Traces Login stands for “TDS Reconciliation Analysis and Correction Enabling System”. Traces Login Portal is a web-based application of the Income Tax Department that provides an interface to all stakeholders associated with TDS administration.

It allows for the viewing of the status of challans, the downloading of Conso Files, Justification reports, and Forms 16/16A/16B/16C/16D/16E/27D as well as the viewing of annual tax credit statements (Form 26AS/Annual Tax Statement).To access the Traces login portal, users need to register and obtain a user Id and password.

This article covers Traces Login Portal registration and login procedures for both Deductors and Tax Payers, along with password reset instructions and additional details.

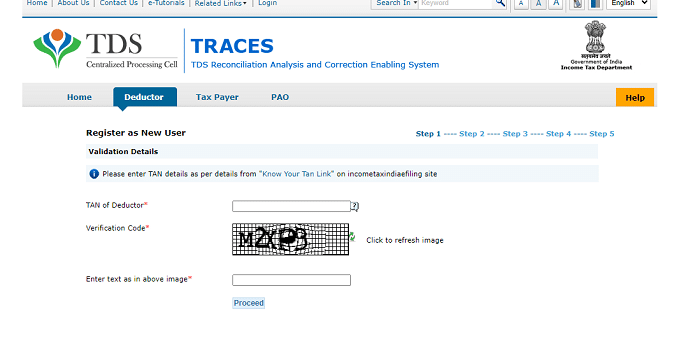

Traces Login Portal Registration Process – Deductor:

- The applicant should open the official website of the Traces Login Portal at https://tdscpc.gov.in.

- On the left side of the home page, click on the “Register as New User” option under the “Login” section.

- Now select the “Deductor” option and enter the necessary details on the next page.

- Here, enter the “TAN of Deductor”, and “Verification Code” and then click on the “Proceed” button.

- On the next page, you have to ‘Token Number’ of only regular statements manually corresponding to the Financial Year, Quarter, and form type displayed.

- Now, click on the ‘Guide’ to select a suitable challan option.

- After that, enter ‘CIN’ details for a challan used in the statement.

- The CD record number is not mandatory. This column is required to be filled only when the same challan is mentioned more than once in a statement.

- If you do not have any valid PAN corresponding to the above challan details, click on the box.

- Next, click on the Guide to select a suitable PAN amount combination and enter TDS deposited amount for the respective PAN and then click on the “Proceed” button.

- The organization details page will open, here select the “Category of Deductor” and enter the “PAN of Deductor”, “PAN of Authorised Person”, DOB of Authorised Person”, and “Designation of Authorised Person”.

- Afterwards, if you are an employee of the deductor then click on “YES” otherwise click on “NO”.

- In the address details section, click on “Same as TAN Master” and then the address details will automatically be updated on the page.

- in the communication details section, you need to enter “Mobile No”, “Alternative Mobile No.”, ‘Email Id”, and “Alternative Email Id” and then click on the “Next” link.

Account Activation Process:

- Now, you need to create “User ID”, “Password”, and “Confirm Password” and then click on “Create Account”.

- All the entered details will appear on the screen. Verify the details once again and then click on the “Confirm” tab.

- The registration request successfully submitted message will appear on the screen.

- And also activation links and codes have been sent to your registered email address and mobile number.

- You must click on the Activation link within 48 hours of receipt of the email to avoid the deactivation of your account.

- After clicking on the activation link, you need to enter “User ID”, “Code sent through email”, and “Code sent through SMS” and then click on the “Submit” button.

- Then the Activation Successful message will appear on the screen.

- In this way, you can complete the Traces Login Portal Registration Process as a Deductor.

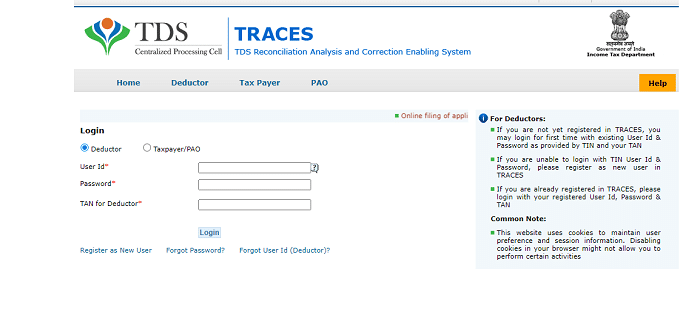

How To Login Into Traces Login Portal As Deductor?

After completing the deductor registration process, you can log in using your login credentials. The following are the steps to login into the Traces login portal as a Deductor.

- Visit the official website of the Traces Login Portal at https://tdscpc.gov.in.

- On the main screen, click on the “Login” link.

- The login page will appear on the screen. Here, select the login type as “Deductor”.

- Now, enter the “User ID”, “Password”, and “TAN for Deductor” and then click on the “Login” button.

- Then you will be logged into the Traces Login portal successfully.

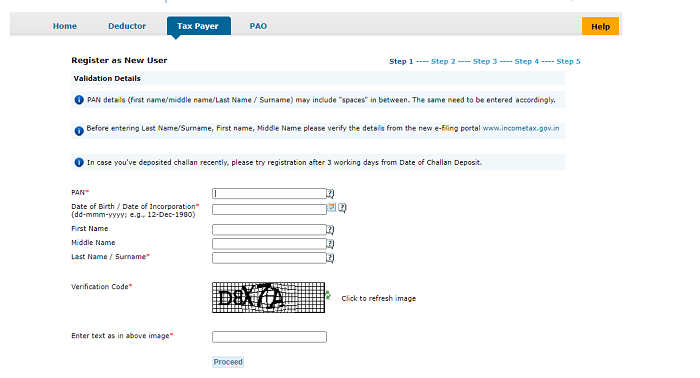

Traces Login Portal Registration Process – Tax Payer:

- Go to the official website of the Traces Login Portal at https://tdscpc.gov.in.

