NPS Login With PRAN: NPS Stands for “National Pension System”, and PRAN means ‘Permanent Retirement Account Number”. The National Pension System was launched by the Central Government of India on 1st January 2004 (Except for the armed force). It was made available to all citizens of India from 1st May 2009. NPS is regulated by the Pension Fund Regulatory and Department Authority (PFRDA), the regulatory body responsible for overseeing pension-related matters in India.

The Government of India has created the National Pension System, a retirement savings program, to aid individuals in planning for their financial security after retirement. It is available to any Indian citizen who wishes to participate and offers various investment options to match their needs.

To improve the convenience and accessibility of the NPS, the government of India has established the NPS Portal. This digital platform offers a wide range of services and features to subscribers. This article will explain NPS Registration & Login Process, Reset Passwords, features & benefits, and other information.

NPS Login Overview:

| Name of the Portal | eNPS – Nationa Pension System Portal |

| Introduced By | Government of India |

| Launched On | January 1, 2004. |

| Made Available On | May 1, 2009. |

| Regulated By | Pension Fund Regulatory and Department Authority (PFRDA) |

| Main Objective | To provide old age security to Citizens of India |

| Beneficiaries | Citizens of India. |

| Official website | https://enps.nsdl.com. |

| Address | Protean eGov Technologies Limited,

1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai – 400 013. |

| Tel No. | 022 – 2499 3499 |

| Fax No. | 022 – 2495 2594/ 2499 4974 |

| Toll-free Number For Registered Subscriber (PRAN is Mandatory) | For NPS Subscriber – 1800 222 080 For APY Subscriber – 1800 889 1030 |

NPS Login With PRAN/IPIN Procedure:

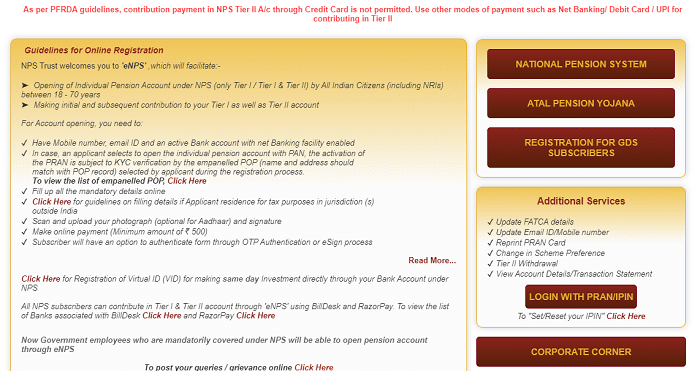

- The applicant should open the official website of NPS at https://enps.nsdl.com/.

- Scroll down the home page, and click “Log in with PRAN/IPIN” under the “Additional Services” section.

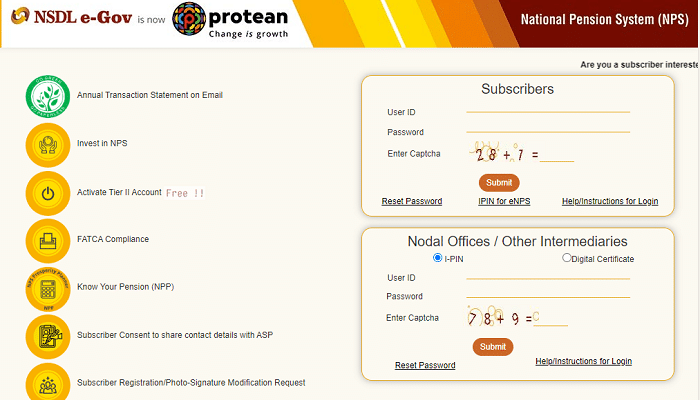

- The NSDL login page will appear on the screen; here, go to the ‘Subscribers’ section and enter your ‘User ID’, ‘Password’, and ‘Captcha Code’ and then click on the ‘Submit’ button.

- Then you will be logged into your National Pension System (NPS) account successfully.

NPS (National Pension System) Registration Process:

Under NPS, registration to open an individual pension account. By using this option, Citizens of India between 18-70 years can open ‘Tier I’ or ‘Tier I and Tier II’ both types of accounts, an NRI/OCI individual can open only ‘Tier I’ account. Individuals can easily register themselves for NPS either through online or offline mode. To register on NPS online, follow the below steps.

NPS Registration Process – NPS Login:

-

- The applicant should visit the official website of NPS at https://enps.nsdl.com/.

- The National Pension System Trust home page will appear on the screen.

- Click on the “National Pension System” tab on the right side of the home page.

- Click on the “Registration” option on the next page.

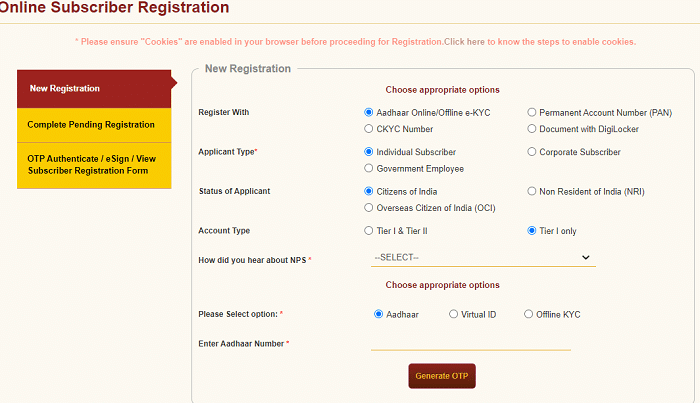

- The online subscriber registration form will open, here you can choose the appropriate options.

