UPI ATM Cash Withdrawal: The way Indians access cash is undergoing a significant transformation with the introduction of UPI ATM, a secure and convenient cardless cash withdrawal system. Developed by Hitachi Payment Services in collaboration with the National Payments Corporation of India (NPCI), the UPI ATM was unveiled during the prestigious Global Fintech Fest held in Mumbai on September 5, 2023. This groundbreaking innovation aims to redefine the traditional ATM experience, providing customers with a seamless and secure method of withdrawing cash. In this comprehensive guide, we will explore the concept of UPI ATM, how it operates, its key features, and how it differs from cardless cash withdrawals. So let’s dive in and discover the future of cash withdrawals in India.

What is UPI ATM?

UPI-ATM, short for Unified Payments Interface ATM, is a revolutionary white-label ATM that enables users to withdraw cash without the need for physical ATM or debit cards. This innovative solution, developed by Hitachi Payment Services, a subsidiary of the renowned Japanese conglomerate Hitachi, in collaboration with NPCI, aims to provide customers with a secure and convenient cash withdrawal experience.

How Does UPI ATM Operate?

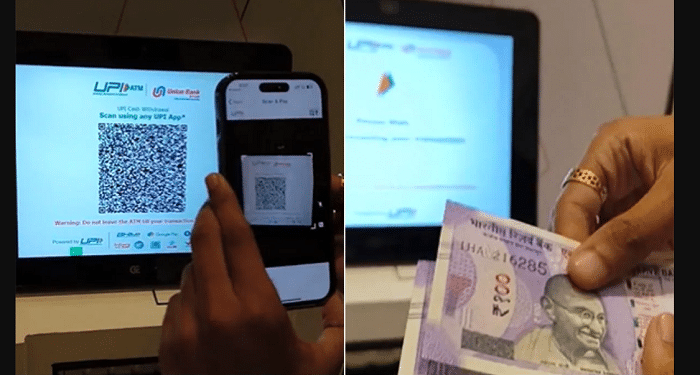

The UPI-ATM operates on a streamlined and user-friendly process. Customers of participating banks can initiate a UPI cash withdrawal by selecting the corresponding option on the ATM. They can then choose the desired withdrawal amount from the available denominations. Once the amount is selected, a unique and dynamic QR code is displayed on the ATM screen.

To complete the transaction, customers need to scan the QR code using any UPI mobile application installed on their smartphones. After scanning, the ATM prompts them to enter their UPI PIN to authenticate the transaction. Once they authorize the transaction, the ATM dispenses the requested cash, providing a seamless and secure cash withdrawal experience.

Key Features Of UPI ATM:

The UPI ATM offers several key features that make it a game-changer in the banking industry. Let’s take a closer look at these features:

Interoperability:

The UPI ATM provides an interoperable platform that enables cardless transactions across multiple banks. Users can withdraw cash from their accounts, irrespective of the bank they are associated with, using the UPI app.

Transaction Limit:

The UPI ATM allows users to withdraw up to Rs 10,000 per transaction, in adherence to the existing daily UPI limit and the transaction limit set by the issuer bank. This ensures flexibility and convenience for customers while maintaining security protocols.

Convenience:

With UPI ATMs, the need to carry physical ATMs or debit cards for cash withdrawals becomes obsolete. Users can now leverage the UPI app to withdraw cash from multiple accounts, simplifying the cash withdrawal process and enhancing convenience.

How To Withdraw Cash From UPI-ATM?

To withdraw cash from a UPI ATM, follow these simple steps:

- Select the “UPI Cash Withdrawal” option on the ATM screen.

- Choose the desired withdrawal amount from the available denominations.

- A dynamic QR code will appear on the screen.

- Scan the QR code using any UPI mobile application on your smartphone.

- Enter your UPI PIN to authenticate the transaction.

- Once authorized, the ATM will dispense the requested cash.

- Collect the cash and complete the transaction.

Differentiating UPI ATM from Cardless Cash Withdrawals:

While cardless cash withdrawals based on mobile numbers and OTPs are already available, the UPI-ATM sets itself apart by utilizing QR codes for cash transactions. This unique approach enhances security and convenience, providing users with a seamless and efficient cash withdrawal experience. Sumil Vikamsey, Managing Director of Cash Business at Hitachi Payment Services, highlighted the distinction between UPI ATM and existing cardless cash withdrawal options.

Public Reaction And Industry Recognition – UPI ATM Cash Withdrawal:

The introduction of UPI ATM has garnered praise from prominent figures in the financial world. Anand Mahindra, Chairman of the Mahindra Group, expressed his awe at India’s rapid digitization of financial services and its consumer-centric approach. He shared a video showcasing the UPI ATM’s functionality, emphasizing the country’s remarkable progress in the fintech industry.

Praveena Rai, Chief Operating Officer of NPCI, acknowledged the potential of UPI-ATM to transform the ATM landscape, making it more cost-effective, accessible, and widespread. She highlighted the positive reception of the UPI-ATM at the Global Fintech Fest, further reinforcing its significance in shaping the future of banking services.

Frequently Asked Questions (FAQs) About UPI ATM Cash Withdrawal:

What is UPI-ATM?

UPI-ATM is a new way to get cash without a card. You use your phone to get money from an ATM.

How do I use UPI-ATM?

Pick “UPI Cash Withdrawal” on the ATM, choose the cash amount, scan the QR code on your phone, enter your PIN, and get your cash.

Is it safe to use UPI-ATM?

Yes, it’s safe. It’s like using your ATM card but without the physical card.

Can I use any bank’s ATM with UPI-ATM?

Yes, you can. UPI-ATM works with many banks, so you’re not stuck to just one.

What is the cash withdrawal limit for UPI ATM transactions?

The cash withdrawal limit for UPI ATM transactions is Rs 10,000 per transaction, subject to the daily UPI limit and the transaction limit set by the issuing bank.

Is this available on all ATM machines?

No, not all ATMs have UPI ATM. Look for one that says “UPI Cash Withdrawal” to use it.

Do I need a special app to use UPI-ATM?

You’ll need a UPI app like Google Pay or Paytm on your phone to make it work.

Why is UPI-ATM important?

UPI-ATM makes getting cash easier, without carrying a card and is a big step in digital banking.

Can I use UPI to withdraw money from an ATM?

Yes, you can use UPI to withdraw money from the UPI ATM, as per the guidelines set by the Reserve Bank of India (RBI).

Can I withdraw cash from an ATM using apps like Google Pay or Paytm?

To withdraw cash from an ATM using apps like Google Pay or Paytm, you need to ensure that the ATM is equipped with UPI-ATM functionality. Currently, this service is available on RuPay debit cards, with plans to expand to other card networks in the future.

Conclusion – UPI ATM Cash Withdrawal:

The introduction of UPI ATM marks a significant milestone in the evolution of cash withdrawal services in India. This innovative solution offers a secure, convenient, and cardless method to access cash, revolutionizing the traditional ATM experience. The future of banking services in the country is set to be reshaped by UPI-ATM, with its interoperability, transaction limits, and enhanced convenience. As India embraces digital financial innovation, UPI-ATM stands as a testament to the nation’s commitment to providing seamless and customer-centric solutions in the fintech industry.