e-NagarSewa House Tax: If you own a house or property in Uttar Pradesh, paying your house tax can seem daunting. But with the advent of technology, the process has become much simpler, thanks to e-Nagarsewa. This online portal has revolutionized how people pay their taxes, making it easier and more convenient.

In this article, we will look at how to pay house tax in Uttar Pradesh using e-Nagarsewa. We will provide a step-by-step guide on using this platform, what documents you need, and the benefits of using e-Nagarsewa to pay your house tax.

For those of you living in Uttar Pradesh who want to pay their house taxes without any difficulty, e-Nagarsewa is the answer. All the information you need can be found on the official website of e – NagarSewa portal of the Uttar Pradesh Municipal Corporation, which is https://e-nagarsewaup.gov.in/.

How To Login Into e-NagarSewa Portal To Pay House Tax?

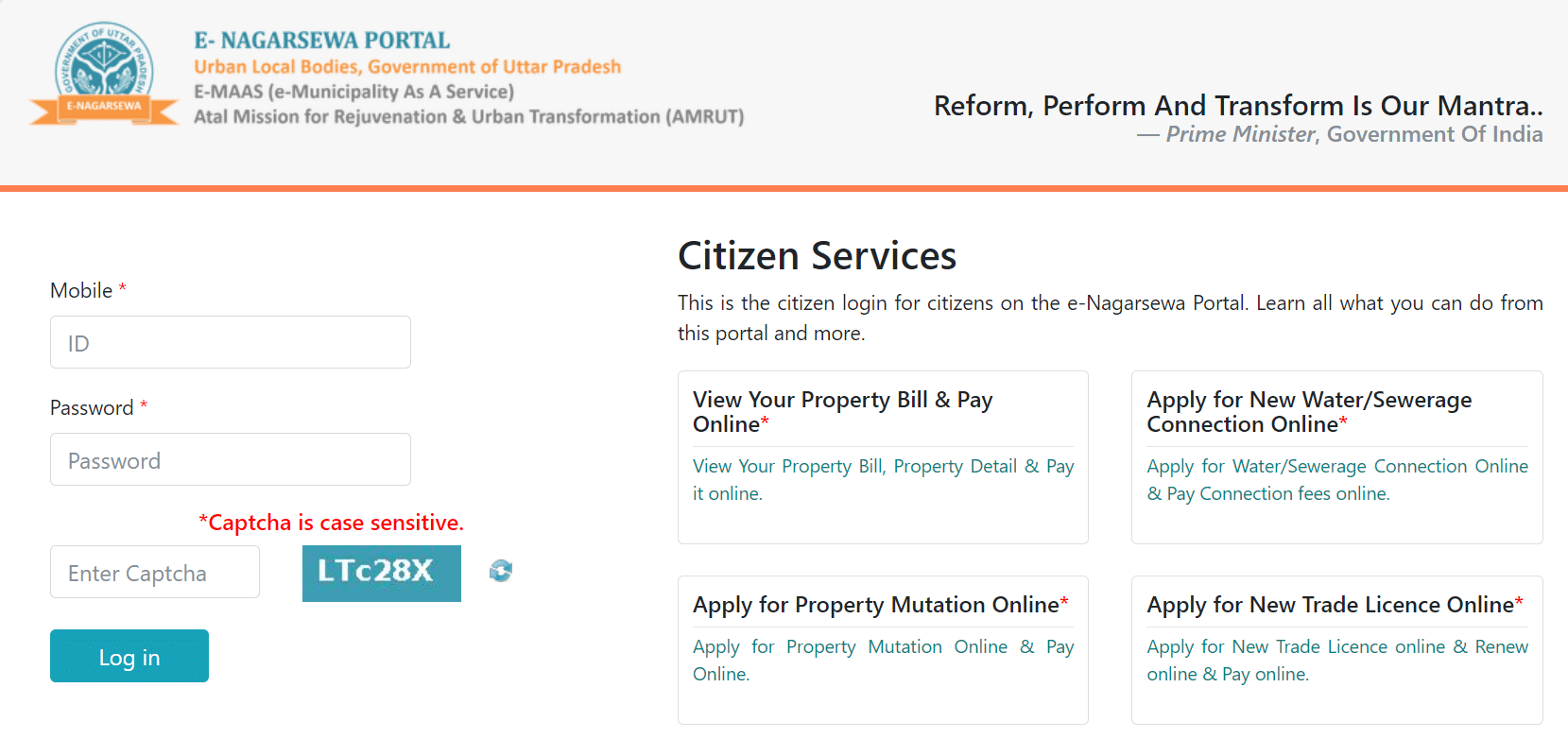

To pay house tax in UP, you must have an account in the e-NagarSewa portal. If you already have an account, you should log into e-NagarSewa Portal. And if you don’t know how to login into the official portal, you are in the right place. Following are the steps to login into e-NagarSewa to pay property tax.

- Go to the official visit i.e., https://e-nagarsewaup.gov.in/

- From the top menu bar, click Citizen Services and tap Citizen Login from the drop-down.

- Now you will be redirected to another page. Here you need to enter your username and password.

- Enter the captcha, and click on the Login button.

Once you log in, you can avail all the services provided by the e-NagarSewa. If you don’t have an account in e-NagarSewa Portal, you can register by following the simple steps.

- Visit the link i.e., https://e-nagarsewaup.gov.in/onlinepay/citlogin, which is the Citizen Login page.

- Go to the bottom of the page to find the Register Button.

- Click on the Register button.

- Now, you will be redirected to another page, where you will be asked to complete the registration form.

- After filling out the form, click on the Submit button.

- At this time, you will get an OTP to your mobile number. This OTP is used to verify your mobile number and to complete the e-NagarSewa Registration Process.

- Now, you will get the Username (Your Phone Number), and the Password will be sent to your mobile number as an SMS.

Use the credentials to log into your e-NagarSewa Account.

The property tax service provides a digital interface, allowing citizens to search and download property bills, make payments online, and download the payment receipt. The following are the steps to learn how to pay property tax in Uttar Pradesh online.

How To House Tax In Uttar Pradesh Using e-NagarSewa Portal?

