HDFC Credit Card Status: HDFC bank management wants to provide consumers with a website that provides services online to avoid them coming to the office and availing of the services wherever they are. The official website of HDFC Bank is https://www.hdfcbank.com. This website provides many services online to consumers. It provides a channel to apply online for a credit card and tells you whether you are eligible for a credit card. You can also check the status of your credit card application.

How To Check HDFC Credit Card Status?

To check your HDFC credit card status, customers can utilize various methods. Follow these steps to check your HDFC credit card status through different methods.

Check Status Using HDFC Net Banking:

- Open the official website of HDFC Bank with the URL- https://www.hdfcbank.com.

- There it will display the home page of the HDFC Bank website.

- You must click the “Login” option in the web page’s top right corner.

- There it will display all the login options available in a drop-down list.

- You have to click on the “Net Banking” option among them.

- Then it will display the login section for Net Banking.

- Login to your net banking account with the credential you created during registration. Then you will be taken to your Net Banking profile.

- There you have to click on the cards section.

- If you have applied for a Credit card, it will display the “Track My Credit Card Application” option.

- If you cannot find the above option, go to Google search and type “HDFC Bank credit card status”. Then, it will display a few links where you must select the first link or click on it: “https://leads.hdfcbank.com/”.

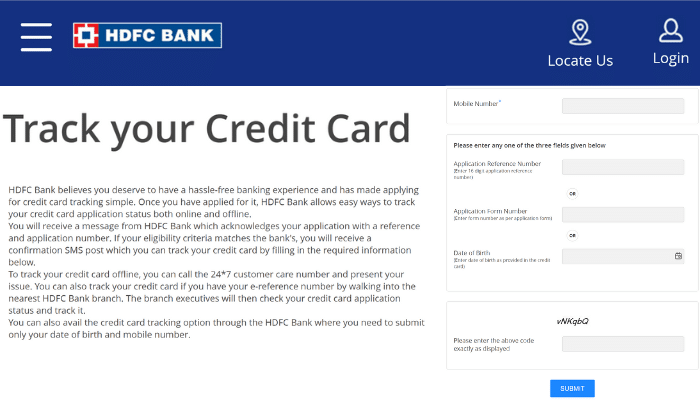

- Then it will display a window that asks you to enter your mobile number.

- Now it asks you to enter your “Application Reference Number”, “Application Form Number”, or “Date of Birth”.

- Enter the security code in the given space and click the “Submit” button.

- Then it will display the status of your credit card application on your screen.

Check Status Using HDFC Bank’s Customer Care Representative:

- Besides the online procedure, you can also check the credit card application status by calling the customer care representative of HDFC Bank.

- The Customer Care Representative number of HDFC Bank is 18002026161 or 18602676161.

- The representative will ask the details like the Application Reference Number, Application Form Number, Date of Birth, and Mobile number for security purposes and to check your application details.

- The representative will go through all your details and will reply to you about the application status.

Credit Card Status Check From Nearest HDFC Bank – Offline Method:

- In this method, you must visit the nearest HDFC Bank Branch and approach the employee working under the credit card section.

- Then you can enquire about your Credit Card Application Status.

- The employee will ask you to tell the application form number or reference number, date of birth, and mobile number registered with the HDFC net banking profile.

- Then the credit card section employee will check your application status on their system and tell the status to you.

How To Apply For HDFC Credit Card Online?

- Open the official website of HDFC Bank on your computer’s browser with the following URL- https://www.hdfcbank.com.

- Then you can see the home page of the HDFC bank website.

- On the right side of the webpage, you can see a card section with the heading “Continue your journey to get the Best HDFC bank Credit Card”.

- Below that, you can see options for Cards and Credit Cards.

- Click on Credit Card, and then it will display a drop-down list with options related to different types of credit cards.

- Select the option “Credit Card” among them.

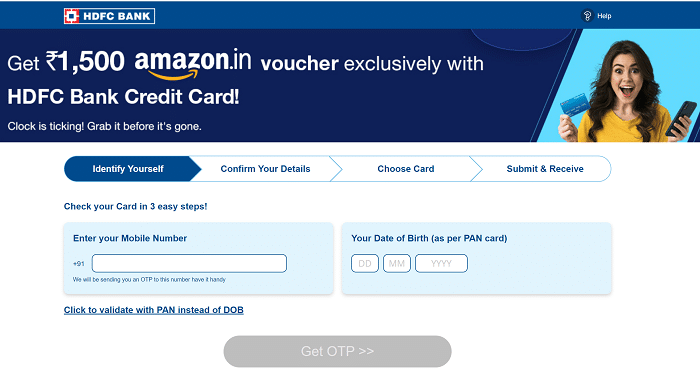

- There it will display four steps to apply for a Credit card online.

- The steps are as follows:

- Identify Yourself

- Confirm your Details

- Choose Card

- Submit and Receive

Documents Required To Apply For HDFC Bank Credit Card:

Proof Of Identity:

- PAN Card

- Aadhaar Card

- Driving License

- Passport

- Voter Identity Card

- Overseas Citizen of India Card

- Person of Indian Origin Card

- Job Card Issued by NREGA

- Letter issued by UIDAI

- Any other Photo Identity Card Issued by Government

Address Proof:

- Aadhar Card

- Driving License

- Passport

- Ration Card

- Power Bill

- Phone Bill

- Gas Bill

- Property Registration Card

Proof Of Income:

- Last three months’ Bank statements

- Pay slips of one or two months

- Latest Form-16 Document.

Apply For HDFC Bank Credit Card – Offline Method:

- Visit the Nearest branch of HDFC Bank. carry all the necessary documents(mention above) required to apply for the Credit Card

- Approach the Credit card section and tell the employee about the credit card requirement.

- Then the employee will provide you with the application for a credit card and will tell you the procedure to apply.

- Fill in all the details in the application properly without mistakes to avoid rejection.

- Fix your passport-size photograph and attach all the necessary documents to the filled application for a credit card.

- Now apply along with the documents to the credit card section employee.

- They will check all your details and send them to higher authorities for validation. The employee will tell you to leave the office and check the credit card status through your net banking account.

- You will receive the credit card through courier to the address you mentioned on the application form.

HDFC Credit Card Status – https://www.hdfcbank.com/:

HDFC Bank is of the largest private sector banks that provides various financial services to consumers. It is the first bank to get approval from the Reserve Bank of India to set up a private sector bank in India. It was started in the year 1994. To date, the bank has 7,821 branches all over the country. 19,727 ATMs, Cash withdrawal machines, and deposit machines provide services to consumers in India. Their services are spread in 3811 cities or towns in the country.