Pan Card Download PDF: A PAN (Permanent Account Number) card is issued by the Indian Income Tax Department and is a 10-digit unique number. This card is necessary for submitting income tax returns and also serves as an identity proof. It is a requirement to provide the PAN number for any financial activity like buying a property, starting a bank account, or investing in mutual funds.

A PAN card is an essential document for the taxpayer in India and is necessary for various financial transactions. You can quickly and easily download a PAN card online from the comfort of your home. This article will discuss downloading the PAN card using various websites and other information.

E-PAN Card Download PDF Details :

Anyone who loses their PAN card or needs a duplicate copy can easily download it online. If you want to download a PAN card in pdf format, follow the steps below.

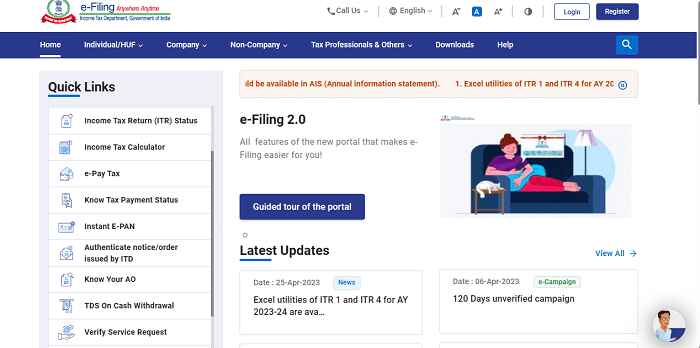

- The applicant should visit the Income Tax Department’s official website ie., https://www.incometax.gov.in.

- Under the “Qu5ick Links” section on the home page, click on the “Instant E-PAN” option.

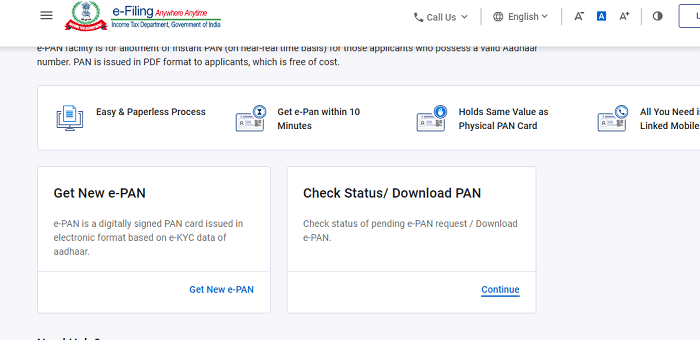

- On the next page, click on the “Continue” link under the “Check Status/Download PAN” section.

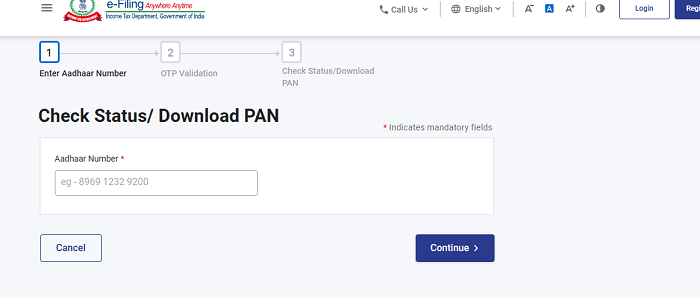

- The Check Status/Download PAN page will open. Enter your 12-digit Aadhaar number and click the “Continue” button.

- The OTP validation page will open. Enter the 6-digit OTP received on your mobile number registered with Aadhaar and press the ‘Continue” button.

- The current status of your New e-PAN request page will open. Here, you can see the status of your e-PAN request.

- If the new e-PAN has been generated and allotted, you can click on “View e-PAN” to view it or “Download e-PAN” to download a copy.

- After clicking on the download e-PAN, a Pdf file of your PAN card will download to your device. You can open and save this file for future use.

PAN Card Download Using NSDL Portal:

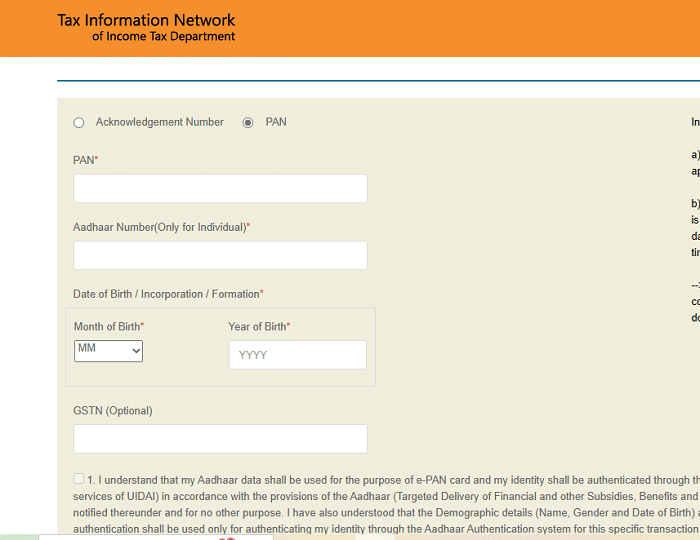

You can also download your PAN card from the NSDL website. If ITD confirms the allotment or changes of PAN within 30 days for the applications submitted to Protean, PAN card holders whose recent application has been processed through Protean can download the e-PAN card for free up to three times. If the PAN is assigned or modifications to the PAN data are confirmed by ITD before 30 days, the fee for downloading an e-PAN card is Rs 8.26/- (inclusive of all taxes). To download PAN Card through the NSDL portal, follow the steps below.

