In the world of stock investments, SIP Calculator is used to calculate return on investments. Mutual fund investing has gained significant popularity among people seeking to grow their wealth over the long term. The Systematic Investment Plan (SIP) is among the best-known and most popular investment methods. Financial institutions and investment platforms provide a useful tool known as the SP calculator to help investors make knowledgeable decisions and understand the potential outcomes of their investments.

Investors use a SIP calculator, also known as a Systematic Investment Plan calculator, to estimate the potential returns on investments made through a Systematic Investment Plan (SIP). SIP involves contributing a fixed amount at regular intervals (monthly, quarterly, etc.) rather than investing in a lump sum amount in mutual funds.

What is A SIP Calculator?

A SIP calculator is an online tool that enables people to get an idea of the returns on their mutual fund investment made through SIP. SIP investments in mutual funds have recently risen to the top of millennials’ list of investment options.

These mutual fund sip calculators are made to evaluate the possible investments of investors in mutual funds. However, a mutual fund scheme’s actual returns can vary based on the number of variables. For the exit load, and expense ratio (if any), the SIP calculator does not provide clarification.

With the help of a calculator, you may estimate your monthly SIP investment’s wealth gain and expected returns. On the basis of a projected annual return rate, you get a rough estimate of the maturity amount for any of your monthly SIP.

Investors can estimate the future value of their investments based on several criteria by utilizing a SIP calculator. It can assist them in understanding the effects of factors like investment quantity, length, and anticipated returns of their investment growth and aid them in making well-informed decisions regarding their investment strategy.

Online SIP Calculators can find anywhere and frequently offers mutual fund companies, financial institutions, or investment websites. They are useful tools for people who planning to invest in mutual funds in a systematic manner and want to assess the possible long-term results of their investment.

How Does A SIP Calculator Work?

A SIP plan calculator works by the values entered by the users. You should enter the investment amount, frequency of investment, duration of investment, and expected returns. On the compound interest formula, the SIP return calculator is designed. The SIP calculator works on the following formula.

M = P × ({[1 + i]^n – 1} / i) × (1 + i)

- M is the amount you receive upon maturity.

- P is the amount you invest at regular intervals.

- n is the number of payments you have made.

- i is the periodic rate of interest.

For example, if you want to invest Rs.1000 per month for 12 months at a periodic rate of interest of 12%.

Then the monthly rate of return will be 12%/12 = 1/1000 = 0.01

Hence, M = 1,000 x ({[1 +0.01 ]^{12} – 1} / 0.01) x (1 + 0.01)

In a year which gives Rs. 12,809 /- approximately.

As per market conditions, the rate of interest on SIP will differ. It may increase or decrease, which will change the estimated returns.

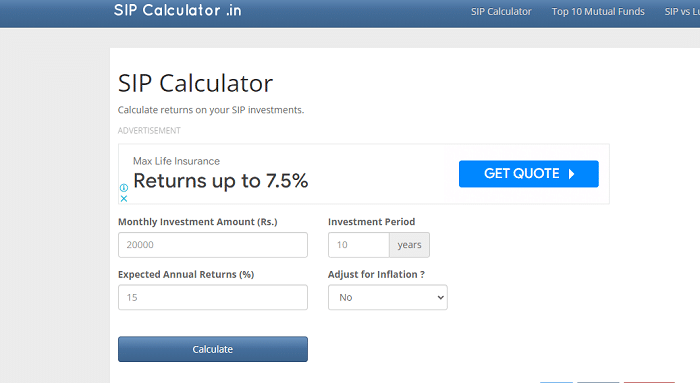

If you want to calculate the SIP online, follow the below steps.

- Visit the https://sipcalculator.in/ website.

- the SIP Calculator will open, here enter “Monthly Investment Amount”, “Investment Period”, and ‘Expected Annual Returns”.

- And also select “Adjust for Inflation” and then click on the “Calculate” button.

- Then the result will appear on the screen.

How To Use SBI SIP Calculator?

It’s simple to use online SIP calculators. To get the outcomes, you need to enter the information listed below.

- The amount you wish to invest (one-time/monthly/annual).

- Investment period (for which you want to stay invested).

- SIP payment period (for which you want to pay).

- Expected rate of return.

The maturity amount and total investment will be shown on the screen after entering these details.

Benefits Of Using A SIP Calculator:

- The SIP calculator offers an estimate of the potential returns based on different investment scenarios, assisting investors in setting realistic financial goals.

- It enables people to plan for specific targets, such as buying a house, funding their child’s education, or building a retirement fund.

- The SIP calculator allows investors to compare the prospective returns of various mutual funds or investment amounts.

- They are able to assess different investment possibilities and make educated choices based on their risk tolerance and financial goals.

- The SIP calculator provides a clear picture of how investments grow over time. By inputting the investment duration and expected rate of return, investors can visualize the compounding effect and understand the power of staying invested for the long term.

- The SIP calculator gives investors flexibility by letting them experiment with various investment amounts and terms.

- The future value of an investor’s investments can affect by changing these characteristics, allowing them to fine-tune their investing plan.

Types of Systematic Investment Plans (SIPs):

Different types of Systematic Investment Plans (SIPs) are available to investors. Here are some common types.

Flexible SIP:

Flexible SIP gives investors the flexibility to invest varying amounts at different intervals. It allows investors to adjust their SP contribution based on their financial situation, allowing for higher investments during periods of surplus income and lower investments during leaner times.

Perpetual SIP:

A perpetual SIP is a SIP without a fixed end date. It continues until the investor decides to stop or modify the plan. This type of SIP is suitable for investors who prefer to have a long-term investment strategy. And do not want to set a specific end date for their investment.

Step-up SIP:

Step-up SIP enables investors to increase their SIP contributions periodically by a fixed amount or a certain percentage. This type of SIP is ideal for investors who want to gradually enhance their investments or align their investments with salary hikes or career growth.

Trigger SIP:

Trigger SIP allows investors to define specific trigger points at which their investments are initiated or modified. The trigger can be based on market conditions such as predefined levels of the stock market index, or other factors like the NAV (Net Asset Value) of the mutual fund. When the trigger condition is met, the SIP is automatically initiated or modified as per the investor’s instructions.

Regular SIP:

Regular SIP is the most widely used type of SIP. Under this plan, investors contribute a fixed amount at regular intervals, typically monthly, into a mutual fund of their choice. It allows investors to invest small amounts systematically over time, regardless of market conditions.

Top-up SIP:

Top-up SIP allows investors to increase their investment amount periodically. Inventors have the option to increase their SIP contribution by a fixed amount or a certain percentage at specific intervals. This type of SIP is suitable for individuals with increasing income or those who want to accelerate their investments over time.

Pause SIP:

Pause SIP allows investors to temporarily halt their SIP contributions for a specified period. This can be useful when investors face financial constraints or want to take a break from investing without completely stopping their SIP.

It’s important to note that these SIP types’ availability may vary across mutual fund companies and financial institutions. To understand the specific types of SIPs available and select the one that best suits their investment goals, and financial circumstances, investors should consult their investment advisors or mutual fund providers.

The SIP calculator utilizes these inputs to calculate the future value of the investments and provides an estimate of the potential returns. It takes into account a number of variables, including the investment amount, the duration of the investments, the expected rate of return, and the frequency of investments.