Chhattisgarh CGSUDA Property Tax: If you own a property in the Chhattisgarh Municipal Corporation, paying your property tax is a crucial responsibility. This tax is used to fund essential municipal services like garbage collection, street lighting, and road maintenance. However, navigating the property tax payment process can be daunting, especially if you’re unfamiliar with the procedures. Thankfully, cgsuda.com offers a convenient solution for property owners in Chhattisgarh to pay their taxes online. This platform is user-friendly and easy to use, making it an ideal option for busy property owners who want to save time and hassle.

In this article, we’ll guide you through the steps of paying your property tax in the Chhattisgarh Municipal Corporation using cgsuda.com. For both experienced and novice property owners, this article will provide information on how to keep track of property tax payments using the Chhattisgarh Municipal platform. This official website, https://cgsuda.com/, allows users to make property tax payments of various municipal corporations of Chhattisgarh online.

The following are the steps on how to pay property tax in Chhattisgarh using the official website of the Chhattisgarh Municipal.

How To Make Chhattisgarh Property Tax Payment Using CGSUDA Portal?

- The citizen should visit the official website of Chhattisgarh Municipal. i.e.,https://cgsuda.com/.

- The home page will appear, here you have to select the “Pay Property Tax ( Online )” option which is under the ‘Property / Holding Tax’.

- One page will open, here you have to select your ULB ( Urban Local Body ) and click on the ‘Go Now’ option.

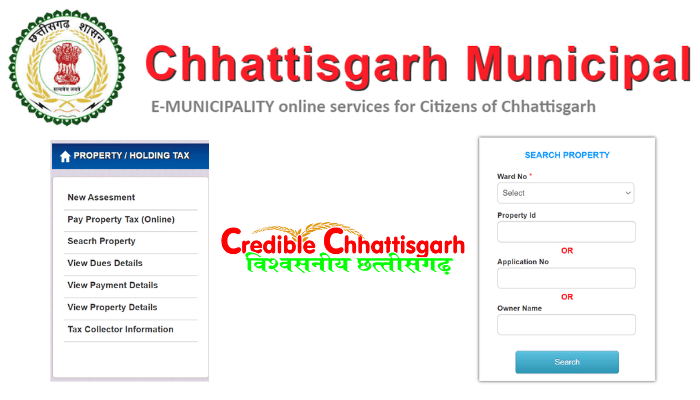

- Then the search property page will appear, here you have to select your Ward Number, Property ID or Application Number or Owner Name.

- After entering all the details click on the ‘ Search ‘ button.

- Now, the property list will appear. Then you have to click on the ‘ View ‘ option to check the property details like address, total area, owner details, and complete property tax details.

- After that, you have to click on ‘ View payment details ‘ to know the information about previous property tax payments.

- Now, you have to click on ‘ View demand details ‘ to proceed with tax payment. Check the details regarding the amount to be paid.

- After checking the bill details if you are sure of making the payment click on the “Pay Property Tax” option.

- The next page will appear and it contains the property tax details and the payable amount. Then you have to click on ‘ I Agree to Terms & Conditions ‘ and then click on the “Pay Now” Option.

- Payment Screen will appear, here You have to click on ‘Pay online’. Then you have to choose the preferred payment mode like a credit card, debit card, net banking, etc.

- And you have to provide the required details in the appropriate fields. Then click on the “Pay Now” option for making a payment.

- Finally, an online receipt will be generated that you can download, save and print for future reference.

Apply For New Assessment Using CGSUDA Portal And Pay Chhattisgarh Property Tax:

- Go to the official website i.e, cgsuda.com

- Scroll and find the Property/Holding Tax section.

- Click on New Assessment.

- Now you will be redirected to another page, and select any one of the three ULB Municipal Corporations which are in the list.

(Be sure, you know the exact Municipal Corporation you have your property in.)

- Click on the “Go Now” button.

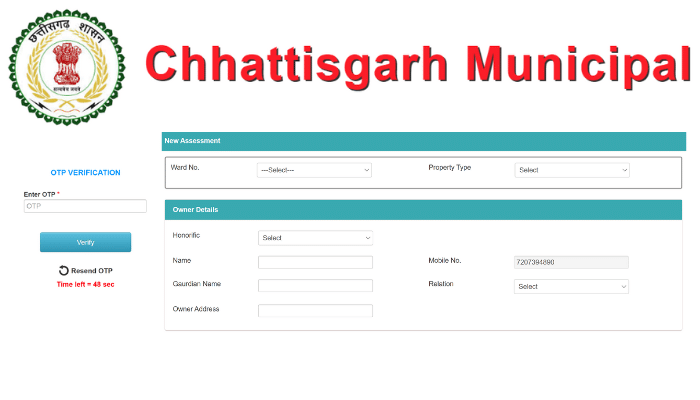

- You will be redirected to the next page, where you need to enter your mobile no. and click on the “Submit” button.

- Now, you will get an OTP, which you need to enter and click on Verify button.

- At this point in time, you will be moved to New Assessment Property Tax Online Form.

- Fill in the property tax online form. Verify all the details and click on the “Submit button”.

How To Pay Property Tax In Chhattisgarh? (Offline)

The following are the steps on how to pay Property Tax in Chhattisgarh through offline mode.

- The citizens of Chhattisgarh can also pay their Property tax by visiting the local municipal office.

- Here, the citizen should submit the Property Tax Challan / Property ID at the designated counter.

- The officials check the details or verify the details provided by the citizen.

- After that, they will share the payment details.

- Now, the citizen can check the bill details and pay the tax amount.

- After making the payment the citizen will get the payment receipt.

Document Required For Property Tax In Chhattisgarh Using CGSUDA Portal:

The applicants are required to provide some documents at the time of online registration. The following is the document details for property tax in Chhattisgarh.

- Mobile Number

- Email Id

- Aadhaar Card

- Challan / Property ID, which is the unique number for the property

- Old property ID, the previous number basis on which tax was paid

- Owner’s Name

- Address of the property

FAQ’s Related Property Tax In Chhattisgarh:

What is the official website of Chhattisgarh Municipal Corporation?

The Chhattisgarh Municipal Corporation’s official website is www.cgsuda.com.

What is the procedure to pay property tax in Chhattisgarh?

Citizens can make payment of their Property tax in Chhattisgarh using the official website of Chhattisgarh Municipal.

What is the validity of Property Tax Documents?

The property tax documents are valid for one year. so, every year it has to be renewed.

Are there any penalty charges for not paying the Property Tax in Chhattisgarh?

Yes, If a taxpayer does not pay the tax amount within the given time period, the concerned department may charge a penalty.

The use of cgsuda.com has many benefits, including paying off taxes on behalf of other Chhattisgarh residents. The most important benefit of using cgsuda.com is that it digitally transfers funds directly from your bank account to the appropriate authorities. Keeping your money in your bank account will not benefit the Chhattisgarh community as it could if it were used for their benefit.

It’s a great option if you’re unable to pay your taxes and want to help others at the same time. We hope you found this guide helpful. If you have any questions about paying your tax in the Chhattisgarh Municipal Corporation using cgsuda.com, feel free to contact our office.