MCGM Property Tax Payment Online: Are you tired of standing in long queues to pay your property tax and update your property details? You can now say goodbye to those tedious processes and embrace the convenience of online property tax payment and management.

The Municipal Corporation of Greater Mumbai (MCGM) has introduced an online portal, enabling property owners to pay taxes, download bills, update names, and make check payments conveniently from home or work. This user-friendly online platform streamlines transactions, saving time and effort with a few simple clicks.

In this article, we’ll be taking a closer look at the MCGM property tax payment online portal and how you can benefit from it. So, sit back, relax, and learn how to simplify your property tax payment and management process.

How To Make MCGM Property Tax Payment Online Using PTaxPortal.MCGM.Gov.In?

The property tax service provides a digital interface, allowing citizens to search and download property bills, make payments online, and download the payment receipt. The following are the steps to pay property tax in Greater Mumbai.

- First, head over to the official Greater Mumbai website, ptaxportal.mcgm.gov.in.

- You will be taken to the home page, with a “Timeline for updating Property Tax Records” page.

- Click on the “Skip” option to take you to the KYC page.

- Once you are here, click on “Ok” to proceed.

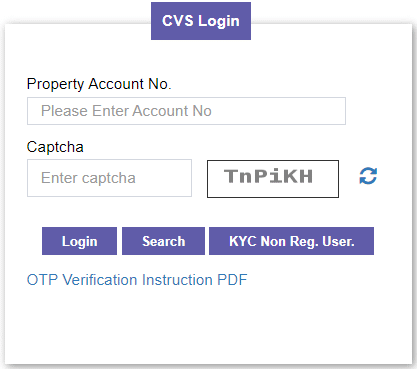

- The next step is to enter your CVS login page.

- You will be asked to enter your Property Account Number and the captcha displayed on the screen.

- Once you have done this, click on the “Login” option.

- After logging in, your details will appear on the screen.

- Check the details to ensure they are correct, and then click “Enter the Amount” you wish to pay (it can be either a full or partial payment).

- Once you have chosen your payment amount, click “Online Payment” and “Terms and Conditions” to confirm your payment.

- Select “Payment Gateway” from the dropdown menu and click “Pay Now.”

- If you have chosen to pay via Internet Banking, select your bank and enter your credentials to “Make Payment.”

- Upon completion of the payment, the Greater Mumbai Corporation of Greater Mumbai (MCGM) Property Tax will provide you with a receipt number as payment confirmation.

With these few steps, you can quickly and easily pay your property tax in Greater Mumbai.

Register Into MCGM Property Tax Portal To Make Tax Payments Online:

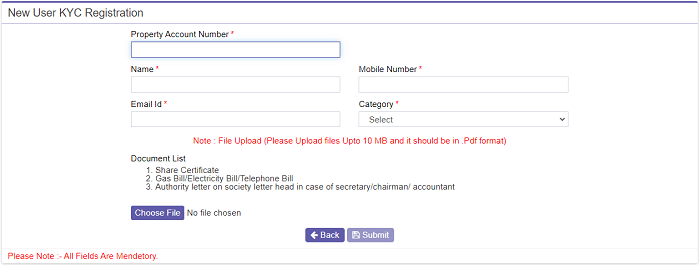

- If you are not a registered user, click ‘KYC Non Reg. User’ option on the MCGM Portal.

- A New User KYC Registration form will open; here, you must enter the Property account number, Name, Mobile Number, and Email Id and select the category.

- After entering all the details, you must upload the documents; the Document list is below.

- Share Certificate

- Gas Bill / Electricity Bill / Telephone Bill

- Authority letter on Society letterhead in case of secretary/chairman/accountant

- After uploading the documents, you have to click on the ‘Submit ‘button then your registration will be completed.

- After completing the registration, you can log in to the MCGM Portal to make Property Tax payments online.

Registering on the MCGM property tax portal allows you to easily make tax payments from the comfort of your home or office. Not only does this save you time and hassle, but it also lets you keep track of your past payments and download receipts for your records. Plus, with the added convenience of online payments, you never have to worry about missing a deadline or incurring additional fees.