- Register with: Aadhaar online/offline e-KYC, Permanent Account Number (PAN), CKYC Number, or ‘Document with DigiLocker.

- Applicant Type: Individual Subscriber, Corporate Subscriber, or Government Employee.

- Status Of Applicant: Citizens of India, Non-Resident of India (NRI), or Overseas Citizen of India (OCI).

- Account Type: Tier I & Tier II or Tier I only.

- How did you hear about NPS: Friend/Family, Social Media, Newspaper/magazines, TV/Radio, Financial Advisor/Apps, or Employer.

- Now select either Aadhaar, Virtual ID or offline KYC and enter the respective number depending on your selection.

- If your select Aadhaar or Virtual ID, you have to enter ‘Aadhaar Number’ or ‘Virtual ID’ and then click on the ‘Generate OTP’ button.

- You will receive an OTP to your registered mobile number; enter the same and click on the ‘Continue’ button.

- In case you select ‘Offline KYC’ you must enter ‘Aadhaar register mobile number’, ‘Last digit of Aadhaar number’, ‘upload Aadhaar e-KYC XML file’, and ‘share code for your paperless offline eKYC’ and then click on the ‘Continue’ button.

- On the next page, you must provide all the mandatory details to generate an ‘Acknowledgment Number’ and then click the ‘Proceed’ button.

- After completing all the details, you must make the payment and generate the PRAN.

- Once you complete the registration process, provide OTP authentication, e-sign it, or print and courier the registration form.

How To Reset NPS Login With PRAN/IPIN Password?

- Go to the official website of NPS at https://enps.nsdl.com/

- Scroll down the home page, and click on “Log in with PRAN/IPIN” under the “Additional Services” section.

- The NSDL login page will appear on the screen, here go to the ‘Subscribers’ section and click on the “Reset Password” under the login field.

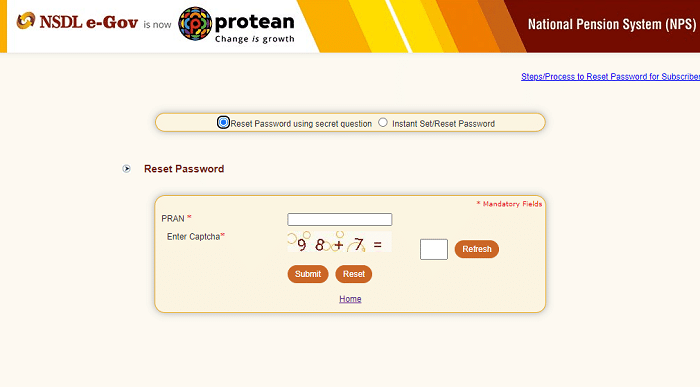

- On the next page, you will have two password reset options.

- Reset password using secret question.

- Instant Set/Reset Password.

Reset Password Using Secret Question – NPS Login:

- After selecting the reset password using the secret question option, enter your ‘PRAN’ and ‘Captcha Code’ and click on the ‘Submit’ button.

- On the next page, you may set/reset the password using the Secret Question and Answer (set at the initial login time).

- You can easily reset your NPS Login Password using the Secret Question option.

Instant Set/Reset Password – NPS Login:

-

- If you select Instant Set/Reset Password, you can reset IPIN by selecting either ‘Nodal office’ or ‘Generate OTP’.

- Selecting Nodal Office Option: If you select the Nodal office, enter “PRAN”, ‘Date of Birth’, ‘New Password’, ‘Confirm Password’, and ‘Captcha Code’ and click on the ‘Submit’ button.

- Once the details are submitted, a confirmation screen displays the entered details required to be confirmed by the user.

- On confirmation, an Acknowledgment Number will be generated. On the screen, a print option is also available, and you may take the print of the acknowledgement details.

- Now, you need to submit the printed Acknowledgment to the associated Nodal Office (PAO/CDDO) for ‘Authorization’ of the request.

- Once the associated Nodal office confirms the Acknowledgment number, you (Subscriber) can log in using a new password.

- Selecting Generate OTP Option: If you choose ‘Generate OTP’, you need to enter ‘PRAN’, ‘Date of Birth’, and select OTP via ‘SMS’ or ‘Email’.

- And also, enter ‘New Password’, ‘Confirm Password’, and ‘Captcha Code’ and then click the ‘Submit’ button.

- On the next page, enter the OTP received on your registered ‘Mobile Number or Email ID’ and click on the ‘Submit’ button.

- After successful submission, an Acknowledgment number indicating Subscriber’s IPIN request through OTP has been successfully processed, and the Subscriber may now log in to his/her NPS account online.

- This way, you can easily reset your NPS Login Password using the Instant Set/Reset Password option.

Features & Benefits Of NPS (National Pension System) – NPS Login:

The benefits of the National Pension System (NPS) are mentioned below.

- It is voluntary – A subscriber can contribute at any point in a financial year and change the amount he wants to set aside and save every year.

- It is simple – the subscriber must open an account with any of the POPS (Point of Presence) or through eNPS.

- It is flexible – Subscriber can choose their investment options and pension fund and see their money grow.

- It is portable – Subscriber can operate their account from anywhere, even if they change city and employment.

- It is regulated – NPS is regulated by PFRDA, with transparent investment norms and regular monitoring and performance review of fund managers by NPS trust.

The National Pension System (NPS) provides individuals a convenient and flexible way to save for their post-retirement years. It offers tax benefits, investment choice, and portability, allowing people to build a retirement corpus according to their preferences and needs. Overall, NPS is a valuable tool for individuals to plan and save for a financially secure and comfortable life after they stop working.