PAN Card Correction Form PDF: The PAN (Permanent Account Number) card is an essential identification number for taxpayers in India. However, people may need to make corrections to their PAN card for various reasons such as name changes, incorrect personal details, or address updates.

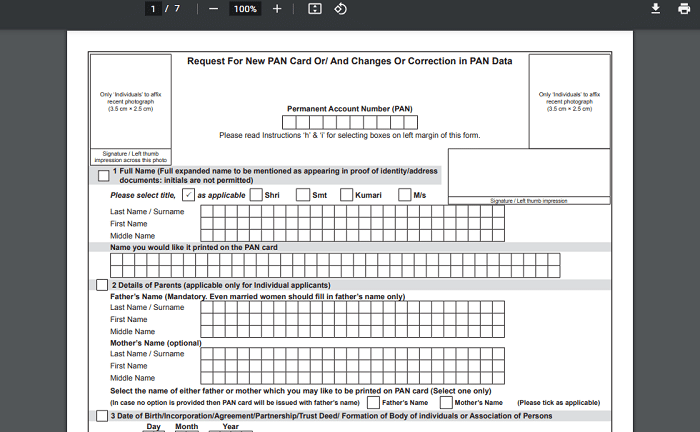

The Income Tax Department of India offers the PAN Card Correction Form PDF, an application form designed for individuals who need to rectify their PAN card details. The PAN card correction form in PDF format can be easily acquired from either the official website of the Income Tax Department or authorized service providers.

This article will explain how to download the PAN card correction form pdf, apply for the PAN card correction online, the necessary documents, fee charges details, and other information.

PAN Card Correction Form PDF Overview:

| Name of the Article | PAN Card Correction Form PDF |

| File Type | |

| PDF File Size | 318 kb |

| PDF Page Count | 7 |

| PAN Card Correction Form PDF Download Link | https://incometaxindia.gov.in/Documents/form-for-changes-in-pan.pdf |

How To Download PAN Card Correction Form PDF?

The following are the steps to download PAN Card Correction Form in PDF format.

- The applicant should visit the official website of the Income Tax Department at https://incometaxindia.gov.in/

- After clicking on the link, the PAN Card modification Form PDF will open.

- Now, you have to click on the down arrow symbol (Download Icon) to download the PDF.

- A PDF file containing the PAN card correction form will start downloading to your device.

- Once the PDF is downloaded into your system, you have to take the printout and fill out the form with the necessary details.

- After filling out the application form, you need to attach mandatory documents like proof of identity, proof of address, and proof of date of birth.

- After that, you have to submit the form to the nearest PAN service centers or TIN-Facilitation Centers, or PAN Centers.

- Then you will receive an acknowledgment containing a unique number on acceptance of this form.

- This acknowledgment number can be used for tracking the status of the application.

- In this way, you can easily download the PAN card correction form in a PDF file.

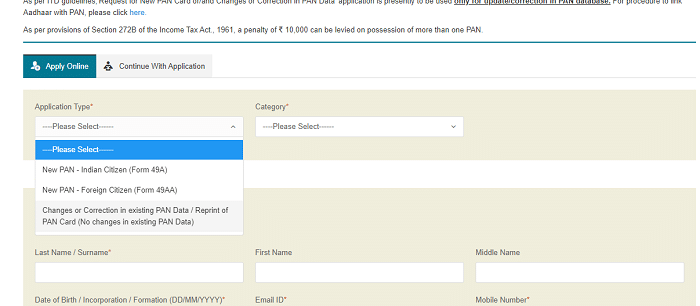

Apply For PAN Card Correction Form Online Through NSDL Portal:

- Visit the official website of NSDL e-Gov at https://tin.tin.nsdl.com/

- The online PAN application form will appear on the screen.

- Here select the Application type as the “Changes or Correction in existing PAN Data/Reprint of PAN card” option, and “Category” from the drop-down menu.

- After that, enter the Applicant’s information like “Title”, “Last Name/Surname”, “First Name”, “Middle Name”, “Date of Birth”, “Email ID”, “Mobile Number”, “Citizenship (Indian or Not)”, “PAN Number” and “Captcha Code” and then click on the “Submit” button.

- Once the request is submitted, a ‘Token Number’ will appear on the screen and the same has been sent to your email id provided in the PAN application. Now, click on the “Continue with PAN Application Form”.

- Now, you will see three options. Ie., ‘Submit digitally through e-KYC & e-Sign (Paperless)’, ‘Submit Scanned images through e-Sign’, and ‘Forward application documents physically’.

