SBI Credit Card Login: SBI Credit Card is one of the most well-known Credit Cards in India. It gives a variety of credit cards with features and advantages such as rewards points, contactless payments, easy EMI options, etc., to meet different financial requirements. With this card, you can make instantaneous purchases for merchandise and services and pay for them later.

This article will discuss the SBI Credit Card Login & Registration Process, SBI Credit Card Benefits, Types of SBI Credit Cards, and other information.

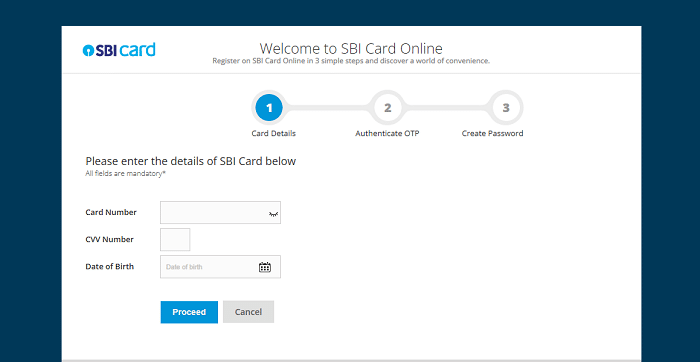

Registration Process On SBI Card Portal?

- The customer should visit the official website of SBI Card at https://www.sbicard.com.

- On the home page click on “Register Now” below the “Login” field.

- The next screen will appear, here enter your “Card Number”, “CVV Number”, and “Date of Birth” and then click on the “Proceed” button.

- After that, you will receive an OTP to your registered mobile number enter the same and click on the “Continue” button.

- Now, on the next page, you have to create the “Username”, “New Password” and “Confirm Password” and then click on the “Register or Sign Up” button.

- Then you will be registered successfully on SBI Card Portal.

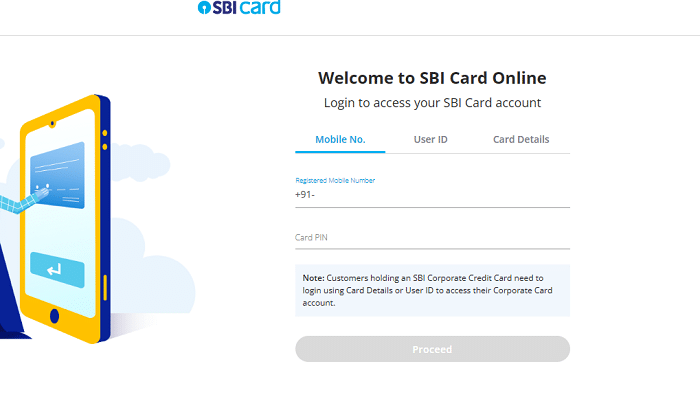

SBI Credit Card Login Process – SBI Card Portal?

- Visit the official website of SBI Card. ie., https://www.sbicard.com

- The home page will appear, here click on the “Login” button on the left side of the page.

- The login page will appear, here you can see 3 login methods. Ie., Mobile Number, User ID, and Card Details.

- You can use any one method to login into the SBI card portal.

- But customers holding an SBI corporate credit card need to log in using Card Details or User ID to access their Corporate Card account.

- Login using Mobile Number: enter your “Mobile Number”, and “Card PIN” and then click on “Proceed”.

- Login Using User ID: enter your “User ID”, and “Password”, and then click on the “Login” button.

- Login Using Card Details: enter your “Primary Card Number”, and “Date of Birth” and then click on “Generate OTP”.

- An OTP will be sent to your registered mobile number enter the same and you can log in.

- In this way, you can easily complete the SBI Credit Card login process on the SBI Card Portal successfully.

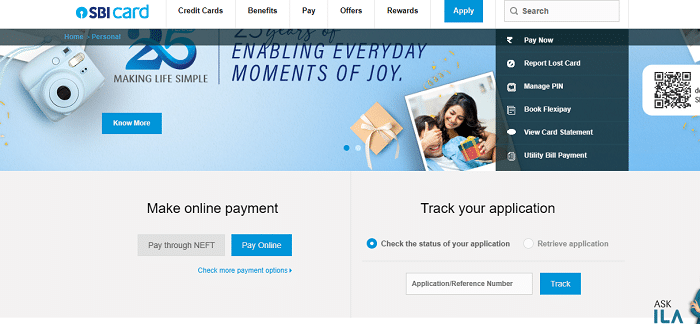

How To Apply For A SBI Credit Card Online?

