GHMC Property Tax Payment: Property tax is an essential component of local government revenue, and it is vital to understand how it works. If you own a property in the Greater Hyderabad Municipal Corporation (GHMC) area. You must pay property tax to the local government. However, many property owners are unaware of the process and end up paying more than they should or missing the deadline. That’s where this guide comes in handy.

In this article, we will guide you through the steps of calculating and paying property tax in GHMC. We will explain property tax basics, the necessary documents, and the online payment process. By the end of this guide, you will have a clear understanding of how property tax operates in GHMC and how to ensure you make timely and accurate payments. So, let’s begin!

How To Make GHMC Property Tax Payments Using GHMC.Gov.In Portal?

The property tax service provides a digital interface, allowing citizens to search and download property bills, make payments online, and download the payment receipt. The following are the steps to learn how to pay property tax online in GHMC.

- To begin with, citizens should navigate to the Greater Hyderabad Municipal Corporation, Government of Telangana website, which is https://ghmc.gov.in/

- Upon arriving at the homepage, they must select the ‘Online Payments’ tab and click the ‘Property Tax’ option.

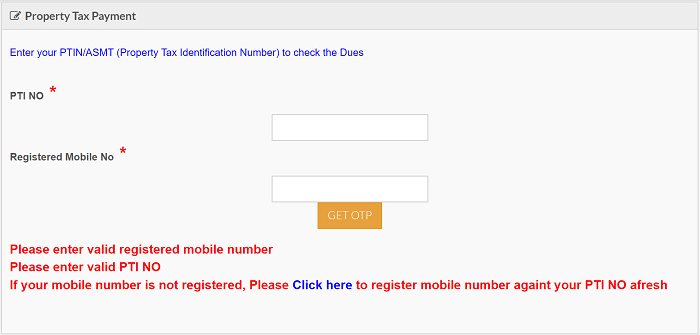

- This will open a new page, where the user must enter their PTIN (Property Tax Identification Number) and registered mobile number to view the dues and then click ‘Get OTP’.

- The OTP will be sent to the user’s registered mobile number, which they should enter and click ‘Submit OTP’.

- Afterward, all relevant details, including arrears, interest on arrears, adjustments, property tax amount, etc., will be displayed on the screen to be verified.

- After that, they must choose their mode of payment. This can be done using their net banking, debit, or credit cards.

- A receipt will be generated after successful payment, which can be saved and printed for future reference.

In this manner, the property tax in GHMC can be paid online.

How To Generate GHMC Property Tax PTIN Number?

To make the property tax payment in Greater Hyderabad Municipal Corporation, Government of Telangana. You must know about your 10-digit PTIN (Property Tax Identification Number) for new properties. In the case of Old Properties, the GHMC allows a 14-digit PTIN. Owners of new Properties have to get a PTIN generated by giving an application to the city deputy commissioner along with copies of their sales deed and occupancy certificate. A physical verification process will take place at the property. After that, all the legal documents, a PTIN, and house number are issued to the owner by the authority. The following are the details about generating PTIN to pay property tax in GHMC.

- Go to the official website of the Greater Hyderabad Municipal Corporation, Government of Telangana, which is https://ghmc.gov.in/.

- The home page will appear, and they should click on the ‘Online Services‘ option and select ‘Self Assessment of Property Tax’.

- The self-assessment form will open, requiring the user to provide their mobile number and click ‘Send OTP’. This will generate an OTP, which should be entered and submitted by clicking the ‘Submit OTP’ button.

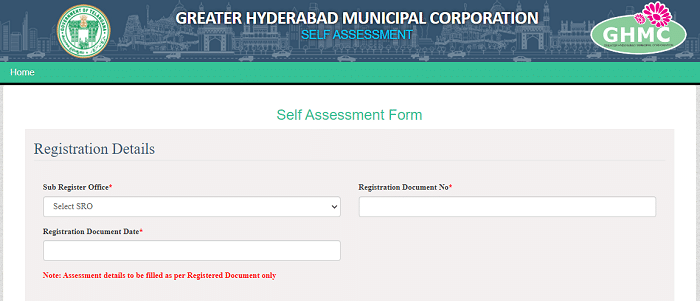

- The self-assessment form will then require the user to enter the registration details. Such as selecting the sub-register office from the dropdown list and entering the registration document number and date.

- Property details like the owner’s name, father’s name, address, etc., must also be filled in, and the sale deed document must be uploaded before clicking the ‘Submit’ button.

- The online application will then be passed on to the deputy commissioner, who will visit the premises and issue a PTIN number to the owner.

How To Add/Update Mobile Number For GHMC Property Tax ID?

- Go to the official website of GHMC i.e., https://ghmc.gov.in

- Select Property Tax from “Our Services” on the Top Menu Bar.

- Keep your cursor on Property Tax to see GHMC.

- You will see Add/Update Mobile Number when you place the mouse pointer on GHMC. Click on it.

- You will be redirected to another page for your PTIN Mobile Number Updation.

- You need to select your area under Circle and enter the Assessment Number.

- Click on the Search button to see your Property Tax details.

- Tap on the Update button, which is next to your property.

- Enter the mobile number you wish to update and request for OTP.

- Authorize the mobile number for PTIN updation by entering the OTP and Clicking on Confirm Button.

Your PTIN Mobile Number updation is completed and linked to your Property Tax Account.

Property taxes are calculated based on the value of the properties and how much each property owner can pay in a given year.

As a general rule, the higher the value of a property, the lower the tax rate. For example, in Greater Hyderabad (GHMC), properties worth Rs 1 crore and Rs 5 crore are subject to a much lower tax rate than those worth Rs 5 crore and Rs 30 crore. But that doesn’t mean you can escape paying the higher tax rates on some expensive properties. If your property is worth Rs 30 crore or more, you will likely have to pay higher taxes.

This guide will help you calculate the amount of tax you will have to pay based on your property’s value and how much you can pay in tax each year.