ULB Haryana Property Tax: The citizens of Haryana State, who have any residential or non-residential property, must pay property tax. There are various ways to pay the property tax. For example, citizens can pay their property tax through Citizen Service Centre or online via the official Haryana Government website.

It is important to note that the property tax imposed on the property varies from state to state in India. In the state of Haryana, six properties are liable to be taxed: residential, commercial, industrial, institutional, government, and vacant land.

The following procedure starts with Registration, who is new to the ULB Portal and doesn’t have a Login. If you already have a ULB Haryana Login, you can start reading this article from “How To Search ULB Haryana To Pay”

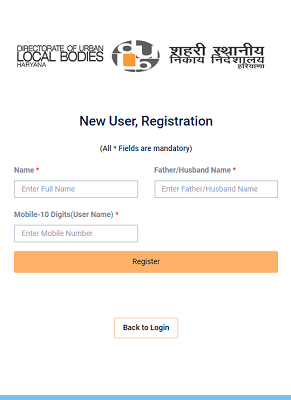

How To Register On ULB Haryana Portal To Pay Property Tax?

- Open a web browser and proceed to the address https://ulbhryndc.org/

- To join NDC, press the ‘New Registration’ button.

- Enter your Name, Father/Husband’s Name, and Mobile Number.

- Click ‘Register’ to continue.

- Once you press the ‘Register’ button, you will receive an OTP.

- Enter the OTP and then click ‘Verify OTP & Submit’.

- Following that, you will be successfully registered on the NDC Portal.

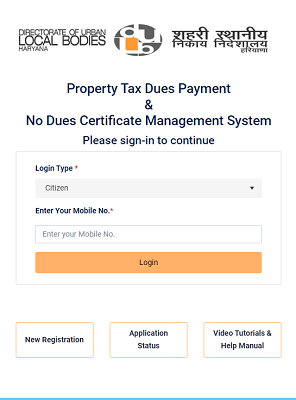

How To Login Into ULB Haryana Property Tax Portal?

- Log into the portal https://ulbhryndc.org/ using your registered mobile number.

- Once you have clicked the “Login” button, you will receive a 6-digit OTP on the same mobile number.

- Once you have entered the OTP, click “Verify OTP & Submit” to proceed.

Search ULB Haryana Property To Pay:

- Register a property under your phone number and view it on the dashboard.

- The dashboard consists of several tabs like Search Property, Download NDC, Re-Print Challan, etc.

- To search for a property, you can use the District, Municipality, Colony, Property ID, Owner Name, or Mobile Number.

- Once you have selected the District and Municipality and entered any other details (if applicable), click the “Search” button.

- This will show you a list of all the properties with their respective details.

How To Make ULB Haryana Property Tax Payment?

- The particulars of the chosen property will be visible on the screen.

- At the screen’s lower right-hand corner, click the “Make Payment” button to proceed.

- Enter the 6-digit OTP that was sent to your mobile phone.

- Select “Verify OTP & Submit”.

- After you enter the OTP, the list of unpaid fees will appear.

- If you want to make the full payment, press the “Pay Online” button to proceed.

- If you prefer making a partial payment, then:

- Uncheck the boxes for which you don’t want to pay.

- The total sum will be adjusted accordingly.

How To Download ULB Haryana Property Tax NO DUES Certificate (NDC)?

- Once the payment has been made, you can generate the No Dues Certificate (NDC) and the payment receipt.

- To print the payment receipt, click on “Print Receipt”.

- To view and print the NDC, click “Print NDC Receipt”.

Alternate Method To Download ULB Haryana Property NDC:

- If you need to download a No Dues Certificate later, you can easily log in to your profile and visit the “Download NDC” tab.

- There you will find a list of all the certificates that have been generated.

- If you want to find a specific certificate, you can use the “Transaction No” search bar to locate it quickly.

- Once you’ve found the certificate you need, click on “Action” to view and download it.

Apply To Create New Property ID In ULB Haryana Portal:

- If you cannot locate your property or have no Property ID (PID), you can create a new one by clicking “Please click here” at the bottom right corner of the page.

- Ensure to read all the terms and conditions and agree to the box.

- Then press the “Click here to proceed” button.

- This will direct you to a page where you must fill in the details to produce the new PID.

- Select the District, Municipality, and Colony where your property is, and the map with the boundary of the chosen locality will appear.

- Identify and locate your property on the map exactly, dragging the pointer and marking it.

- Hit “Next” to proceed.

- Then select the property’s ownership type and enter the owner’s details.

- If there is more than one owner, press the “Add Owner” button.

- Enter the Property & Construction Details, and if there is more than one floor, press the Add More button again.

- Upload the necessary documents to support your application, which must be in PDF, jpeg, or png.

- After selecting one of the PID Request types (New PID Request or New PID Request under Tatkaal Scheme), read the declaration and agree to the box, then press either “Submit Request” or “Pay Now and Submit Request”.

- Upon submission, a One-Time Password (OTP) will be sent to the registered mobile number, and an Application number will be generated to track the status of the application.

How To Check Your ULB Haryana Property ID Application Status?

- Under the My Property/Payment section, you can check the status of your property ID.

- Enter the appropriate data, such as your application number and mobile number, then click Search.

- The properties associated with the information will be displayed on the screen.

Alternate Method To Check Status Of ULB Haryana New Property ID Application:

- To observe the advancement of the application, you can head to the home page and type in the application id.

- Select “Check Application Status” and enter your Application ID.

- Press “Check Status”.

The Government of India levies an annual charge, known as property tax, on residential and non-residential property owners. This property tax is to be paid annually to the municipal corporation of the jurisdiction where the property or land is located. Property tax is an important source of revenue for Haryana and is paid by the property owners to the local government. It helps the government offer various services and amenities to the area’s citizens. The property tax helps the local government to build infrastructure and improve the quality of life of the people living in the area. This annual tax is vital to the government’s financial system and helps ensure the city’s smooth functioning.