- Open the official website of SBI Card.

- On the home page click on the “Apply” link on the right side of the page.

- On the next screen, you can find 36 credit cards, now, you have to select one credit card as per your choice and click on the “Apply Now” button.

- Click on the “Start Apply Journey” link on the next page.

- Now, you have to enter your personal details like “First Name”, “Middle Name”, “Last Name”, and “Mobile Number” and then click on the “Continue” button.

- Next, enter your “Professional Details” like “Occupation”, “Designation”, “Company Name” etc, and “KYC Details” like “Address” “Pin Code” etc., and then click on the “Submit” button.

- After that, you will receive an instant decision on the application basis of the information provided.

- If your application is approved, you will receive a call from the SBI Card team for verification.

- After the verification, the card is issued to you.

How To Track SBI Credit Card Application Status?

- Go to SBI Card Portal ie., https://www.sbicard.com

- The home page will appear, scroll down the page you will find a “Track Your Application” section.

- Here enter your “Application Number/Reference Number” and click on the “Track” button.

- Then the status of your SBI Credit Card application will appear on the screen.

SBI Credit Card Benefits:

SBI Card provides various benefits to customers. Some of them are mentioned below.

Contactless Transactions:

You can simply tap your SBI Credit Card on NFC-enabled POS machines to make simple, convenient & secure transactions.

Reward Points:

You can earn Reward Points with every purchase made using SBI Card. The accumulated Reward Points can be redeemed for various gifts from the Rewards Catalogue.

Exclusive Cashback & Discounts:

You can avail Cashback & Discounts, on various merchants & Partners in travel, shopping, Dinning & other categories.

Add-On Card:

You can gift your loved ones up to 2 complimentary Add-on SBI Cards.

Pay In EMIs:

You can pay back your big purchases in easy EMIs.

Cash Withdrawal From ATMs:

You can use your SBI Card to withdraw cash from any ATM across India.

Types Of SBI Credit Cards:

SBI Card offers a range of credit cards to provide unmatched privileges & benefits, tailor-made to meet your different needs. Following are the different types of credit cards offered by SBI Card.

Lifestyle Cards:

Lifestyle cards such as SBI Card ELITE, Doctor’s SBI Card, etc. provide you with unmatched lifestyle privileges & benefits.

Reward Cards:

Reward Cards like SBI Card PRIME, Apollo SBI Card, OLA Money SBI Card & Many more, offer great Cashback, Discounts & Reward Points on your spending.

Shopping Cards:

Shopping Cards such as Simply CLICK SBI Card, Simply SAVE SBI Card, Lifestyle Home Centre SBI Card PRIME, Max SBI Card PRIME & many more, provide you with exclusive shopping benefits & features.

Travel & Fuel Cards:

Travel & Fuel Cards such as Club Vistara SBI Card, Etihad Guest SBI Card, IRCTC SBI Card Premier, Yatra SBI Card & much more, are specifically designed keeping in mind the needs of a traveler with unmatched travel and fuel-related benefits.

Banking Partnership Cards:

Banking Partnership Cards such as Central Bank of India SBI ELITE Card, City Union Bank SBI Card PRIME, Allahabad Bank SBI Card ELITE & many more, provide you with exciting benefits that come from our exclusive banking relationships.

Business Cards:

Business Cards such as SBI Card PRIME Business & SBI Card ELITE Business, to help you in growing your business.

Necessary Documents To Apply For SBI Credit Card:

The following are the mandatory documents to apply for an SBI Credit Card.

- PAN Card.

- Copy of Aadhaar Card (with first 8 digits masked) or any valid government address proof.

- Other documents like your income documents – Salary Slip, Income tax return, etc. may be required depending upon the credit card eligibility & policy.

Minimum Age Limit To Apply For A SBI Credit Card:

The minimum age limit to be eligible to apply for a credit card online is

- Salaried individual – 21 years and above.

- Retired pensioners within the age group of 40-70 years.

- Self-employed individuals above the age group of 25 years.

The SBI Credit Card offers a range of credit cards that come with various features and benefits to suit different financial needs. Applying SBI credit card is a simple process that can be done through their website or mobile app. Before applying for an SBI credit card, make sure to read the terms and conditions, fees, and charges carefully to understand the benefits and costs associated with it.