- Firstly, the citizen should visit the official website of e – NagarSewa portal of Uttar Pradesh Municipal Corporation https://e-nagarsewaup.gov.in/.

- The home page will appear here, you have to go to ‘ULB Services’ and click on ‘Property Tax’.

- Admin Login Page will open, here, you must select ULB type and city. If you are a registered customer, log in to the portal by entering your login Id and Password, and the captcha to appear on the screen.

- Now you can search for the property by entering the required details like City, House Number, Owner Name, and Address. Then you need to enter the Property ID and click the Submit button.

- After that, all the property details will be appeared on the screen along with the bill details.

- Now, you must check the checkbox against the quarter or arrear bills for which the payment can be made. Then you need to click on the ‘Pay Now’ option.

- Then you will be redirected to the payment gateway. Here you have to select your mode of payment. You can use your net banking, debit card, or credit card to pay.

- The following details should be filled in to make the payment:

- UBL name

- Collection Date

- Collection Centre

- Payment Mode

- Bank Details

- Then you have to fill out all the necessary payment details and click on the ‘Make Payment‘ option to make the payment.

- After making the payment, your receipt will automatically be generated. You may Save the receipt and print the receipt for future reference.

This way, you can pay the property tax in Uttar Pradesh online.

Documents Required For Paying House Tax in UP Using e-NagarSewa Portal:

Applying for house tax in Uttar Pradesh using the e-NagarSewa Portal is simple and convenient. It is important to submit all the required documents to ensure the application succeeds. The documents required to apply for house tax in Uttar Pradesh using the e-NagarSewa Portal include the following:

- A valid identity proof such as an Aadhaar card, passport, driving license, PAN card, etc.

- A valid proof of residence includes a ration card, electricity bill, voter ID, bank statement, etc.

- A photograph of the house or property in question.

- The property tax assessment slip or the property tax demand notice received from the local body.

- A copy of the latest property tax receipt, if any.

- A copy of the property ownership document such as the sale deed, transfer of rights, lease agreement, etc.

- Any other documents as may be specified by the local body.

It is important to ensure that all the required documents are provided when applying for house tax in Uttar Pradesh using the e-NagarSewa Portal. Applicants should also check with the local body to see if additional documents may be required. By providing all the necessary documents, applicants can get their house tax applications processed quickly and without any hassle.