Income Refund Status ITR: Filing income tax returns (ITR) is a crucial obligation for taxpayers in India. It not only helps individuals fulfil their legal responsibilities but also allows them to claim refunds if they have paid more tax than required. However, it is essential to stay informed about the income refund status ITR to track the progress of your refund. In this comprehensive guide, we will explore the process of checking your income refund status, understanding the different refund statuses, and resolving common issues. Let’s dive in!

Why Should You File ITR?

Before we delve into the intricacies of checking income refund status ITR, it is crucial to understand why filing ITR is important. Here are a few key reasons:

- Legal Compliance: Filing income tax returns is a legal requirement for individuals whose income exceeds the specified threshold.

- Claiming Refunds: By filing ITR, you can claim refunds if you have paid more tax than required. This ensures that you receive the excess amount back from the Income Tax Department.

- Financial Documentation: ITR serves as an essential financial document that can be used for various purposes, such as obtaining loans, applying for visas, or purchasing assets.

- Avoiding Penalties: Failing to file ITR can lead to penalties, interest charges, and legal consequences. It is crucial to meet the deadlines and fulfil your tax obligations.

How To Track Income Refund Status ITR?

Tracking income refund status ITR is a straightforward process that can be done online. Here’s a step-by-step guide to help you navigate the Income Tax Department’s e-filing portal and check your refund status:

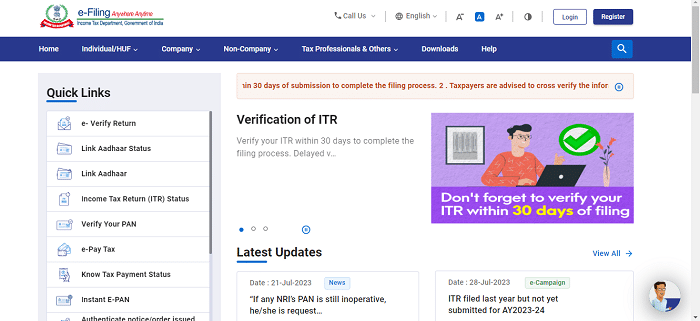

- Visit the Income Tax e-filing portal at https://www.incometax.gov.in/iec/foportal/.

- The e-Filing, Income Tax Department home page will appear on the screen.

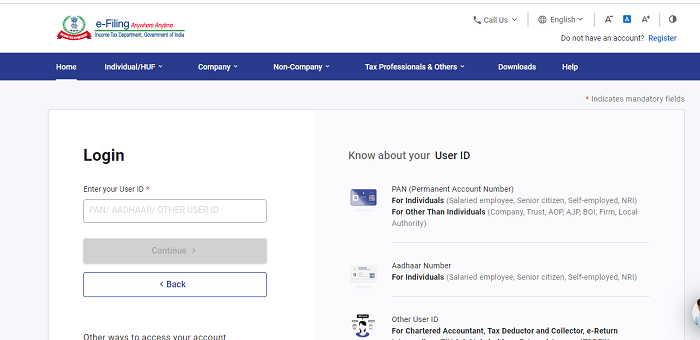

- On the home page, click on the “Login” button.

- Now, log in to your account using your registered user ID, password, date of birth, or date of incorporation (as applicable). Enter the captcha code provided on the page.

- Once logged in, navigate to the “My Account” section on the portal’s dashboard.

- In the “My Account” section, select the “Refund/Demand Status” option.

- You will be able to view your refund details, including the assessment year, Income refund status ITR, and mode of payment. If there are any issues with the refund process, the reason for the failure will also be provided.

After filing the ITR, the Income Tax Department typically processes refunds within 20-45 days. By regularly checking your income refund status, you can stay informed about the progress of your refund and take necessary actions if any issues arise.

Understanding Different Income Refund Statuses – Income Refund Status ITR:

When checking your income refund status ITR, you may come across different statuses that indicate the processing stage of your refund. It is essential to understand these statuses to effectively track your refund and address any issues that may arise. Here are some common income refund statuses in India:

Not Determined:

This status indicates that your income tax return is yet to be processed. Ensure that your ITR is properly filed and verified.

