GST Login ID Password: GST Stands for Goods and Service Tax. A Goods and Service Tax (GST) was proposed sixteen years ago, during the period of Sri Atal Bihari Vajpayee as Prime Minister. Then, on February 28th, 2006, the then-union Finance Minister proposed in his budget for the following financial year of 2006-2007 that the GST would go into effect on April 1st, 2010.

GST in India replaced value-added taxes, service taxes, purchase taxes, excise duty, and other indirect taxes. It’s a single taxation system on specified goods and services. The Indian government has introduced the GST Portal for registration. Companies eligible for GST must register and receive a unique GSTIN.

GST registration is essential for all service providers, buyers, and sellers. For example, a Company must register for GST if its income is 20 lakhs or more within a financial year. This article will discuss GST Registration, required documents, GST Active Status check, GST Number Search in India, Types of GST in India, and other information.

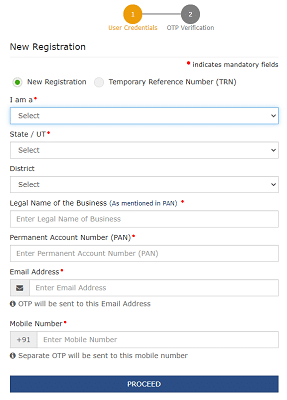

GST Login ID Password Registration Process On GST.Gov.In Portal:

The following are the steps to register for GST on GST Portal.

PAN, Email ID & Mobile Authorisation:

- The applicant should visit the GST Portal. I.e., https://www.gst.gov.in

- Go to the “Services” section and tap on the “Registration” tab and then press the “New Registration” option.

- The New Registration form will open; here, you must select a category, for example, “I am a Tax Payeer” or “I am a Tax Deductor,” etc.

- Now, select the “State” “District” and enter the “Legal Name of the Business (As Mentioned in PAN),” “Permanent Account Number (PAN),” “Email Id,” “Mobile Number,” and “Captcha Code” and then click on “Proceed” button.

- The GST Portal shows all the GSTINs / Provisional IDs / UNIs / GSTP IDs linked to the same PAN across India, and click the “Proceed” button.

- The OTP verification page will appear. Enter the OTP you received on your mobile number in the Mobile OTP field. OTP is only valid for 10 mins.

- In the Email OTP field, enter the OTP you received at your email address. And then click on the “Proceed” tab.

- The system-generated Temporary Reference Number (TRN) will appear on the screen, then click the “Proceed” button.

- Enter the Temporary Reference Number (TRN) and Captcha text in the corresponding fields, then click the “Proceed” button to continue.

- The “Verify OTP” page will appear, and you will receive the same OTP on your Mobile and Email.

- Enter the OTP sent to your mobile number and email address in the Mobile / Email OTP section. Select the “Proceed” button.

- My Saved Application page will appear on the screen; click the “Edit” icon under the action column.

Business Details & Aadhaar Authentication:

- The registration application form will appear and has several tabs. There are ten tabs on the top of the page. The charges are as follows:

-

-

- Business Details

- Promoter/Partners

- Authorized Signatory

- Authorized Representative

- Principal Place of Business

- Additional Places of Business

- Goods and Services

- State Specific Information

- Aadhaar Authentication

- Verification

-

Documents Upload & Complete Application Form Submission:

- Click on each tab to enter the details and upload the necessary documents. And then submit the application form.

- After submitting the application form, the success message will display on the screen. In addition, you will receive the acknowledgment in the next 15 minutes on your registered email address and mobile number.

- The Application Reference Number (ARN) receipt is sent to your email address and mobile number.

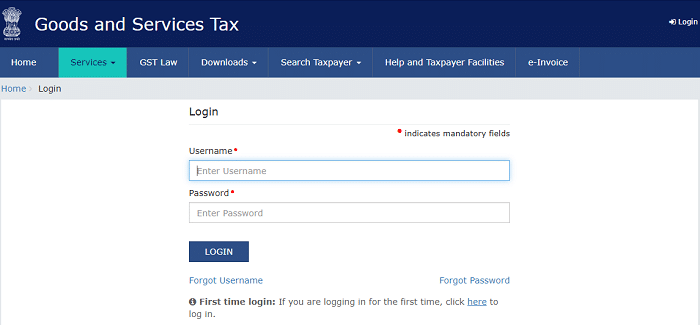

GST Portal Login Using GST ID Password:

The following are the steps to log in to GST Portal.

- Visit https://www.gst.gov.in website

- Press the “Login” tab on the top of the right side of the home page.

- You must Enter your “User Name” and “Password” and then click on the “Login” option.

