Gujarat Property Tax Online Payment: Property tax is an important aspect of owning property in Gujarat, and it’s essential to understand the process of paying property tax in different municipal corporations. Ahmedabad Municipal Corporation (AMC), Gandhinagar Municipal Corporation, and Rajkot Municipal Corporation (RMC) have unique systems and requirements for property tax payments. As a property owner in Gujarat, it’s crucial to stay up-to-date with the latest regulations and guidelines to avoid penalties and legal issues.

This article will explore how to pay property tax in each municipal corporation and provide the necessary information to ensure you comply with the laws and regulations. So whether you’re a new property owner or a seasoned investor, read on to learn how to navigate the property tax system in Gujarat.

Gandhinagar Property Tax: How To Make Gujarat Property Tax Online Payment?

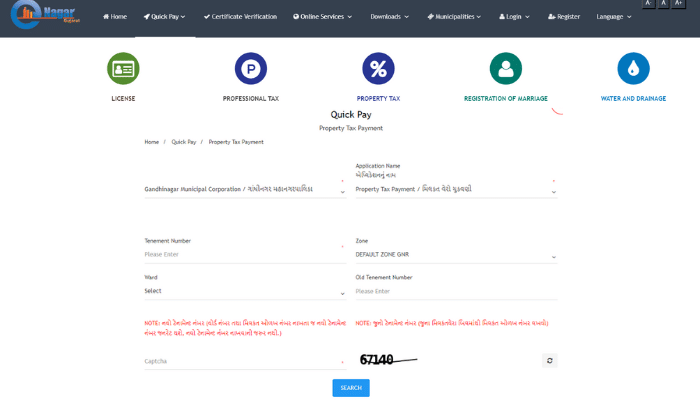

Live in Gandhinagar Municipal Corporation, Himatnagar Nagarpalika, Palanpur Nagarpalika, or Patan Nagarpalika ULB regions. You can pay property tax in Gujarat using the official website of the eNagar Gujarat Web Portal. i.e., https://enagar.gujarat.gov.in/.

- The citizen should visit the official website of eNagar Gujarat Web Portal Using https://enagar.gujarat.gov.in/

- The home page will appear, here have to click on the ‘Quick Pay’ option

- Then you have to click on “Property Tax Payment”.

- Quick Pay page will appear, now, you have to select the ULB Name, Application Name as Property Tax Payment, Tenement Number, Zone, Ward, Old Tenement Number and enter the captcha code, which is displayed on the screen, then click on ‘Search’ button.

- The next page will appear, this page contains the due amount along with your property details.

- After checking the due amount and property details, you have to click on the ‘Pay Button’ and select any online mode to make payment.

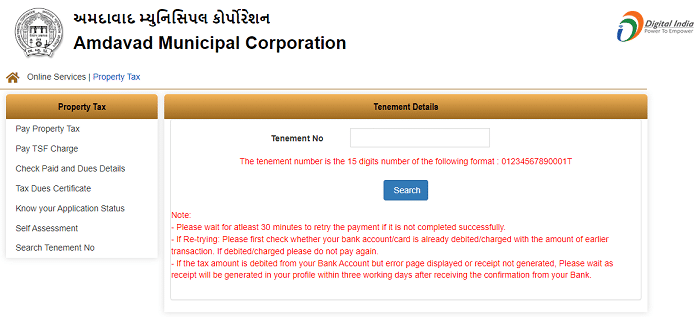

How To Pay AMC Tax Bill Using Ahmedabad Municipal Corporation eGovAMC Portal?

People living in Ahmedabad Municipal Corporation can pay their AMC Tax Bill using eGovAMC Portal, a dedicated online service for this specific AMC. Following are the steps to pay Property Tax Bill in AMC.

- Go to https://ahmedabadcity.gov.in/.

- From the secondary menu bar, go to “Online Services” and select “Online Services – Without Login” to see “Property Tax”.

- Tap “Property Tax” and click “Payment of Property Tax”.

- Now, you will be redirected to https://egovamc.in/.

- Enter the 15-digit Tenement No here, and click the “Search” button.

- Now, you can see property tax dues (if any) for the Tenement No you entered.

- Verify the details and select the appropriate payment method.

- Complete paying the AMC Property Tax Bill, and save the tax receipt as proof of payment.

How To Pay RMC Tax Bill Using Rajkot Municipal Corporation Online Portal?

RMC has to pay their Property Tax Bill every year for those who have properties in Rajkot Municipal Corporation. If you are one of them, you can pay the RMC tax bill using the Rajkot Online Portal. Following are the steps to pay Property Tax in RMC using the rmc.gov.in portal.

- Visit the official website of Rajkot Municipal Corporation (RMC), i.e., https://www.rmc.gov.in/.

- Go to “Online Services” on the top menu bar, and select “1. Property Tax”.

- Tap on “1.1 Property Tax Payment” to continue to pay the RMC Property Tax bill.

- Now, you will be redirected to https://www.rmcegov.gov.in/.

- Click on “Property Tax Payment” from “Online Services”.

- You will be asked to enter “Old Property No” or “New Property No”.

- Select any of the above options, and enter the Property No as your selection.

- Click on the “Show amount Payable” button to see the Property Tax dues (if any) for the property no that you entered.

- Select the appropriate payment method and complete the payment to clear RMC Property Tax bill dues.

- After completing the payment, you will receive a transactional ID and payment acknowledgment.

How To Pay Property Tax Using Citizen Service Center ( CSC ) In Gujarat?

To pay their property tax through the Citizen Service Centre in their Urban local bodies, individuals must provide their property tax invoice details. The following steps outline the process for paying property tax using the Citizen Service Centre (CSC) in Gujarat:

- First, the applicant must visit the CSC and present their tax pay invoice to the corresponding officer.

- Next, the officer will verify the applicant’s information on the computer system and inform them of the amount payable.

- The applicant may pay the amount to the officer either through cash or online transaction.

- Once the payment has been made, the applicant will receive a successful payment receipt from the officer.

- The entire process is completed within a day.

Document Required To Register For Online Property Tax Payment In Gujarat:

The applicants must provide documents to pay property tax in Gujarat. The following are the document details for property tax in Gujarat.

- Aadhaar Card

- Address of the Property

- Owner Name

- Mobile Number

- Email Id

- House Number ( Unique Number for the said property in the bill / old paid bill )

- Receipt of the updated property tax bill.

FAQs On Property Tax in Gujarat:

What is the official website of eNagar Gujarat State?

The eNagar Gujarat State official website is https://enagar.gujarat.gov.in/

What is the procedure for paying property tax in Gujarat?

Citizens can make payment of their Property tax in Gujarat using the official website of eNagar Gujarat or by visiting the nearest Municipal office of their respective area or the government-recognized service centers.

What is the validity of Property Tax Documents?

The property tax documents are valid for one year. So every year, it has to be renewed.

Are there any penalty charges for not Paying Property Tax in Gujarat?

Yes, If a taxpayer does not pay the tax amount within the given period, the concerned department may charge a penalty.

In addition to covering the necessary running costs of a city, municipal governments may acquire funds from a variety of sources. These can include fees charged for services such as vehicle registrations and driver’s licenses, rental and lease of properties and the sale of goods and services. Once the necessary funds have been collected, they can be allocated to provide city services and programs, ultimately aiming to enhance the quality of life for the surrounding areas.

Unfortunately, there are still many aspects of Gujarat that need to be improved in terms of providing services to the people. For instance, many cities in Gujarat do not have a Citizen Service Center, leading to individuals having to manage their own paperwork related to living in the city.