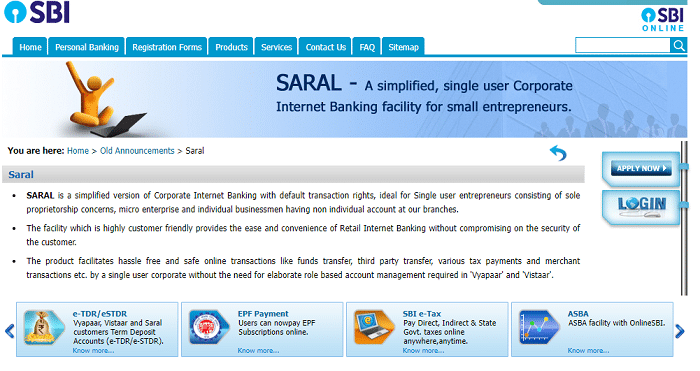

SBI Saral Login: State Bank of India (SBI) is one of the largest banks in India and offers various services and an online portal to its customers. SBI Saral is a simplified, single-user corporate Internet banking facility for small entrepreneurs. It is a simplified version of Corporate Internet Banking with default transaction rights, ideal for single-user entrepreneurs consisting of sole proprietorship concerns, micro-enterprises,s and businessmen having non-individuals at their branches.

While prioritizing customer security, a user-friendly facility provides the ease and convenience of retail Internet banking. Our product enables secure online transactions, including money transfers, third-party transfers, tax payments, and merchant transactions, all accessible through a single corporate user account in ‘Vyapaar’ and ‘Vistaar’, without the need for complex role-based account administration.

This article will explain the SBI Saral Login procedure, services available on the SBI Saral portal, Features, Permitted transaction details, SBI Saral Pension plan details, and other information.

SBI Saral Login Procedure:

- Visit the official website of SBI Corporate Banking Saral at https://corp.onlinesbi.sbi/corporate/sbi/corp_saral.html

- The home page will appear. Click on the “Login” button on the right side of the home page.

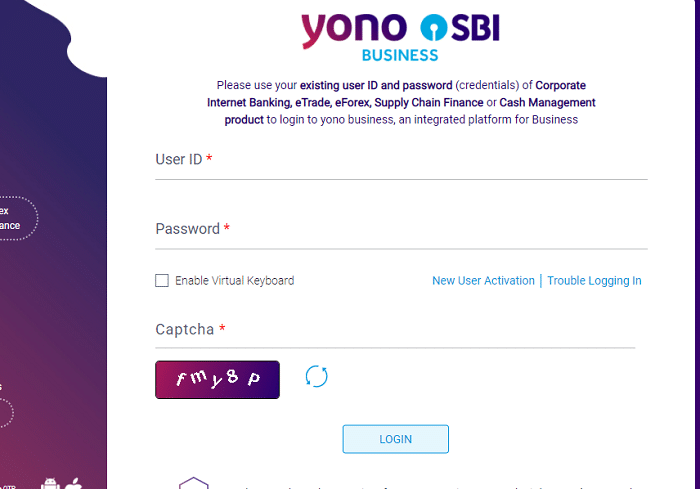

- The Yono business page will open; here, click on the “Login” button.

- The login page will appear. Enter your “User Id”, “Password”, and “Captcha Code,” and then click on the “Login” button.

- Then you will be logged into the SBI Saral portal successfully.

SBI Saral Login – Features:

- Single-user operated and easy to use.

- Facility to view account information and download account statements.

- Transaction rights on the accounts.

- Facility to schedule transactions for a later date.

- Facility to set beneficiary level limits.

- Facility to set separate limits for DD issue requests and tax transactions.

- SMS-based OTP for beneficiary additions, fund transfers, merchant transactions, etc.

Permitted Transactions – SBI Sarala Login:

- Fund transfer to account in SBI (Intra Bank Payments) up to Rs. 5 lakhs daily.

- Funds transfer to accounts in banks other than SBI (Interbank Payments) up to Rs. 5 lakhs daily.

- Request for DD issue up to Rs. 5 lakhs per day.

- Payment of Taxes- direct (CBDT), indirect (CBEC, CUSTOMS, etc), and State Government taxes.

- Payment of EPF subscription.

- Merchant transactions.

- Bill payments.

- Payment to registered suppliers (Petrol/LPG dealers can pay the oil majors).

- Application to IPOs through ASBA.

- Participation in e-auction.