Refund Paid:

If your income tax return has been processed and the refund has been issued, this status will indicate that the refund has been sent to your bank account or by cheque.

Assessment Year Not Displayed In Refund Status:

This status suggests that you have not filed any income tax returns for the specified assessment year. It is crucial to file your returns promptly.

No Demand, No Refund:

If the Income Tax Department does not find you liable for any income tax returns, this status will be displayed. Review your return if there are discrepancies between your calculations and the department’s assessment.

Refund Unpaid:

This status indicates that your income tax return has been sent, but your bank or address has not received it. You should investigate the reason for the refund failure and request a re-issue if necessary.

ITR Processed, Refund Determined, And Sent Out To Refund Banker:

This status implies that the refund request has been generated by the Income Tax Department and sent to the refund banker for processing.

Demand Determined:

If the Income Tax Department has rejected your income tax refund claim and found an outstanding demand for unpaid taxes, this status will be displayed. You must pay the outstanding amount to process your ITR.

Contact Jurisdictional Assessing Officer:

This status indicates that the Income Tax Department requires further information regarding your income tax return. Contact the Assessing Officer in your jurisdiction for clarification.

Understanding these income refund statuses will help you navigate the refund process effectively and address any issues that may arise during the processing.

Types Of ITR Forms – Income Refund Status ITR:

To file income tax returns in India, taxpayers must use the appropriate ITR form based on their income sources and category. The Income Tax Department has categorized ITR forms into different types. Here are some common types of ITR forms:

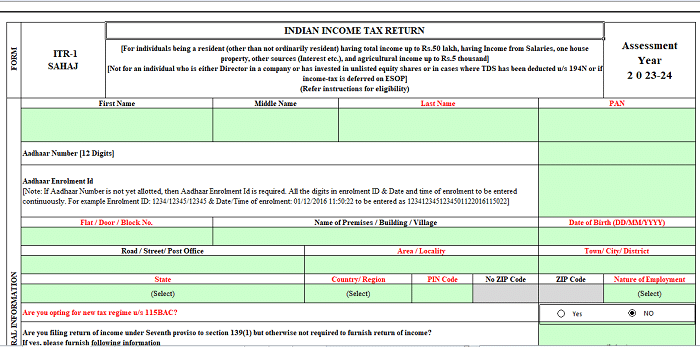

- ITR-1 (SAHAJ): This form is for individuals with income from salary, one house property, and other sources like interest, etc. It is suitable for individuals with a total income of up to Rs. 50 lakhs.

- ITR-2: Individuals and Hindu Undivided Families (HUFs) with income from salary, house property, capital gains, and other sources but not having business or professional income are required to use this form.

- ITR-3: This form is for individuals and HUFs having income from business or profession.

- ITR-4 (SUGAM): Individuals, HUFs, and firms (other than LLP) having presumptive income from business or profession can use this form.

- ITR-5: This form is for LLPs (Limited Liability Partnerships), Association of Persons (AOPs), Body of Individuals (BOIs), and Artificial Juridical Persons (AJPs).

- ITR-6: Companies other than those claiming exemption under section 11 (Income from Property Held for Charitable or Religious Purposes) must use this form.

- ITR-7: This form is for persons including companies required to furnish a return under section 139 (4A), (4B), (4C), or (4D) of the Income Tax Act.

It is crucial to select the correct ITR form based on your income sources to ensure accurate filing and claim any eligible refunds.

Downloading ITR Form – Income Refund Status ITR:

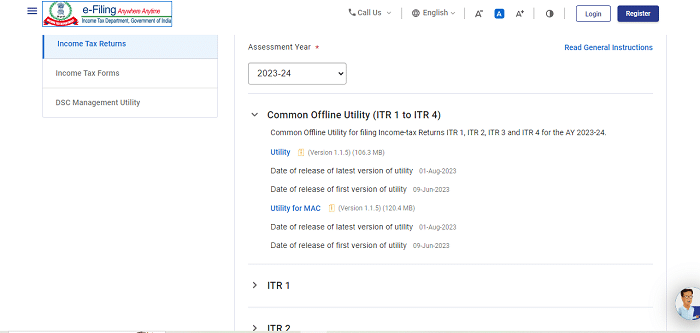

To file income tax returns, taxpayers need to download the appropriate ITR form from the Income Tax Department’s official website. Here’s a step-by-step process to download ITR forms:

- Visit the Income Tax Department’s official website at https://www.incometax.gov.in/iec/foportal/.

