Cibil Score Check Free Online By PAN Number: Cibil score is the term used to describe the credit score generated by the Credit Information Bureau (India) Limited (CIBIL), which is one of the leading credit bureaus in India. It is a 3-digit numerical evaluation of a person’s creditworthiness that is based on their credit history. The score ranges between 300 and 900, with a higher score indicating better creditworthiness.

Banks and financial institutions share an individual’s credit history with CIBIL, which gathers and maintains this data. This includes credit card usage, loan repayment, and other credit-related actions. Lenders rely on this data to assess a person’s creditworthiness when reviewing loan or credit card applications, aiding in the calculation of their CIBIL score.

A higher CIBIL score indicates that an individual has a good credit history, and demonstrates responsible credit behavior. And is more likely to repay their loans on time. This increases their chances of getting approved for loans and credit cards and may also enable them to negotiate better interest rates and terms.

This article will give information about how to check your Cibil Score free online by using your PAN number, Cibil Score Range details, and the Cibil score calculation process.

How To Check Cibil Score Free Online By PAN Number?

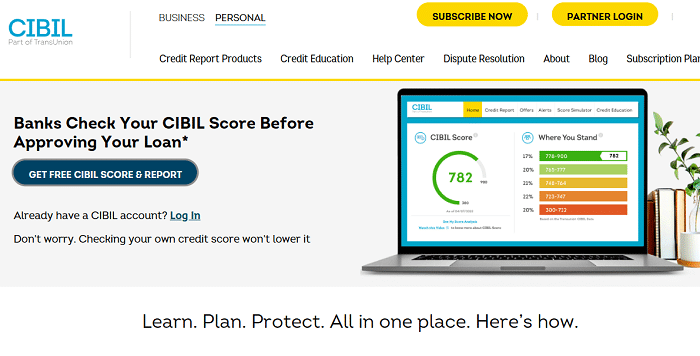

- Visit the official website of Cibil at https://www.cibil.com.

- The home page will appear on the screen, here click on the “Get Free Cibil Score & Report” link.

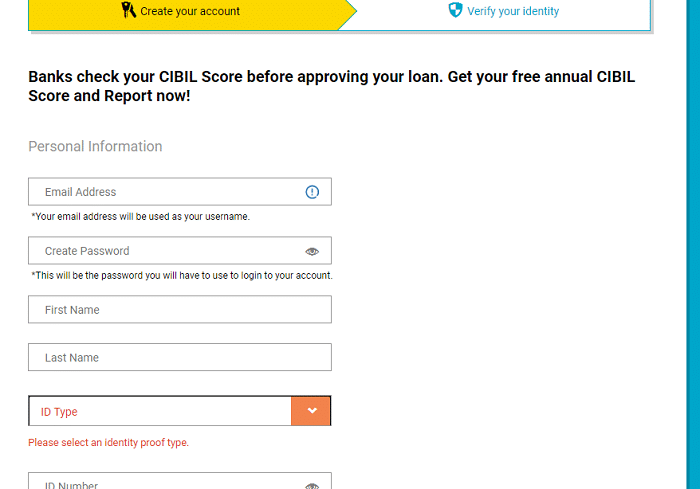

- The next page will open, here you have to create your account by entering the necessary details.

- You need to enter your “Email Address”, “Create a Password”, “First Name”, “And last Name”, and select the ‘“ID Type as Income Tax ID Number (PAN)” form the drop-down list.

- Now, enter the ‘PAN Number’, ‘Date of Birth’, ‘Pin Code’, and ‘Mobile Number’ and select ‘State’ from the drop-down list.

- After completing all the details, verify the details once again and then click on the ‘Accept & Continue’ button.

- On the next page, you have to select the alternative mobile number or email Id and press on ‘Continue’ button. You may also ‘Skip this Question.

