Goa House Tax: Are you a homeowner in Goa wondering how to pay your house tax? Look no further than the Goa Online Citizen Services Portal, specifically the https://goaulbservice.gov.in/ website. This user-friendly site allows you to pay your house tax online from the comfort of your home.

With just a few clicks, you can access your tax information, view your outstanding balance, and pay securely and conveniently. Plus, the site is available 24/7, so you can spend your taxes anytime.

This article will provide instructions on how to pay residential property tax in Goa using the Goa Online Citizen Services Portal. This will make the process easier and free up time for other activities. The following are the steps to do this, utilizing the official website of the Directorate of Municipal Administration, Government of Goa: https://goaulbservice.gov.in/

How To Pay House Tax In Goa Online Using goaulbservice.gov.in?

- The Citizen should visit the official website of the Directorate of Municipal Administration, Government of Goa. i.e., https://goaulbservice.gov.in/

- The home page will appear; here, you have to click on ‘Payment on Tax ‘under Online Services, which is on the right side of the page.

- On clicking the Payment on Tax, you will get three options. The first is Pay House Tax, the second is Pay Rent, and the third is Pay Trade Board & Signboard fee.

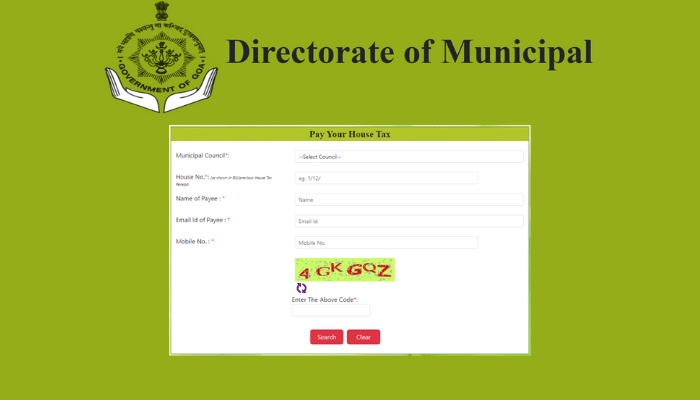

- You have to click on the ‘Pay House Tax’ Options then the new page will open.

- The Pay Your House Tax page will appear on your screen; here, you have to select the Municipal Council, and also you have to enter the required details like House number, Name of Payee, Email Id of Payee, and Mobile Number. Then finally, you have to enter the captcha code, which is displayed on the screen.

- After entering all the details, click the ‘Search ‘button.

- Now, you can see the property tax generated for the respective Property.

- Here, you have to check the checkbox against the arrear bill or quarter bill for which you want to make the payment. Then you have to click on the ‘Pay Now ‘button.

- Now you will get the bill details. If you are sure of making the payment, click the ‘Confirm ‘button.

- Now you will be redirected to the payment gateway.

- Here, you must choose the payment option ( Debit Card, Credit Card, Net Banking ), provide the required information, and click ‘Make Payment ‘to proceed.

- After making payment, your receipt will be automatically generated for future reference.

How To Register/Login Into Goa House Tax?

If you are a new user, you can easily register to gain access to the wide variety of services the portal has to offer. Here is a step-by-step guide to help you get started:

- First, go to the Goa Government e-Service Portal at https://goaulbservice.gov.in/.

- On the homepage, click the Login button.

- This will take you to the login page, where you can either log in as an existing user or register as a new user.

- If you register as a new user, click the “New Users Register Here” button.

- This will take you to the Online Registration Form.

- Here, you must fill out the form with your details.

- Once you have completed the form, click the “Register/Sign Up” button to finish the registration process.

And that’s it! You have registered as a new Goa Government e-Service Portal user. You can now access the portal’s various services with your new account. We hope you have a pleasant experience with the Goa Government e-Service Portal.

Document Required To Register House Tax On GoaULB Portal:

The applicants must provide copies to pay property tax in Goa. The following are the document details for property tax in Goa.

- Aadhaar Card

- Address of the Property (Electricity Bill/Water Bill)

- Owner Name

- Mobile Number

- Email Id

- House Number ( Unique Number for the said Property in the bill / old paid bill )

- Receipt of the updated property tax bill

- Copy of the assessment order

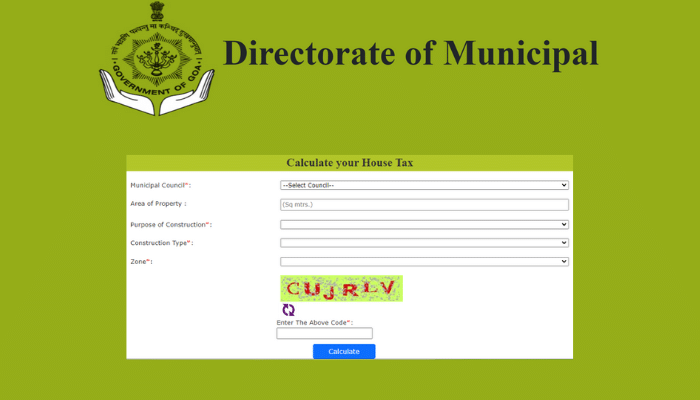

How To Calculate House Tax In Goa?

The property Tax of Goa is calculated based on parameters like the Property’s age, plinth area, zonal location of the site, residential or non – residential status, construction type, and other parameters. Any citizen of Goa can also check the property tax using the property tax calculator available on the official website of the Directorate of Municipal Administration, Government of Goa. i.e., https://goaulbservice.gov.in/. The following are the steps to know about how to calculate Property tax in Goa.

- The Applicant should visit the official website of the Directorate of Municipal Administration, Government of Goa. i.e., https://goaulbservice.gov.in/

- The home page will appear. You must click on the ‘Calculate House Tax’ option under the Links on the left side.

- Then you will get a ‘Calculate your House Tax’ page.

- On this page, you have to select the Municipal Council, and also you have to enter the required details like Area Of Property, Purpose of Construction, Construction Type, and Zone.

- Finally, you have to enter the captcha code displayed on the screen.

- After entering all the details, click the ‘Calculate ‘button.

- Then you will get the property tax details.

In this way, you can calculate property tax in Goa.

The Directorate of Municipal Administration, Government of Goa, has launched an online payment portal for Goa citizens to pay for services like DPT fees, electricity bills, etc. The portal is known as goaulbservice.gov.in, and it also offers a house tax payment facility.