Jammu Property Tax: Paying property tax in Jammu & Kashmir is now easier than ever. Starting from 1st April 2023, all residents living in municipal areas of the union territory must pay property tax for their residential and non-residential properties.

The property tax rates for residential properties will be 5% of the Tax Annual Value (TAV), while the tax rate for commercial properties will be 6% of the TAV. The TAV is determined based on several factors, including the municipality type, land value, floor area, age of the property, slab, usage type, and occupancy.

These property tax rates contribute to state revenue and promote equitable citizen contributions. Timely payment supports local economic growth and enhances Jammu & Kashmir’s quality of life.

How To Pay Jammu Property Tax Using Jammu.Cantt.Gov.In Portal?

The property tax service provides a digital interface, allowing citizens to search. Also, download property bills, make payments online, and download the payment receipt. The following are the steps to know about how to pay property tax in Jammu and Kashmir.

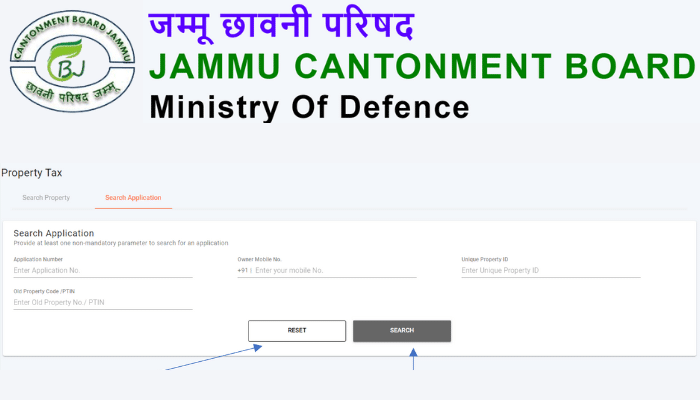

- Firstly, the Citizen should visit the official website of the Ministry of Defence, Jammu Cantonment Board. i.e., https://jammu.cantt.gov.in/

- The home page will appear; here, you have to click ‘Property tax ‘under ‘Public Services’ on the left side.

- The Property Tax page will appear here. You must scroll down the page and click the ‘APPLY ‘button.

- Then the eChhawani page will open and asks to select the Regional language. In addition, you have to set your regional language.

- After selecting the language ‘login ‘box will appear; here, you have to log in to the system mobile number and OTP.

- If you don’t have an account, click the ‘Register ‘option. Enter your mobile number name, choose the cantonment, click the Continue option, and register yourself.

- After registering, you can log in through your mobile number and OTP.

- After login, you must search for the required property using the “Search Property “option.

- Then your bill will display on the screen. You may download the invoice.

- After checking the bill, you must pay the property tax using the portal of Property tax bill payment link received through SMS and Email.

- Then you have to Download the receipt.

- The payment status will be updated through SMS and email.

- Finally, you can download & print the Property Tax bill and receipts for future reference.

How To Calculate Jammu Property Tax?

The following isis the Calculation of Property tax information in Jammu and Kashmir.

The Taxable Annual Value ( TAV ) of a property under the Act. And the property tax due for a financial year shall be calculated by the formula in Schedule – I to these rules.

The property tax calculated for the building shall hold for a block of three years unless any change to such calculation is necessitated based on the circumstances envisaged in the Act for allowing revision in such analysis.

The first block shall commence from 1st April 2023 and remain in force until 31st March 2026. The blocks shall be similarly calculated after that.

New buildings coming up after the commencement of the block shall have their tax liability calculated concerning the 1st day of the relevant union, and irrespective of their having completed three years, their liability to tax shall be calculated anew from the date of commencement of the new block of three years for Corporation as a whole.

A building is liable to property tax for only a part of the year. The tax due shall be proportional to the number of completed months, and features of the month not ended shall be ignored.

Penalty Charges Late Payment Of Jammu Property Tax:

If any Citizen fails to file a return in due time, unless prevented by sufficient cause, shall, without prejudice to the interest owing for the delay in payment. Make the person from whom it is due liable to a penalty of Rs 100 /- or 1 % of the tax due. Whichever is higher for every month of default. The maximum penalty cannot be greater than Rs 1000 /-

FAQs On Property Tax In Jammu and Kashmir:

What is the validity of Property tax Documents in Jammu and Kashmir?

The Property tax documents are valid for one year. So, every year it has to be renewed.

Are there any penalty charges for not paying the Property tax in Jammu and Kashmir?

Yes, the concerned department may charge the penalty if any taxpayer does not pay the tax amount within the given period.

As per the current law, the Jammu and Kashmir government is the only authority authorized to collect and distribute funds. To pay the interest on buildings and other loans taken by the government. It is the only entity with the sole power to collect and distribute funds to fund the state’s public works. The state government can collect and distribute funds per section 123 of the Jammu and Kashmir Finance Act, 2017. For the following reasons:

It can collect funds through the sale of bonds, consumption of certain funds generated through the government’s resources, etc. For example, the Jahu and Kashmir governments can sell bonds, create specific funds, and use these funds for the same purposes.

The government’s main objectives are to provide development and improve the residents’ standard of living. However, one major disadvantage of the government related to cash flow is that the collection of funds is not always enough. In this light, the government must improve its cash flow situation.