- If logging in for the first time, click the Login tab below the “Click Here” link.

- The New User Login Page will open, enter your “Provisional ID / GSTIN / UIN” and “Password” and then press the “Login” button.

- Then you will be logged in to the GST Portal successfully.

Likewise, you can log in to your GST Portal using your unique ID and Password.

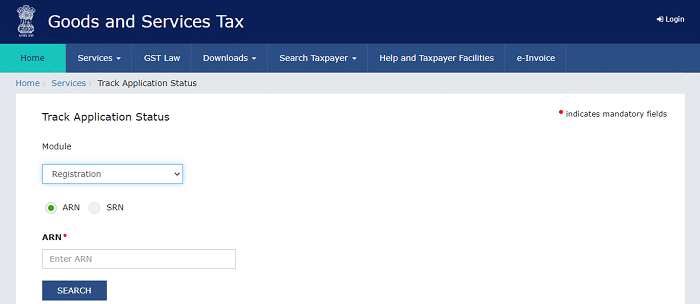

Check GST Application Status On GST Portal Without Using Login ID & Password:

Once you have completed the registration application process successfully, you will get an Application Reference Number (ARN). Using this ARN number, you can check the status of the GST Application. The following are the steps to check the quality of the GST application.

- Open the https://www.gst.gov.in website.

- Select the “Services” tab, press on the “Registration” tab, and click on the “Track Application Status” option.

- Here, you should enter your “Application Reference Number (ARN)” and click on the “Search” button.

- Then the GST Status details will appear on the screen.

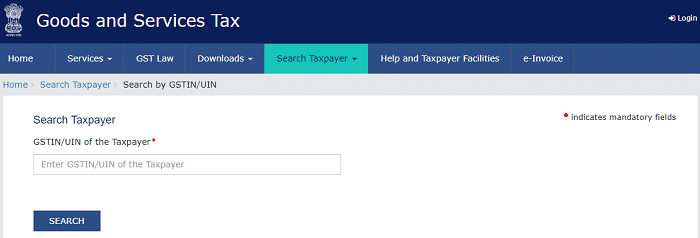

How To Search GST Identification Number (GSTIN) On GST Portal?

After completing the GST registration process, the applicant will get a GST registration certificate and GSTIN. If the applicant wants to search for their GSTIN, follow the below steps.

- Visit the GST Portal.

- You will see the home page in front of you, and on the navigation bar, select the “Search Taxpayer” tab.

- Click on the “Search by GSTIN/UIN” option and enter the “GSTIN/UIN of the Taxpayer,” and then click on the “Search” button.

- Then the detail will appear on the screen.

Necessary Documents For Online GST Registration:

The following are the documents mandatory for registration of GST.

Proprietorship:

- PAN Card

- Address Proof of Proprietor.

LLP:

- PAN Card of LLP

- LLP Agreement

- Partners’ names and address proof

Private Limited Company:

- Certificate of Incorporation.

- PAN Card of Company.

- Articles of Association, AOA.

- Memorandum of Association, MOA.

- Resolution signed by board members.

- Identity and address proof of directors.

- Digital signature.

Proof of Address of a Director:

- Passport.

- Voter ID

- Aadhaar Card

- Ration Card

- Telephone or Electricity Bill

- Driving Licence

- Bank Account Statement.

GST Tax Rates Details:

The GST rates are subject to change and may vary depending on the type of goods or services being supplied. Therefore, checking the current GST rates before purchasing or offering a service is always good. The following are the GST Tax rates in India.

- 0% GST applies to essential food grains, fresh vegetables, and medical supplies.

- 5% GST applies to processed food, packaged food, and some household items.

- 12 % GST applies to mobile phones, Laptops, Televisions, etc.

- 18% GST applies to Air Conditioners, Refrigerators, and Washing Machines.

- 28% GST applies to items like Luxury Cars, Tobacco, and Aerated Beverages.

- Also, 3% GST is applicable on Gold, 6% GST on Crude Oil and Natural Gas, and 18% GST is applicable on services like Telecom, Insurance, and Banking.

The Goods and Services Tax (GST) is a tax on the supply of certain goods and services in India. It replaced all indirect taxes like excise duty, service tax, and VAT. GST aims to simplify the tax structure and create one tax regime for all goods and services consumed in India. It will also help eliminate possible loopholes and increase revenue through administrative and technological means. The GST has been implemented across the country since 1st April 2010. It is a single tax regime with a national portal through which all the registered businesses can collect and transfer the market data based on the location, type of goods and services. This will help in the better functioning of the economy. Now that you know the background and basic information about the Goods and Services Tax, the following will help you to register for GST on an online portal.