Chennai Corporation Property Tax: If you are a property owner in Chennai, you know how important it is to stay on top of your property taxes. In the past, paying property taxes in Chennai meant standing in long lines at government offices and dealing with endless paperwork. However, with the advent of technology, paying your Chennai property taxes has become easier than ever.

Now, you can make property tax payments online from the comfort of your home or office. In this article, we’ll guide you through paying your Chennai property taxes online and highlight some of the benefits of doing so.

Whether you are a first-time property owner or a seasoned veteran, read on to learn how to simplify your property tax payments in Chennai.

How To Make Chennai Corporation Property Tax Online Payment?

The property tax service provides a digital interface, allowing citizens to search and download property bills, make payments online, and download the payment receipt. The following are the steps to learn how to pay property tax online in Chennai Corporation.

- Firstly, the citizen should visit the official website of the Greater Chennai Municipal Corporation i.e., https://chennaicorporation.gov.in/.

- The home page will appear, here, you have to search for Online payments and click on ‘Property Tax Online Payment’.

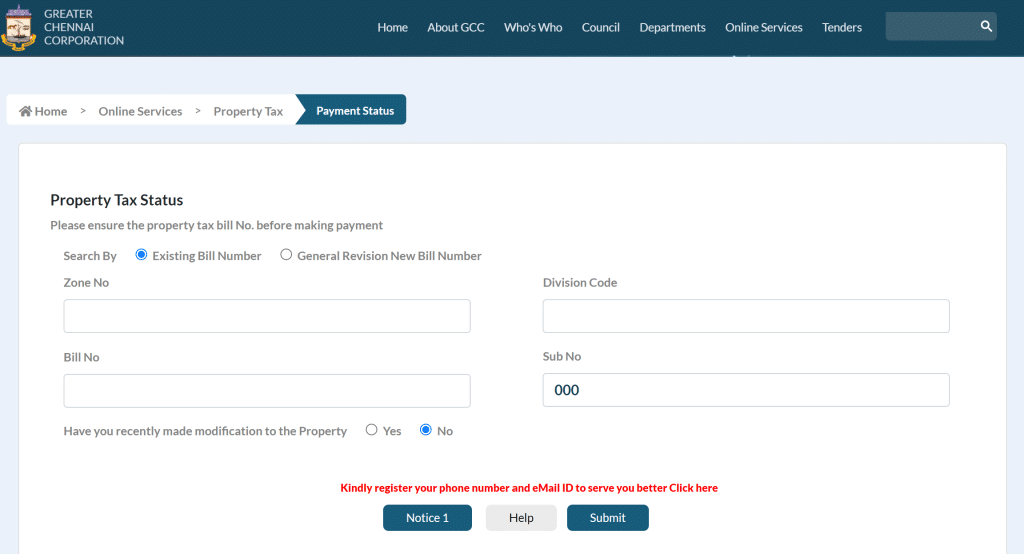

- The next page will open, here, you have to enter the required details like Zone No, Division Code, Bill No, and Sub No. here you have to select search by ‘Existing Bill Number‘.

- After completing all the details, click on the ‘Pay Tax‘ option and choose your payment option according to your preference (Credit Card, Debit Card, Internet Banking).

- After making the payment, your receipt will automatically be generated. Save and print it for future reference.

- In this way, you can pay the property tax in Chennai Corporation.

How To Pay Greater Chennai Corporation Property Tax? Offline Method:

People of Chennai Corporation State can also make their Property tax Payments by visiting their area’s Greater Chennai Corporation office or the government-recognized service centers. The following are the steps to pay property tax in Chennai Corporation (offline).

- People should visit the nearest Greater Chennai corporation office.

- You must go to the property tax counter and provide your tax number.

- Then the executive will check the details and provide your tax due list.

- After confirming the amount and details, you can pay the amount to the officer using cash or an online transaction.

- Finally, the payment process is done, and the applicant will get a successful payment receipt from the officer.

- This way, you can pay the property tax in Chennai Corporation offline.

How To Pay Chennai Property Tax Online Payment Using Phone Pe UPI?

You can now pay the Greater Chennai Corporation Property Tax using some UPI service providers. Among many, PhonePe UPI is one of the most trusted UPI payment method options to pay Property Tax in Greater Chennai.

The following are the steps to pay your Chennai Corporation property tax:

- Open the PhonePe App on your mobile phone.

- Authenticate your PhonePe to Login into your account.

- Scroll down to find the “Recharge & Pay Bills” section, and Tap on the “See All” button.

- Select “Municipal Tax” from the Financial Services & Taxes section at the bottom of the App.

- Now, search scroll to find “Greater Chennai Corporation” and tap on it to select it.

- Enter your “New Property ID”, and click on Confirm button.

- You can see the property tax details for the Property ID you entered here.

- Verify and Complete the payment by selecting any of the banks you linked with your PhonePe.

- If the transaction is successful, you will receive a message, and a property tax receipt will be sent to your email.

Documents Required To Check Chennai Corporation Property Tax Status:

The applicants are required to provide some documents to pay property tax in Chennai Corporation. The following are the document details for paying property tax in Chennai.

- Existing Bill Number

- Receipt of the New property tax bill

- Zone No, Division Code, and Sub No.

- House Number (Unique Number for the said property in the bill/old paid bill)

Who Should Make Chennai Corporation Property Tax Online Payment?

The following are the eligibility criteria to pay property tax in Chennai.

- The applicant should be an Indian Citizen and the age should be of 18 years

- Any person who is a permanent resident in the state of Chennai Corporation

- Any person who owns a property in Chennai has to pay a property tax

FAQs Related To Greater Chennai Property Tax:

Is it mandated to pay Water tax for every property that has Property Tax?

No. Only properties with CMWSSB Water Connection have to pay Water Tax.

What is the official website of Chennai Corporation?

The official website of Chennai Corporation (Greater Chennai Municipal Corporation) is www.chennaicorporation.gov.in

What is the validity of Documents for Property Tax in Chennai?

The property tax documents are valid for one year. So, every year it has to be renewed.

Are there any penalty charges for not Paying Property Tax in Chennai?

Yes, if a taxpayer does not pay the tax amount within the given time, the concerned department may charge a penalty.

For those paying their Chennai property taxes online, the process is simple. Begin by opening an account with a major bank in your vicinity. This done, you have the option of paying your monthly property taxes from the convenience of your home or workplace. Tenants and homeowners of residential properties in Chennai may be eligible for a reduced rate on their monthly payment. To benefit from this, it is important to keep your property records up-to-date and file your tax returns properly.