- The e-Filing, Income Tax Department home page will appear on the screen.

- On the home page, go to the “Downloads” tab on the navigation bar.

- Now, select “Income Tax Returns” and locate the relevant ITR form based on your income sources and category.

- Click on the download link to save the form to your computer.

- Open the downloaded form using a PDF reader and fill in the required details accurately.

- after filling out the form, save it and generate the XML file for e-filing.

- Upload the XML file on the Income Tax Department’s e-filing portal to complete the filing process.

Downloading the correct ITR form and accurately filling it is crucial for error-free filing and ensuring a smooth refund process.

Key Changes In ITR Filing Process – Income Refund Status ITR:

Over the years, the Income Tax Department has introduced various changes to the ITR filing process to streamline the procedure and make it more convenient for taxpayers. Here are some key changes:

- Online Filing: The Income Tax Department encourages taxpayers to file their ITR online through the e-filing portal. The online filing offers convenience, speed, and access to various services and resources.

- E-Verification: The introduction of e-verification has eliminated the need for physical verification of ITRs. Taxpayers can now verify their returns electronically using methods such as Aadhaar OTP, net banking, or bank account-based validation.

- Pre-Filled ITR Forms: The Income Tax Department has started providing pre-filled ITR forms with pre-populated information such as salary, interest income, and TDS details. This simplifies the filing process and reduces errors.

- Digital Signatures: Taxpayers can now sign their ITR forms digitally using a digital signature certificate (DSC). This eliminates the need for physical signatures and makes the process more efficient.

- Faster Refund Processing: The Income Tax Department has implemented a new refund processing system to expedite the refund process. This has reduced the average time taken for refunds and improved overall efficiency.

It is essential for taxpayers to stay updated with these key changes and adapt to the evolving ITR filing process to ensure smooth and hassle-free filing and refund processing.

Overview Of ITR Filing Timeline – Income Refund Status ITR:

To ensure timely filing of ITR and avoid penalties, taxpayers must be aware of the key dates and deadlines associated with the process. Here’s an overview of the ITR filing timeline:

- April: The Income Tax Department releases the updated ITR forms for the assessment year.

- July 31: The deadline for individuals and HUFs to file their ITR for the previous financial year (April 1 to March 31) without any penalty.

- October/November: The deadline for filing ITR for taxpayers who are required to get their accounts audited.

- December 31: The deadline for filing belated returns for individuals and HUFs who missed the July 31 deadline.

- January/February: The Income Tax Department starts processing ITRs and verifying the information provided.

- February/March: Taxpayers can start checking their income refund status online approximately 10 days after their refund has been sent.

- March 31: The end of the financial year and the last date for filing revised returns for the previous financial year.

By adhering to these timelines and meeting the deadlines, taxpayers can ensure a smooth filing process and track their income refund status effectively.

FAQs About Income Refund Status ITR:

Can I file ITR offline?

Yes, taxpayers have the option to file ITR offline by submitting physical copies of the ITR form to the nearest Income Tax Office.

What happens if I miss the ITR filing deadline?

Failing to file ITR by the deadline may attract penalties and interest on the outstanding tax liability.

How long does it take to receive the tax refund after filing ITR?

The time taken to process tax refunds may vary, but it usually takes a few weeks to a few months.

Income Tax Refund Status (ITR) is a crucial aspect of the tax system, providing taxpayers with an opportunity to claim excess taxes paid and ensuring proper compliance with tax regulations. By understanding the types of ITR forms, the process of tracking Income Refund ITR status, and adhering to the timeline for ITR filing, taxpayers can efficiently manage their tax liabilities and refunds, contributing to a smoother tax ecosystem for everyone involved.