Madhya Pradesh eNagarapalika Property Tax Online Payment: Property Tax Online Payment in Madhya Pradesh is essential to a responsible citizen. Property tax is an important source of revenue for the Government of Madhya Pradesh and is the responsibility of citizens who own property in the state. Property tax payments can be made quickly and conveniently offline and online.

People can go to the municipal office in their area to make their property tax payments in person or alternatively go online by using the MPeNagar Palika platform, the official website of the Madhya Pradesh Government. This website, www.mpenagarpalika.gov.in, provides citizens with a fast and convenient way to pay their bills. Property tax payment is an important part of being a responsible citizen and contributes to Madhya Pradesh’s development.

The Government of Madhya Pradesh has made it easy for citizens to pay their property tax bills online, making it an effortless process. So, if you are a responsible citizen of Madhya Pradesh, pay your property tax online.

How To Pay Property Tax In Madhya Pradesh Using eNagarPalika Portal?

The property tax service provides a digital interface, allowing citizens to search and download property bills, make payments online, and download the payment receipt. The following are the steps to know about how to pay property tax in Madhya Pradesh.

- Firstly, visit the Madhya Pradesh eNagar Palika official website. The official website of Madhya Pradesh eNagar Palika is www.mpenagarpalika.gov.in

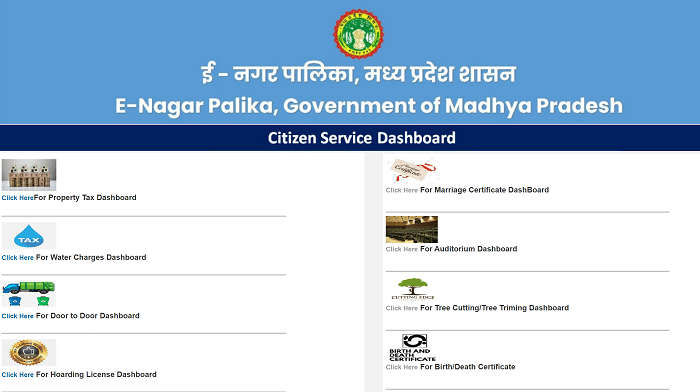

- A home page will appear, here, the applicant/citizen selects the Property tax service under e-services.

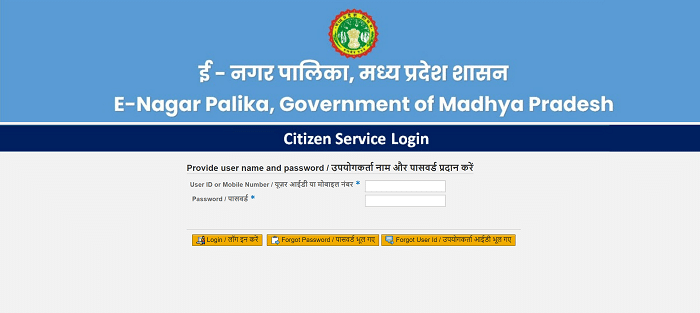

- Then the citizen/applicant must log in first with credentials, or Citizen can also create the login Account on the same page.

- For registration applicants/citizens, click on the sign-up button. The application form will open, here, the citizen should enter all the required details like User Id, First name, Middle Name, Last Name, Email Id, Mobile No, Password, Date of Birth, Pan Card No, Aadhaar Card no, and click on confirm button.

- Now the registration is completed then, you have to go to the login page and log in with your User Name and password.

- The citizen / Applicant can pay online Property tax by providing the required details.

- Now you will be redirected to the payment gateway where citizens can process the payment via net banking, debit card, credit card, and UPI.

- After the successful payment, the receipt can be downloaded with the help of the download receipt option available on the screen.

- Once you make the payment, we will send the receipt to the provided email Id, and you will receive a notification regarding the payment on your mobile. We will also update the same in ULB records.

Quick Pay Option: How To Pay Property Tax In Madhya Pradesh?

The following are the details about how to pay property tax in Madhya Pradesh using the “Quick Pay” option on Madhya Pradesh eNagar Palika official website:

- Go to visit the Madhya Pradesh eNagar Palika official website. The official website of Madhya Pradesh eNagar Palika is www.mpenagarpalika.gov.in

- A home page will appear here, and the applicant/citizen selects “Property Tax Payment” under “Quick Services”.

- A new page for quick payment will appear on the screen, asking for “ Property ID”.

- The applicant should enter the ‘ Property ID ‘ and click the ‘Search’ button.

- The system will display the applicant’s details on the screen. Then, click “Print the ledger report / Demand Note” if required, and confirm the address, name, and payable amount.

- Here, you must enter your Mobile number and email Id if required to change, then click “Pay Online”.

- You must verify the transaction ID, Property ID, and Tax Amount. If all the details are correct, you have to click on the “Confirm” button and also click the “Terms & Conditions” to confirm

- You have to select the payment gateway ( Internet banking / Credit Card / Debit Card / UPI / Freecharge / NEFT / RTGS )

- You have to complete your payment by using your credentials. Upon confirming your property tax payment, you will receive a receipt number on your mobile/email address, verifying the Madhya Pradesh Property tax payment for your specific residential or commercial property.

- This way, you can pay the property tax in Madhya Pradesh using the “Quick Pay” option.

How To Pay Property Tax In Madhya Pradesh At Municipal Corporation Office?

People of Madhya Pradesh State can also make their Property tax Payments by visiting the nearest Municipal office or government-recognized service centers. The following are the steps on how to pay property tax in Madhya Pradesh (offline):

- People should visit the nearest municipal corporation office in their respective areas.

- You must go to the property tax counter and provide your tax number.

- Then the executive will check the details and provide your tax due list.

- After confirming the amount and details, you can pay the amount to the officer using cash or an online transaction.

- Finally, the officer completes the payment process and provides the applicant with a successful payment receipt.

In this way, you can pay the property tax in Madhya Pradesh offline.

Who Should Pay Property Tax In Madhya Pradesh?

In order to pay property tax in Madhya Pradesh, there are certain eligibility requirements that must be met.

- Individual must be an Indian citizen

- Must have at least 18 years of age

- Additionally, they must be a permanent resident of Madhya Pradesh and own property within the state.

If one wishes to obtain town planning approval for a new property, they can do so by applying through the RCMS Portal of Madhya Pradesh. This portal also offers various eSeva Services provided by the government of MP, including the ability to file complaints about property disputes. If there are any questions or concerns, one can leave a comment below.