- On the left side of the home page, click on the “Register as New User” option under the “Login” section.

- Now select the “Tax Payer” option and enter the necessary details on the next page.

- Here, enter your “PAN”, “Date of Birth/Date of Incorporation”, “First Name”, “Middle Name”, “Last Name/Sur Name”, and “Verification Code” and click on the “Proceed” button.

- The Validation Details page will open, here you have 4 options you can select any one option to proceed

- Option 1: If you select option 1 then enter the details of TDS/TCS deposited like “TAN of Deductor”, “Type of Deductor”, “Assessment year”, “Month-Year” and “TDS/TCS Amount”.

- Option 2: In case you select option 2 then enter the Challan details of tax deposited by the Taxpayer. Ie., Advance Tax, Self Assessment tax, TDS on the property, and TDS on rent.

- You need to enter “Assessment Year”, “Challan Serial Number”, and “Amount”.

- Option 3: If you select option 3 then enter the mentioned details of 26QB statement details filled by the Buyer before correction.

- You must enter “Acknowledgment Number”, “PAN of the Buyer”, “Amount Paid/Credited”, and “Correction Id/Request Id”.

- The updated Buyer can select the “Update Pan of the Buyer” box, and the Previous Seller can select the “Pan of Seller” box. And also enter the “Pan of Seller”

- Option 4: Option 4 is authentication through Aadhaar or VID. here, tick the check box for Aadhaar/VID Authentication.

- After choosing any one option, complete the details and then click on the “Next” button.

Account Activation Process:

- Now, you need to enter the communication address details. And also enter the communication details like “Mobile Number”, “Alternative Mobile Number”, and “Email Id” and then click on the “Next” button

- The login details page will open, here, the User Id will be automatically displayed because it is a PAN of the taxpayer.

- Now, you need to create “Password”, and “Confirm Password.

- After that, select the “Security Question” and enter its “Answer’ and then click on the “Create Account” option.

- Once you have clicked on the “Create Account” option, all the details entered by you display on the screen.

- Once again verify the details carefully and then click on the “Confirm” button. If any changes are there you can click on the ‘Edit’ link.

- The successful registration message will appear on the screen. And also activation links and codes have been sent to your registered email address and mobile number.

- You must click on the Activation link within 48 hours of receipt of an email to avoid the deactivation of your account.

- After clicking on the activation link, you need to enter “User ID”, “Code sent through email”, and “Code sent through SMS” and then click on the “Submit” button.

- Then the Activation Successful message will appear on the screen.

- In this way, you can complete the Traces Login Portal Registration Process as a Tax Payer.

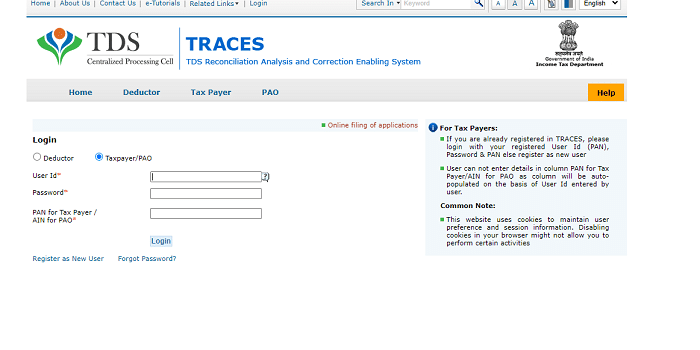

How To Login Into Traces Login Portal As Tax Payer?

Once you have completed the registration process as a taxpayer, you can log in using your login credentials. The following are the steps to login into the Traces login portal as a taxpayer.

- Open the official website of the Traces Login Portal at https://tdscpc.gov.in.

- On the home page, click on the “Login” link on the left side of the home page.

- The login page will appear on the screen. Here, select the login type as “Tax Payer/PAO”.

- Now, enter the “User ID”, “Password”, and “PAN of Tax Payer/AIN for PAO” and then click on the “Login” button.

- Then you will be logged into the Traces Login portal successfully.

How To Reset Login Password For Traces Login Portal?

- Go to the official website of the Traces Login Portal at https://tdscpc.gov.in.

- On the home page, click on the “Login” link on the left side of the home page.

- On the next page, click on the “Forgot Password?” link below the login field.

- A forgot password window will open, here you have to select the type either “Deductor” “Tax Payer”, or “PAO”.

Deductor Password Reset Process:

- If you choose the Deductor option then click on the “Proceed” button.

- Now, enter the “User ID”, “TAN of Deductor”, “Token Number”, “TAN Registration Number”, and “Verification Code”, and click on the “Proceed” button.

- After completing the verification process, you can able to change your Traces Login portal password.

Tax Payer Password Reset Process:

- If you choose the Tax Payer option then click on the “Proceed” button.

- Now, enter the “User ID”, “Date of Birth/Date of Incorporation”, “Last Name/Sur Name”, “First Name”, “Middle Name”, and “Verification Code” and click on the “Proceed” button.

- Once you have completed the verification process, you can change your password.

The Traces Login Portal provides various facilities to the people like online correction, Refund Functionality, Request for Resolution as a Deductor or a Tax Payer, Form 26QB/26QC/26QD Correction, Download Conso File/Justification Report, etc. The portal offers a secure login mechanism for authorized individuals or entities to perform their TDS-related activities online.