The Amravati government issues a property tax bill to pay on a person’s asset or property by estimating its value and taxing it accordingly. As per the government rule, all homeowners in Amravati must pay a yearly fee for house tax to the Amravati Municipal Corporation (Amravati Mahanagar Palika) every year. The municipal Corporation relies upon the funds collected as Property Tax to provide public facilities and services.

The current tax rate determines the amount of tax owed by multiplying the property’s fair market value.

Amravati Municipal Corporation is responsible for collecting Property tax. Property tax can be paid online and offline method. The due date for payment of property tax in Amravati Municipal Corporation (AMC) is 30th June.Multiplying the property’s fair market value by the current tax rate determines the amount of tax owed.

How To Pay Amravati Property Tax From Amravati Municipal Corporation Official Website?

- Go to https://amravaticorporation.in/

- Check for the Property Tax Button and Click on it.

- Now you will be redirected to https://propertytax.amravaticorporation.in/

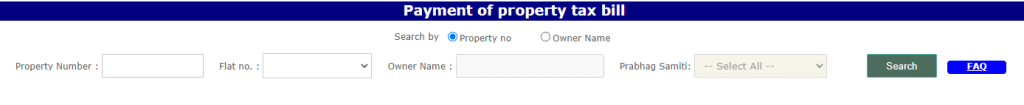

- You will be asked to search your property by Property No or Owner Name. Choose any one of the two options.

- Enter the Property No or Owner No, as per your previous selection.

- Select any one of the zones from the Prabhag Samiti dropdown and click the search button.

- You will get your property tax details.

- Confirm and proceed to make the payment.

Pay Property Tax Bill In AMC From Bank:

- You can pay property tax at Municipal Corporations or Citizen’s facilitation centres or at authorised bank branches such as SBI, HDFC, ICICI or self-pay tax payment kiosks.

- Pay property tax in the respective municipal office.

- Submit the Account number and the required documents to the concerned authority.

- As authorities verify the details and advise about the payment.

- Please use the respective challan to remit the fee at the fee counter. The applicant receives a receipt from the officials for the fees remitted. You can use this receipt as proof of tax payment for your property.

Amravati Municipal Corporation Overview:

In the Indian state of Maharashtra, Amravati Municipal Corporation is the governing body for the city of Amravati. This municipal corporation involves democratically elected members led by a mayor and administers the city’s infrastructure, public services & police.

The official website of Amravati Municipal Corporation is Amtcorp.org. The portal provides an online payment option to its users. By visiting amravaticorporation.in, citizens can pay property tax.

The collection of Property Tax processes and assessment of tax has been simplified by the Amravati Municipal Corporation more transparently. In Amravati, offline and online facilities are subsequently available for all people. If available, most members recommended you and suggested making the payments online. Also, the Amravati Municipal Corporation provides straightforward steps to pay online.

Important Details About Amravati Municipal Corporation Property Tax:

| Property Tax Summary | Amravati Mahanagar Palika Details |

| Name of Municipal Corporation | Amravati Municipal Corporation |

| Official Website | Amtcorp.org |

| City Name | Amravati |

| Total People Count | 6.47 lakhs |

| Name of the State | Maharashtra |

| Address of Amravati Municipal Corporation | Rajkamal Square, Amravati, Maharashtra, India, 444601 |

| Contact No. of Amravati Municipal Corporation | 1800-233-6450 |

Amravati Property Tax Bill: Required Documents

You will require the following details

- Owner Name

- Aadhaar Card

- Bank Account Number

- Address of the property

Amravati Municipal Corporation Property Tax Bill Calculator:

Taxpayers can calculate their property tax online. However, you can note how the Amravati Municipal Corporation calculates House Tax. Usually, the interest rate on property tax varies between 5 and 20%. The property tax amount is calculated based on the residential area. So, it varies from one property type to another property type.

Property tax is equal to (=) Tax rate X Total carpet area/area of land if the land is vacant X type of building X age factor X usage factor X floor factor.

The authorities calculate the property tax for a building in Amravati based on several factors. These factors include the basement area of the building, the prevailing rate in the street where the property is, whether the building is for residential or non-residential purposes, and whether the owner or a tenant is living in that space. Additionally, the authorities also take into account the total span of the building’s existence.

Property tax is responsible for taxing different kinds of properties. It’s important to note that property tax rates are not uniform across the entire nation but vary across different locations, cities, and states. Each tax-collecting body may have its own unique methods to determine house tax.

Eligibility To Pay Amravati Property Tax Bill:

You must be at least 18 years old and a citizen of India.

Should have own land or any property in your name

Amravati Property Tax Bill: Validity

The property tax paid is sustainable for one year. Every year, you should renew it.

Different Kinds Of Properties Responsible For Being Taxed Under Property Tax:

- Residential house (self-occupied or let out)

- Office Building

- Factory Building

- Godowns

- Flats

- Shops

Amravati Mahanagar Palika Property Tax FAQs:

- What is mean by property tax?

- Property owners must pay a certain amount to the concerned local government or the concerned area’s municipal corporation, called property tax.

- What is the name of the official website of Amravati Municipal Corporation?

- The official website is amravaticorporation.in for Amravati Municipal Corporation.

- How many people live in Amravati City?

- An estimated 6.47 lakh people live in Amravati.

- How to Apply to Pradhan Mantri Matru Vandana Yojana in Amravati?

- You can apply from Official Website: https://pmmvy-cas.nic.in/

Additional Information That Might Help:

- The tax is imposed on houses and businesses.

- New construction information, existing building information, and property improvements must be made known to the concerned state office so that the appropriate adjustments of tax assessments are made.

- Property tax clearance is required since this will also be needed in acquiring services like water, sanitation, and electricity.

- Homeowners must regularly pay property tax according to a set schedule, which can be every 6 months or once a year, depending on the state.

- It is best to pay the tax on time to avoid any problems.

- Some people and groups, like schools, charities, veterans, retired pensioners’ groups, NGO homes, and teachers’ association buildings, can qualify for tax exemption.