MC Shimla Property Tax: If you’re a property owner in Shimla, you know that paying property tax is a necessary part of owning a home or land. However, generating bills and accessing receipts can be a hassle. Luckily, the Municipal Corporation of Shimla has implemented a new system to streamline the process.

With the launch of their online portal, mybill.shimlamc.org, property owners can easily generate bills, view and download receipts, and make payments with just a few clicks. This user-friendly platform not only makes it easier to stay on top of your property tax payments, but it also helps to reduce the burden on government officials by automating the process.

In this article, we will explore the features and benefits of this new system and how it can make life easier for property owners in Shimla.

How To Pay MC Shimla Property Tax Using ShimlaMC.Org Portal?

The following are the steps to pay Property tax in MC Shimla

- Visit the official website at https://www.mybill.shimlamc.org/.

- On the homepage, you’ll find a ‘Property Tax’ menu on the left-hand side of the page.

- Click on this to take you to the ‘Pay Property Tax’ page.

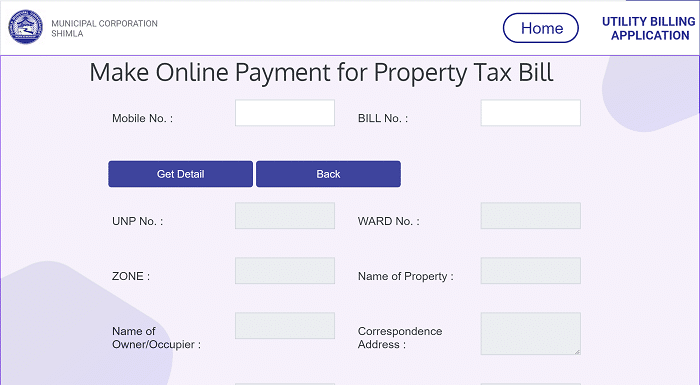

- On this page, you must enter your mobile number and bill number to bring up the UNP No, Ward No, Zone, Name of Property, Name of Owner / Occupier, and Correspondence Address.

- Once you have entered this information, click the ‘Get Details’ button.

- You’ll then need to enter the payment type and interest @ 1% / Month.

- The payable amount will be calculated automatically, allowing you to complete the process and pay your property tax online.

- If you are ready to pay, you must confirm the amount first.

- Then, click on the play button to proceed.

- After completing the payment, you will get a confirmation receipt which you can download, save, and print for future reference.

- This receipt serves as an official document that certifies your payment.

How To Search Your Property Details Using ShimlaMC.Org?

- Go to the official website mybill.shimlamc.org

- Click on the “Property Tax” icon on the home page.

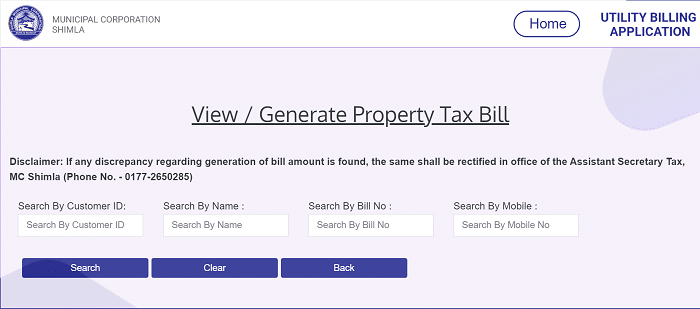

- Now, you can find more options under “Property Tax”; tap on “Search Property Details.”

- You will be redirected to another page, where you will be asked to enter your Name or Customer ID.

- Click on the “Search” button to view your property details.

Apply For MC Shimla Property Tax NOC Certificate:

- Visit the official website, i.e., mybill.shimlamc.org

- As you can see, the “Property Tax” icon on the home page, tap on it.

- Now you will see all the options under “Property Tax.”

- Click on “Apply for Property Tax NOC” to move to the application form.

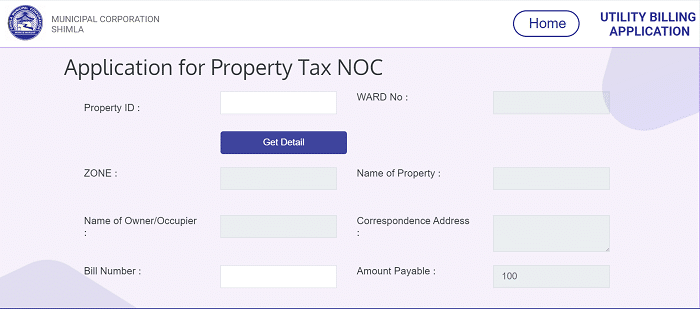

- You can see the “Application for Property Tax NOC” online form.

- Enter your MC Shimla “Property ID” and click “Get Details.”

- Your property details and the Bill Number and Amount Payable will automatically be updated.

- If the amount payable is 0, you see a “View” button.

- Click the “View” button to check the Property Tax NOC Certificate details.

- Confirm the details on the NOC Certificate and click on the Download button.

MC Shimla Property Tax Fee Details:

The following is the information about fee details for property tax in Municipal Corporation Shimla:

- The property tax amount in MC Shimla is calculated based on the residential area. So, it varies from one property to another.

- The property tax for a building in Municipal Corporation Shimla is calculated based on Basement area, the rate prevalent in the street where the property is located, Usage of the building (residential/non – residential access ), Type of Occupancy (Owner/tenant), and the total span of the building’s existence.

Document Required To Apply For MC Shimla Property Tax Online Account:

The applicants must provide documents to pay Municipal Corporation Shimla’s property tax. The following are the document details for property tax in MC Shimla.

- Aadhaar Card

- Address of the Property

- Owner Name

- Form number as per the assessment list for property tax ( Unique number for the said property )

- Old form Number ( previous number through which tax was paid )

FAQs Related To Property Tax In Municipal Corporation Shimla:

What is the official website of MC Shimla?

The Municipal Corporation Shimla’s official website is https://www.mybill.shimlamc.org/

What is the procedure for paying property tax in MC Shimla?

Citizens can make payments of their Property tax in Municipal Corporation Shimla using the official website of Property Tax Management System, MC Shimla. i.e., https://www.mybill.shimlamc.org/.

What is the validity of Property Tax Documents?

The property tax documents are valid for one year. So, every year it has to be renewed.

Are there any penalty charges for not paying the Property Tax in MC Shimla?

Yes, If any taxpayer does not pay the tax amount within the given period, the concerned department may charge a penalty.

What are the Penalty Charges if you do not pay the property tax in MC Shimla?

If the tax payment is made one month after the financial year’s end, interest at 1 percent per month will be charged until the payment date.

MC Shimla has developed a new technology to address the problem of low payment rates and lengthy processes. The state government has launched a new system that has automated paying rates and generating receipts. This will make life easier for the residents of Shimla.

The new system will establish an online portal where residents can make payments, view their property details and track their prices online.

The Municipal Corporation will issue a digital token (SWIFT code) to the residents of Shimla so that they can make payments online. The residents must provide identification details, a photo of themselves, and their properties’ addresses and names on this portal.