

- Locker Availability Enquiry.

- Aadhaar Linking.

- TDS Enquiry.

- Call Us.

- State Bank Collect.

- PPF Account.

- Transfer of Savings Account.

Transaction Limits For SBI Yono Mobile Banking:

The following are the transaction limits for the respective mode of transaction.

| Transaction | Per Day Limit (in Rs.) |

| Transfer within self accounts | 2,00,00,000 |

| Fixed / Recurring Deposit | 99,99,999 |

| Third-Party Transfer within SBI | 10,00,000 |

| Interbank Transfer – NEFT | 10,00,000 |

| IMPS | Per Txn Limit 5,00,000 |

| Quick Transfer | Per Txn Limit 10,000

Per Day Limit 25,000 (Overall Daily Limit 5,00,000 for both IMPS and Quick Transfer) |

| Credit Card VISA Transfer | 1,00,000 |

| mCash | 1,101 – Per Transaction

2,202 – Per Day. 5,101 – Per Month |

| UPI | Daily Transaction limit of Rs. 1,00,000 |

| Bill payment | 5,00,000 |

| Mobile Top Up & Top Up Buddy | Per Txn Limit 10,000

(Overall Daily Limit 50,000) |

| SBI Prepaid Cards | 50,000 |

| DTH Recharge | 50,000 |

| Postpaid Bill Payment | 50,000 |

| IMPS Merchant Payments | Overall Daily Limit 1,00,000 |

| SBI Life Premium | 50,000 |

| Transaction Limit for a newly added Beneficiary (First 4 days) | 1,00,000 |

Necessary Precautions Should Be Taken To Access SBI Yono Mobile Banking:

- After receiving the SMS with your User Id and default password, immediately log on to the Yono Mobile Banking app and change your default password.

- Please don’t disclose your User ID and Password to anyone.

- Please change your password at regular intervals.

- Please don’t use obvious passwords (like name, date of birth, etc.)

FAQs On SBI Mobile Banking:

What is Yono Lite SBI Mobile Banking?

Yono Lite SBI is the State Bank of India Retail banking application on Mobile. All the existing Yono Lite SBI app users and internet banking users can use this application. The application is available at Google Play Store, Apple App Store for iOS, and Microsoft Store for Windows. The customers can download the app from the respective application marketplaces and access the application with his/her Internet banking username and password.

Can I access this application from multiple or only one mobile phone?

No, it is mobile-bound. You can only access the device in which you are registered.

What are the requirements for accessing Yono Lite SBI?

- A smartphone with Android (OS 2.3 or above) and/or Apple (with iOS 4.1 or above), and/or Windows (OS 8.1 or above).

- Internet connectivity like GPRS/EDGE/3G/4G/Wi-Fi.

- SBI Debit card or internet banking User Name and Password.

The SBI Yono Mobile Banking integrates many banking services into a single app. The banking services are available 24/7. Customers can perform tasks such as checking account balances, reviewing transaction history, transferring funds between accounts, paying bills, etc., from their mobile devices. This comprehensive offering eliminates the need for multiple banking apps or visiting physical branches.