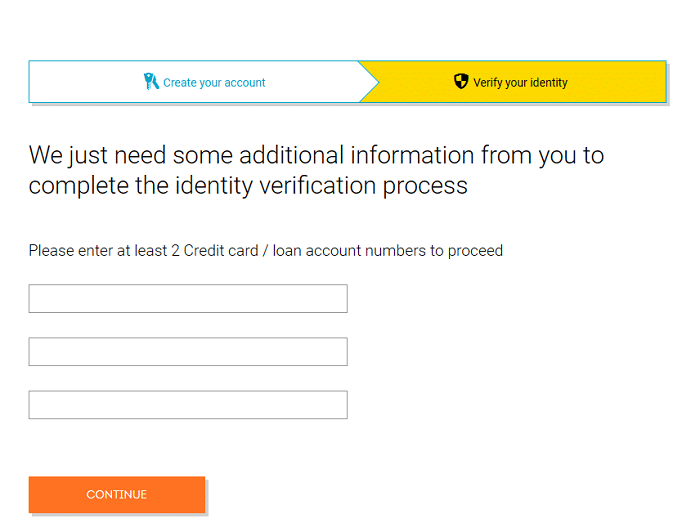

- After that, you need to provide some additional information to complete the identity verification process.

- For this, you must enter at least 2 Credit Card or Loan account numbers and then click on the ‘Continue’ button.

- After entering the necessary information, you have to go through an authentication process to confirm your identity.

- Once your identity is verified, you should be able to view your CIBIL score and credit report.

- In this way, you can easily check your Cibil score free online by PAN number.

CIBIL Score Range Details – Cibil Score Check?

The CIBIL Score range is a scale that represents your creditworthiness. The range of Cibil’s score is from 300 to 900. The general meaning behind the various score ranges is broken down as follows.

- Poor (300-549): If your Cibil Score is in this range, it suggests a poor credit history. It may indicate a sign of defaults, late payments, high credit utilization, or other negative factors. You can consider a high-risk borrower by lenders, which makes it difficult to obtain an authorized loan with good terms.

- Fair (550-649): A CIBIL Score in this range indicates a fair credit history. It suggests that lenders face a moderate level of risk. While you may be eligible for credit, you may still face limitations and higher interest rates compared to individuals with higher scores.

- Good (650-749): A Score in this range indicates a good credit history. It demonstrates responsible credit behavior, including timely payments, and moderate credit utilization. These people are typically seen by lenders as lower risk and are more likely to have their credit applications approved with favorable terms.

- Excellent (750-900): A Cibil Score in this range represents an excellent credit history. It indicates a strong track record of responsible credit management. Individuals with scores in this range have a higher likelihood of getting approved for credit with the best terms and interest rates available.

CIBIL Score Calculation Process – Cibil Score Check?

The Cibil Score is calculated using a complex algorithm that considers a number of aspects of your credit history. While the exact calculation methodology is private to Cibil, the following factors generally influence the calculation of your Cibil score.

- Payment History (35% weightage): This factor considers your track record of making timely payments on your loans and credit cards. Your credit score may be impacted negatively by any instances of late payments, defaults, or settled accounts.

- Credit Utilization (30% weightage): This component looks at how much credit you are currently using in relation to the overall credit you have available. A low credit utilization ratio, or just using a small amount of your available credit, is considered as good for your credit score.

- Credit History Length (15% weightage): The length of your credit history is taken into consideration. A longer credit history demonstrates your experience in managing credit and can positively impact your score, assuming you have a good repayment record.

- Credit Mix (10% weightage): Having a variety of credit types, such as a mix of secured and unsecured loans (eg home loan, vehicle loan, or credit card) is considered to be good for your score.

- New Credit Applications (10% weightage): This factor considers the number of recent applications and credit inquiries you have made. Multiple credit applications within a short period may view as an indication of financial stress and can have a negative impact on your credit score.

FAQs On Cibil Score Check:

What is the full form of CIBIL?

The full form of CIBIL is Credit Information Bureau (India) Limited. It is an authorized credit agency by the Reserve Bank of India (RBI).

What is the Cibil score check?

Cibil Score is a 3-digit numerical evaluation of individual creditworthiness that is based on their credit history.

What is the range of the Cibil Score?

The Cibil Score ranges between 300 and 900, with a higher score indicating better creditworthiness.

What are the other Credit Bureaus to provide credit score details?

The other Credit Bureaus are Experian, Equifax, and CRIF High Mark, these also provide credit scores based on their own methodologies.

What can I do to improve my Cibil Score?

Repaying your loans and credit card bills on time will help you to improve your Cibil Score.

The first step in managing your creditworthiness is to check your Cibil score. You may get your Cibil score free and learn important details about the state of your credit by following the instructions provided in this article. Always keep an eye on your credit report and take the necessary steps to improve your score if needed. Better credit opportunities and financial security making possible by having a high credit score.