Separate Transaction limits are permitted for the following types of transactions:

| S.No | Type of Transaction | Transaction Limit Per Day (RS) |

| 1. | Supplier Payment | 25 lacs |

| 2. | E-auction for Govt. Departments | 1 Crore. |

| 3. | Payments to Govt. and semi Govt, institutions including taxes and statutory dues such as EPF, ESI, etc. | 2 Crores. |

| 4. | OLTAS, CBEC, and ICEGATE | 2 Crores. |

Services Available On SBI Saral Portal:

- Account view/statement.

- Bulk transaction through file upload.

- MIS reports.

- Fund transfer.

- Direct & Indirect tax payment.

- Host-to-Host integration.

- Demand Draft / Banker’s Cheque Request.

- Direct Debit.

- Demat View Facility.

- Utility Bill Payment.

SBI Saral Pension Plan Details:

SBI Saral Pension Plan is a single premium, individual, non-linked, non-participating, immediate annuity product. This plan provides you with regular income, with a return on the purchase price, without letting you make any compromise. The plan offers financial independence in just a few simple steps, to live a happy retired life. The key features, advantages & benefits of this plan are mentioned below.

Features:

- Security for your retirement with a standard immediate annuity plan.

- Choose from the available return of premium options: Single life or Joint life annuity.

- Option to avail loan facility in case of financial need.

- Option to avail of the surrender facility on being diagnosed with a specified critical illness.

Advantages:

- Security: Financial independence to live a happy retirement life.

- Reliability: Regular income to take care of your expenses.

- Flexibility: Freedom to choose from the return of premium options – Single Life or Joint Life Annuity.

Benefits:

- Life annuity with a return of 100% of the purchase price (ROP): Annuity is payable in arrears at a constant rate throughout the life of the Annuity.

- All future payouts cease immediately after the Annuity’s death, and the purchase price is refunded to the nominee/legal heirs.

- Joint Life Last Survivor Annuity with a return of 100% of the purchase price (ROP) on the death of the last survivor:

- An annuity is payable in arrears constantly until the primary annuitant is alive.

- On the death of the primary annuitant, if the spouse is surviving, the spouse continues to receive the same amount of annuity for life till his/her death.

- On the death of the last survivor, the purchase price shall be payable to the nominee/legal heirs.

- If the spouse has pre-deceased the primary annuitant, then on the primary annuitant’s death, the purchase price shall be payable to the nominee/legal heirs.

- Tax Benefit: Income tax benefits/exemptions are as per India’s applicable income tax laws, which are subject to change from time to time.

Eligibility Criteria For SBI Saral Pension Plan:

| Minimum | Maximum | |

| Age at Entry (as on last birthday) | 40 Years | 80 Years |

| Premium | The minimum annuity installment can be paid as per the annuity payment mode. | No limit, as per Board Approved Underwriting Policy. |

| Minimum Annuity Payout (per installment) | Monthly: Rs.1,000 Half-Yearly: Rs. 6,000

Quarterly: Rs. 3,000 Yearly: Rs. 12,000 |

No limit, as per Board Approved Underwriting Policy |

| Premium Payment Term | Single Premium | |

| Annuity Payment Mode | Monthly, Quarterly, or Half-Yearly, or Yearly. | |

Sample Annuity Benefits Illustration – SBI Saral Pension Plan:

Annual annuity payout @ Age – 60 years for purchase Price of Rs. 10 lacs (excluding applicable taxes).

| Annuity Options | Annual annuity amount | Annuity amount as a % age of Purchase price | Death Benefit |

| Life Annuity with a return of 100% of the purchase price (ROP) | Rs. 58,721 | 5.87% | Rs. 10,00,000 |

| Joint Life Last Survivor Annuity with a Return of 100% of Purchase Price (ROP) on the death of the last survivor. | Rs. 57,961 | 5.80 | Rs. 10,00,000 |

| *For Joint Life Same age has been considered for both the annuitants. | |||

Necessary Document To Apply For SBI Saral Pension Plan:

- The policyholder must submit a duly filled insurance application/proposal form.

- Address Proof like Passport, Aadhaar Card, Voter ID, etc.

- Identity Proof such as an Aadhaar Card, PAN Card, Voter ID, etc.

- Detailed medical history report.

- The police holder might also be required to provide income proof based on the sum assured amount chosen.

- Age proof.

SBI Saral is a simplified single-user transactional product best suited for small businesses, sole proprietorships, and individual businessmen who need online access to their company’s accounts. The product provides transaction rights to the user involving the transfer of funds to own or third-party accounts up to a limit of Rs. 5 lakhs per day. Overall, SBI Saral is a very useful & essential platform for SBI Corporate Customers.