- To complete the total process online through Aadhaar OTP, select the first option for updating your PAN.

- If you want a new physical copy of the updated PAN card, you have to select the ‘Yes’ option.

- Now, scroll down the page and enter the last four digits of your Aadhaar Number and update the necessary details. And remember to tick the relevant box for which correction or update is required.

- After filling out the details, click on the ‘Next’ button and complete the contact and other details.

- Now, attach the proof of document along with a copy of your PAN and complete the declaration section and submit the form.

- After submitting the form, you need to make the payment through various payment gateways. After successful payment, you will receive a payment receipt.

- Now, click on ‘Continue’ and complete the KYC process. An OTP is generated and sent to Aadhaar registered mobile number enter the same and submit the form.

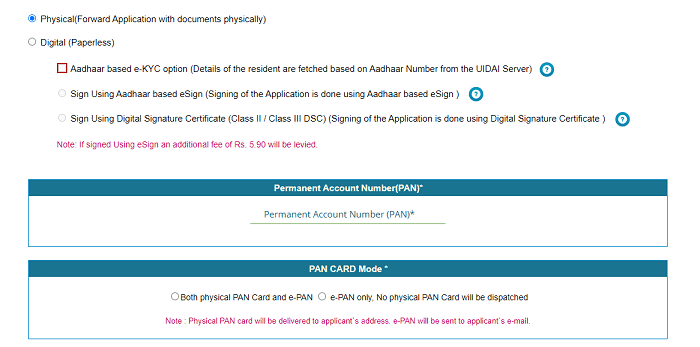

Apply For PAN Card Correction Form Online Through UTIITSL Portal:

- Visit the official website of UTIITSL at https://www.pan.utiitsl.com.

- The main page will open, here go to the “PAN Services” section and click on the “Change/Correction in PAN Card” option.

- The next page will open, here click on the “Apply for Change/Correction in PAN Card details” tab.

- Now, select the mode of submission of documents either “Physical” or “Digital”.

- Enter the Permanent Account Number (PAN) and select the “PAN Card Mode” and click on the “Submit” button.

- Once the request is registered, you will receive a reference number and click on ‘OK’.

- Now, you have to enter the name and address and click on the ‘Next Step’ button.

- After that enter the PAN number and complete the verification section and tap on the ‘Next Step’ button.

- Now, upload the necessary documents and click on the ‘Submit’ button.

- For PAN correction, generally, it will take around up to 15 days. When your PAN card is dispatched via post, you will receive a text message on your registered mobile number.

Necessary Documents To Change PAN Card Details:

The following are the mandatory documents to change PAN card details.

- Copy of PAN Card.

- Identity Proof.

- Address Proof.

- Proof of Date of Birth.

PAN Card Correction Form Fee Details:

| Sr. No. | Parameters | Fees | GST @ 18% | Total | Amount to be Charged |

| PAN Applications – Applicant opts for physical PAN Card | |||||

| 1. | Dispatch of physical PAN card in India (Communication address is Indian address) | 86.00 | 15.48 | 101.48 | 101.00 |

| 2. | Dispatch of physical PAN Card outside India (where foreign address is provided as address for communication) | 857.00 | 154.26 | 1011.26 | 1011.00 |

| PAN Applications – Applicant opts for only e-PAN Card (No Physical Card Requested) | |||||

| 1. | The communication address is the Indian Address | 56.00 | 10.08 | 66.08 | 66.00 |

| 2. | The communication address is foreign | 56.00 | 10.08 | 66.08 | 66.00 |

PAN Card Correction Form – Contact Details:

| Mode | Income-Tax Department | NSDL e-Gov |

| Website | https://www.incometaxindia.gov.in | https://www.tin-nsdl.com |

| Call Center | 1800-180-1961 | 020-27218080 |

| Email ID | tininfo@nsdl.co.in | |

| SMS | SMS NSDLPAN <space> Acknowledgement No. &send to 57575 to obtain application status.

For example Type ‘NSDLPAN 881010101010100’ and send it to 57575. |

|

| Address | Income Tax PAN Services Unit (Managed by NSDL e-Governance Infrastructure Limited), 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016. |

Forms for change of PAN Card are provided so that any applicant who applies for changes in the PAN card need it to provide the following changes he desires in the application. Details such as PIN no. in a new house are necessary while filing the correct change request PAN card applications on their part so that mistakes need to be avoided. While following up this process through forms of the submitting of the applicants also obtain their copies before delivering.