To transfer the amount from bank to bank, one must have Airtel Payments Bank IFSC Code. Airtel Payments Bank was founded in 2010. It is a subsidiary organization of Bharti Airtel. The IFSC is the Indian Financial Service Code given to every branch of every bank. The Reserve Bank of India gave the Airtel Payments Bank the status of a Scheduled Bank. The headquarters of the Airtel Payments Bank is situated in New Delhi. The founder of the Bank is Anubrata Biswas. The Reserve Bank of India has assigned an 11-digit alpha-numeric code called the Indian Financial Service Code (IFSC) to every branch of India. People use this code for transactions between different banks. Like any other bank Airtel Payments Bank will also have an IFSC Code for each of its branches in India.

Ways To Find Airtel Payments Bank IFSC code:

As per the Reserve Bank of India, India offers three distinct methods of financial transactions: National Funds Electronic Transfer (NEFT), Real-Time Gross Settlement (RTGS), and Immediate Payment System (IMPS). Each of these transaction types requires an IFSC code. Let’s explore the various methods to obtain an IFSC code.

- You can find the IFSC on your Bank Passbook and bank Cheque leaflet.

- We can search for the IFSC code on the official website of the Reserve Bank of India. We can search for the IFSC code of any bank in the list available on the RBI.

- The IFSC code can be found on the official websites of banks. We can search with the IFSC code with the help of the Branch name of the Bank.

Airtel Payments Bank Login Procedure:

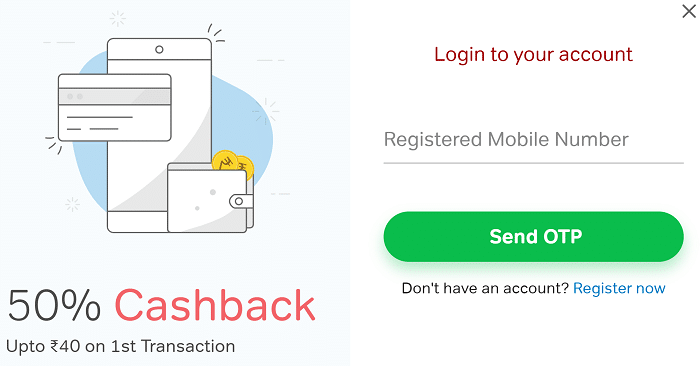

The users who want to log in to the website must have registered on the Airtel Payments Bank Official website. The official website of Airtel Payments Bank is https://www.airtel.in/bank/. The user must also have a bank account in Airtel Payments Bank to use and get registered on this website. Now let us see the procedure to log in to the website:

- Open the Official website of Airtel Payments Bank with the URL- https://www.airtel.in/bank/ on the browser of your personal computer.

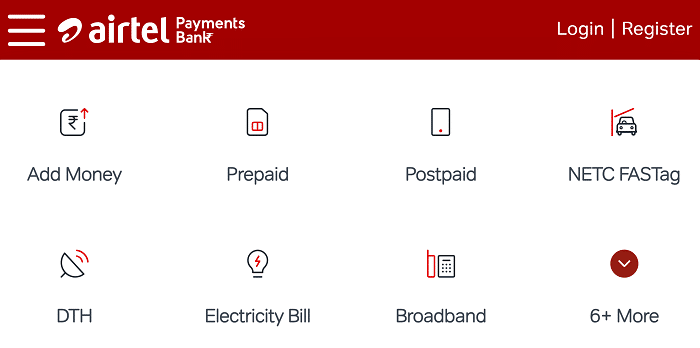

- Then it will display the home page of the Airtel Payments Bank official website.

- On the top right corner of the webpage, you can see the option “Login.” Click on it.

- The login section of the Airtel Payments Bank will take you to where you will be asked to enter your Registered Mobile number.

- Enter your mobile number and click the “Send OTP” button at the end of the Login Section.