Check Property Account Number To Make Property Tax in Greater Mumbai Using MCGM Online:

The following are the steps to know about how to check the property Account Number on Greater Mumbai’s official website

- To begin, go to the official website of Greater Mumbai State at www.ptaxportal.mcgm.gov.in.

- The ‘Timeline for updating Property tax Records’ is on the homepage.

- Click on the ‘Skip’ option to move to the KYC page, and click “Ok.”

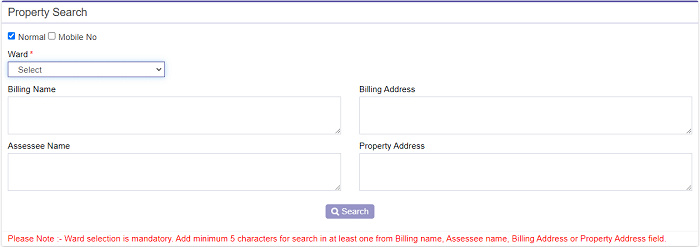

- You will then be taken to the CVS Login page, where you must click the ‘Search’ option.

- Once on the Property Search page, select your ‘Ward’ from the dropdown menu and fill in the fields for Billing Name, Billing Address, Assessee Name, and Property Address.

- After entering all the details, click on the ‘Search’ option to get the details.

- Then, click the ‘Respective Radio’ button or note down the Property Account Number from the matching MCGM Property Tax details list.

- You need to check the accuracy of the property details before proceeding further.

- Click the “View Bill” radio button to view the PDF document.

- This will open the PDF document on a separate page, where you can also opt to download or print it as you, please.

- Click the “Details” link under the “View Details” heading to check the tax details.

This will display the necessary tax information on the screen.

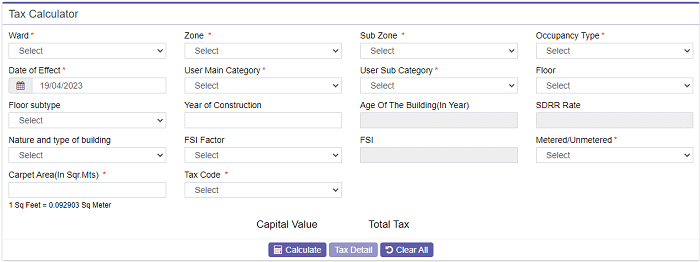

How To Calculate Your Property Tax Using MCGM Online Portal?

The amount you pay as property tax depends on your property’s type, location, and size. But calculating your property tax can be daunting, especially if you are unfamiliar with the process. Fortunately, MCGM has made it easy for property owners to calculate their property tax using their online portal. This article will guide you through calculating your property tax using the MCGM online portal.

- Open the official website of MCGM, i.e., https://ptaxportal.mcgm.gov.in/

- You can see a poster ad about Property Tax MCGM. Click on the Skip button.

- Now you will see a call about Completing KYC for your property in MCGM; tap on the “OK” button.

- Now you are on the actual home page of the MCGM Property Tax portal.

- To calculate your property tax, click the “Tax Calculator for any hypothetical example; click here, under Tax Calculator. Or, click here to go directly to the Tax Calculator page.

- You will be asked for mandatory details like Ward Number, Occupancy Type, etc., as shown in the image below.

- Click on the Calculate button to get the tax estimate for your property in the MCGM region.

By tapping on the “Tax Detail” button, you can get the exact tax details for your property in Mumbai.

MCGM Property Tax Payment Online – https://ptaxportal.mcgm.gov.in/:

To help facilitate a hassle-free tax payment experience for its citizens, the MCGM has created a technologically advanced online portal that allows anyone in the city to pay off their government-imposed fees online. This online portal is convenient and saves you time and energy, as you can complete your transactions with just a few clicks. Through the MCGM online portal, you can quickly and easily pay off your city-imposed fees, such as property tax, among other charges. Not only does this save you time and hassle, but it also lets you keep track of your past payments and download receipts for your records. Plus, with the added convenience of online payments, you never have to worry about missing a deadline or incurring additional fees.