- Visit the official website of NSDL at https://www.onlineservices.nsdl.com/

- The Download e-PAN card page will open. Here, enter your “PAN Number”, “Aadhaar Number”, “Date of Birth”, “GSTN (optional), and “Captcha” and then click on the “Submit” button.

- An OTP will send to your registered mobile number and email ID. Click the “Download e-PAN” link after entering the OTP in the field provided.

- Your PAN card will download on your device in a PDF format.

PAN Card Download Using UTIITSL Portal:

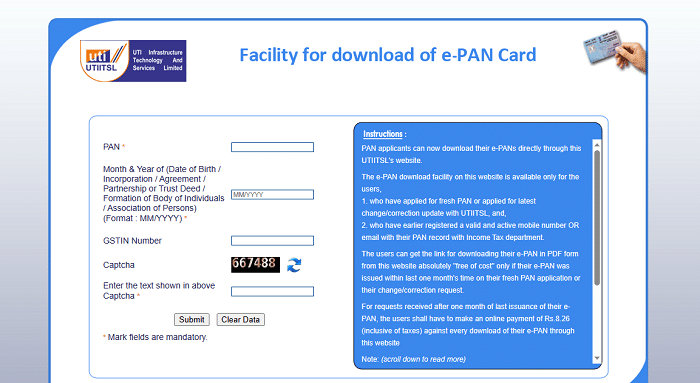

The PAN card holders can now download the e-PAN card directly through the UTIITSL website. For those who have applied for a new PAN Card or the most recent change or correction update with UTIITSL and have previously registered a valid and active mobile phone or email Id with their PAN record with the Income Tax Department, the PAN Card download facility is available on this website.

This UTIITSL website would offer the candidates a free-of-cost link for downloading their PAN card in PDF form only if their fresh PAN application or their change/correction request resulted in the issuance of the e-PAN card within the last month’s time. For requests received after one month of the last issuance of their e-PAN Card, the users shall have to make an online payment of Rs. 8.26 (inclusive of all taxes) against every download of their PAN Card through this website.

- The applicant must open the official website of UTIITSL at https://www.utiitsl.com.

- The home screen will appear. Scroll down the page and click the “PAN Card Services” option under the “Our Services” section.

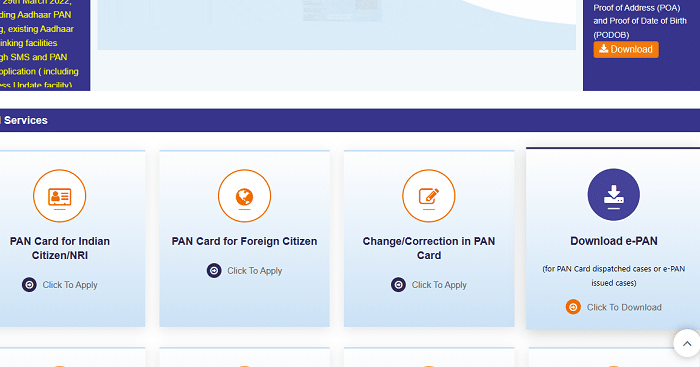

- The PAN services Portal will open; you must drag the page and press the “Download e-PAN” option under “PAN Services”

- The Facility for Download of e-PAN card page will open. Here, enter your ‘PAN Number”, “Date of Birth”, “GSTIN Number”, and “Captcha Code” and then click on the “Submit” button.

- After OTP verification, you can download the PAN Card.

- Suppose your mobile number and email are not already registered. In that case, you should use the e-PAN card download facility later by submitting a change/correction request application.

FAQs On Pan Card Download:

What is Pan Card?

The Income Tax Department of India issues PAN (Permanent Account Number) cards, a 10-digit unique identification number, to individuals, companies, and organizations who pay taxes in India.

What is the official website of the Income Tax Department?

The official website of the Income Tax Department is https://www.incometax.gov.in.

What is the Procedure for PAN Card Download?

Candidate who has applied for a new PAN Card or those who have submitted changes to their existing PAN Card can download the e-PAN card using NSDL and UTIITSL websites.

What is e-PAN?

E-PAN is a digitally signed copy of a PAN card issued by the Income Tax Department.

What are the official websites available for PAN Card Download?

The official websites to get a PAN Card are as follows:

- https://www.incometax.gov.in,

- https://www.onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html,

- https://www.utiitsl.com.

PAN Card is an essential document for those who are taxpayers in India. PAN Card is now easy for all to get. e-PAN cards are also provided by the Income Tax Department without an application and other steps. One can easily request a duplicate if a PAN Card is lost. All services offered by the Income Tax Department in India are available and user-friendly online. It is thus convenient to download a PAN Card using different websites.