- Then you will receive an OTP on your mobile phone and need to enter that OTP in the given space on the website.

- The system will take you to your Airtel Payments Bank online account and grant access to use the services on the website if the OTP is correct.

How To Find Banking Point Of Airtel Payments Bank?

The Airtel Payments Bank has almost 5 lakh branches and is trying to set up many new branches. So to find out the nearest Airtel Payments Bank branch, you have to follow the below steps:

- Open the Official website of Airtel Payments Bank with the URL- https://www.airtel.in/bank/.

- Then it will display the home page of the Airtel payments bank website.

- Scroll down the web page to the bottom to find a list of options headed “Help at Hand.” You must find the “Banking Points” option in that list and click on it.

- Then it will display an India map, and above that, it will ask you to enter “City or Pincode.”

- If you enter a city name, it will display the list of Airtel Payments Bank Branches available in the specified city.

- If you enter the Pincode of your location, it will display all the Airtel Payments Bank branches available in and around the location of the Pincode you mentioned.

Features Of Airtel Payments Bank:

- Airtel Payments Bank has 5 Lakh branches or Banking Points where consumers can open their accounts and perform many Financial transactions.

- Personal Accident Insurance Cover of 1lakh rupees is free on few conditions.

- Provides an interest of 6.0% to the consumers of their bank.

- An online Debit Card is Provided.

- Cash can be deposited in any Airtel Payments Bank which is near you.

- It also allows you to buy third-party Insurance.

- It allows you to withdraw money from any ATM, and the bank points are available near your place whenever needed.

- You can transfer money from the Airtel Payments Bank to any bank in India.

- It provides you a path to recharge your mobile, pay the DTH bills, Pay the Electricity Bill, pay a water bill, pay the gas bill, and many other monthly expenses or bills.

- It also allows you to book bus, train, and flight tickets through the Airtel application.

Products Of Airtel Payments Bank:

Airtel Payments Bank provides different products or services that make consumers use services and make their daily activities easy and comfortable. Now let us see the products provided by the Airtel Payments Bank:

- Whatsapp Banking

- Rewards 123

- Safe Pay

- Digi Gold

- Video KYC

- FASTag

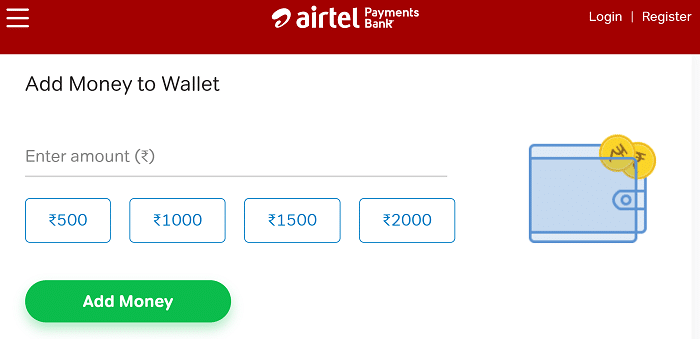

- Airtel Money Wallet

- Recharges(Mobile and DTH)

- Utility Payment

- Vector Borne Diseases

- Airtel Thanks App

- Savings Account

- Airtel UPI Referal

- Insurance Premium

- Atal Pension Yojana

- Travel

- Debit Card

Airtel Payments Bank IFSC Code – https://www.airtel.in/:

Airtel plans to invest 1 billion dollars in India, opening many branches to bring customers under its cloak. We expect Airtel Payments Bank to grow significantly in the coming days as it will soon have nearly 5 lakh customers or points of access. This growth will enable Airtel Payments Bank to offer numerous services to its customers.

Furthermore, Airtel Payments Bank is starting with one product called Airtel Money, a prepaid debit card that customers can use for various transactions. Additionally, these debit cards are accepted anywhere a debit card is accepted. Many people across the country are already using Airtel Money, and it might soon move on to provide more and more products and services to customers.