Karnataka One Login Property Tax: Are you a property owner in Karnataka? Are you tired of the hassle of standing in long queues and filling out paperwork to pay your property taxes? Karnataka One Login Property Tax is here to make your life easier! This online portal allows you to pay your property tax from the comfort of your home, eliminating the need for physical visits to government offices.

With just a few clicks, you can also verify your payment status and retrieve your tax payment receipt. As a highly skilled digital marketing specialist, I assert that the Karnataka One Login Property Tax revolutionizes property ownership in Karnataka.

So why wait? Sign up today and experience the convenience and efficiency of Karnataka One Login Property Tax for yourself! The official website of Karnataka State is karnatakaone.gov.in

How To Register Into Karnataka One Portal To Pay Property Tax?

The property tax service provides a digital interface, allowing citizens to search and download property bills, make payments online, and download the payment receipt. The following are the steps to know about how to pay property tax in Karnataka.

- Firstly, the citizen should visit the Karnataka official website. The official website of Karnataka State is https://www.karnatakaone.gov.in/

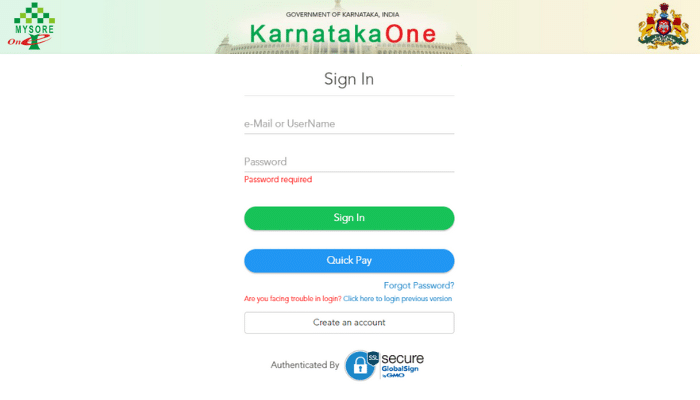

- The home page will appear here, you have to sign in using your email or username and password.

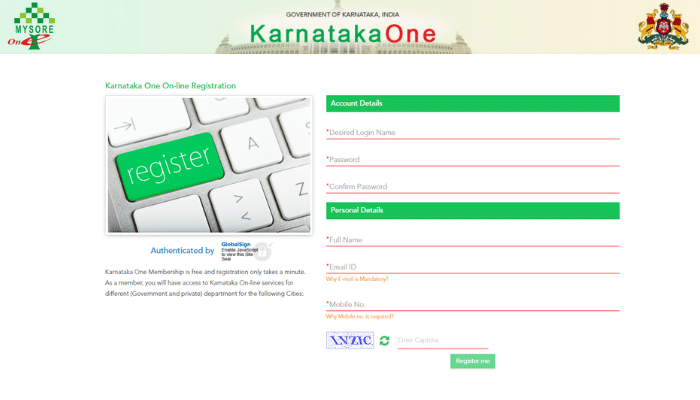

- Click on “Create an Account”.

- The online registration page will open, here you have to enter the required information like Account details ( Desired Login Name, Password, Confirm Password ), Personal Details like your Full name, Active Email Id, and Active mobile number, and enter the captcha, which is display on the screen.

- Finally, click the ‘ Register Me‘ button to create an account in Karnataka One Portal.

Karnataka One Login To Pay Property Tax In Karnataka:

- After registration, you have to enter user credentials for the Login.

- After signing in, select “ Property tax Payment Online “ from the list available under services.

- The payment of Property tax page will open, here, you have to enter the valid PID No given by the department of the individual customer, then click on the ‘ Search icon ‘ to fetch the customer’s details.

- You must enter applicant details like Property No, ward no, Bill number, and Address, then select the radio button as “ Year “. It includes the amount to be paid to the customer.

- Here you have to select the pay modes: Net banking, Paytm, Debit Card, and Credit Card.

- Select the desired ‘ Pay Mode ‘ from the Pay Mode grid, then click the terms and conditions checkbox.

- After checking all the details, click on the ‘ Continue for Payment ‘ option and click “ Ok “ to submit the transaction.

- You have to redirect to the payment gateway. You will enter your card/bank details and proceed with the payment.

- After making the payment, your receipt will be automatically generated for future reference.

- In this way, you can make the online Property Tax payment in Karnataka

How To Pay Property Tax In Karnataka One Portal Using Quick Pay Option?

The following are the steps to learn how to pay property tax in Karnataka using the “ Quick Pay “ option.

- Firstly, the citizen should visit the Karnataka official website. The official website of Karnataka State is https://www.karnatakaone.gov.in/

- The home page will appear here, you have to click on the “ Quick Pay “ option.

- The available Services page will open here you have to select the ‘ Property Tax Payment Online ‘ option.

- The payment of Property tax page will open, here, you have to enter the valid PID No given by the department of the individual customer, then click on the ‘ Search icon ‘ to fetch the customer’s details.

- You must enter applicant details like Property No, ward no, Bill number, and Address, then select the radio button as “ Year “. It includes the amount to be paid to the customer.

- Here you have to select the pay modes: Net banking, Paytm, Debit Card, and Credit Card.

- Select the desired ‘ Pay Mode ‘ from the Pay Mode grid, then click the terms and conditions checkbox.

- After checking all the details, click on the ‘ Continue for Payment ‘ option and click “ Ok “ to submit the transaction.

- You have to redirect to the payment gateway. You will enter your card/bank details and proceed with the payment.

- After making the payment, your receipt will be automatically generated for future reference.

In this way, you can make the Property Tax payment in Karnataka using Quick Pay.

Document Required To Self Assessment Your Property In Karnataka One:

The applicants are required to provide some documents to pay property tax in Karnataka. The following are the document details for property tax in Karnataka.

- Aadhaar Card

- Address of the Property

- Owner Name

- Mobile Number

- Email Id

- 15 digits holding the number

- Receipt of the updated property tax bill.

Property taxes are an important source of revenue for the people of India. The government of India takes this responsibility seriously, and it has a shining record for being a reliable tax collector. However, it is usually a major responsibility of the citizens of the states to pay their own state’s taxes. Not only does it affect their finances significantly, but it also negatively marks their credit history.

With the launch of the Karnataka One Portal, the State’s citizens can now easily pay their own state’s tax using their digital identity.

The citizens of the State can also avail of the “ Quick Pay” option to pay their taxes quickly and easily. The government portal allows the user to choose the payment mode of his/her convenience ( Net banking, RuPay, Paytm, Debit Card ) and makes the payment instantly. The portal is another way to improve citizens’ financial freedom and simplify payment.