BBMP Property Tax Online Payment: The municipality body known as ‘BRUHAT Bangalore MAHANAGARA PALIKE’ requires the citizens of Bangalore to pay a yearly property tax. They utilize these funds to enhance civic facilities in Bangalore. They determine the property tax amount by using the unit area value of UAV units, which is based on the property’s location, purpose, and returns. To compute the property tax, they multiply the sq.ft per unit by the current value.

The Stamps and Registration Department assigns guidance values and divides BBMP into six zones. The citizens can pay the property tax in Bangalore online or offline, and it varies depending on the zone and occupancy.

How To Make BBMP Property Tax Online Payment Using BBMP Tax Portal?

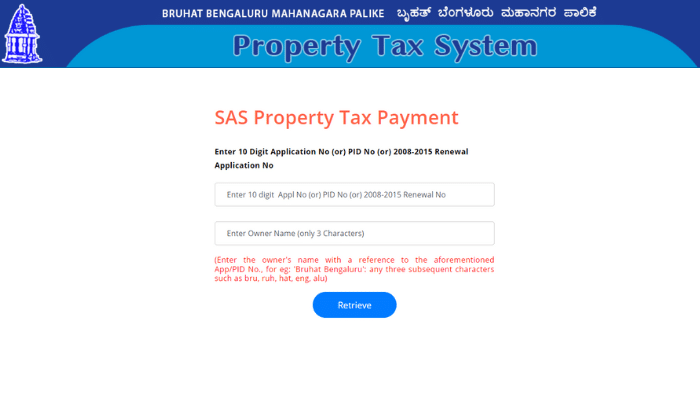

- Go to the official website of the BBMP property tax portal, i.e., https://bbmptax.karnataka.gov.in/.

- Enter the PID number and three characters of the property owner in their respective columns. Tap on the Retrieve button.

- Click on Proceed after checking all the property details, and it will take you to Form IV.

- If there are any changes to be made, check the box on the page and click proceed, which will take you to form V.

- After choosing the online payment mode, it will lead you to a payment page you can pay either by using net banking or card payment, It takes 24 hours to see the payment status in the portal.

If you are facing any problems, you can raise a complaint at bbcrev@gov.in

How To Pay BBMP Property Tax Manually?

- To pay in manual mode, one has to go revenue office and take the form required for tax payment.

- Complete all the details and submit them to the revenue officer’s office.

- Pay the amount by card or demand draft.

There are options for paying e challan through banks like IDBI, cooperative bank, SBI, Maharashtra bank, etc. One can fill out the form online and pay the challan amount in these banks as property tax.

How To Check Status Of BBMP Tax Name Change Application?

One can check the status of the BBMP tax name change application after applying on BBMP tax online portal.

- Go to the official website of the BBMP property tax portal

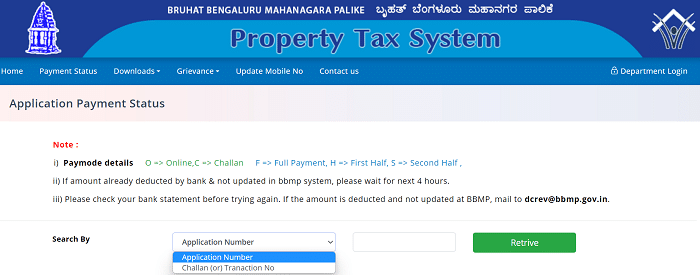

- Click the payment status tab available on the home page

- Select the Application Number or Challan/Transaction Number, enter the number, and tap the Retrieve button.

- The status of the payment will be displayed on the screen.

How To Download BBMP Property Tax Challan Receipt?

- Go to the BBMP tax property portal.

- Click on the downloads tab.

- Select the print receipt option from the drop-down list.

- Select the assessment year, enter the application number and captcha code, and click submit.

- The property tax receipt will be downloaded in pdf format.

BBMP Property Tax One Time Settlement To Get Rebate?

Taxpayers must pay the property tax before 31 March of the subsequent year as the property tax period starts in April of one year and ends in March of the subsequent year. For instance FY 2022-23, one must pay by 31 March 2023.

- BBMP also provides a 5% rebate on property tax paid in one instalment within the due date stipulated by BBMP.

- Delayed payment of property tax upto 2% per month and 24% per anum

- The property tax can be paid in installments without a rebate.

How To Calculate BBMP Property Tax?

Property tax generally equals 20% off the property’s total area multiplied by the value of Sq Ft fixed by the BBMP. The tax includes tenanted, occupied parking spaces also.

The formula required for the computation of property tax includes

Property tax(K)= (G-I)*20% + cess (24% of property tax)

Where,

G=Gross unit area value, it arrives as X+Y+Z and I=G*H/100

X= Tenanted area property * Sq ft unit rate per property X10 months

Y=Self area sq ft property * Sq ft unit rate per property X10 months

Z= Vehicle parking area * Sq ft rate per vehicle parking area X 10 months

H= percentage depreciation value

Generally, percentage depreciation is based on the property’s age, which allows BBMP plus 24% cess property tax.

BBMP Tax Forms:

There are 6 forms required for BBMP tax payment anyone who is paying BBMP tax should submit these 6 forms

| FORM | APPLICABILITY | REMARKS |

| 1 | Property along with property identification number, which includes the street number and wand number

It is present in the last payment of tax |

These are the properties of erstwhile BBMP, and the form colour is white |

| 2 | The khata number is given with the relevant property for these PID numbers is not present | The form colour is a pin and the erstwhile properties of CMC and TMC |

| 3 | Properties without PID number and Khata number | Unauthorized properties, along with sanitation and the form, are in green colour |

| 4 | When there is no change in the property like usage, occupancy, etc | The form is in white colour |

| 5 | When there is a change in a property from residential to nonresidential | The form is in blue colour |

| 6 | When the property is exempted from paying the tax | The form is white |

BBMP Latest News:

Bhurat Bangalore Mahanagara Palika is now planning to acquire some land from 118 private property owners on Rajakaluvas to increase the width of Strom Water Drains.

As the water level is crossing the threshold level during floods, BBMP came up with decision.

Frequently Asked Questions To Related to BBMP Property Tax:

Should I consider the parking area space as an open veranda or under the portico for property tax payment?

It includes either an open veranda or under portico based on the residential area.

Does the property count as self-occupied or rented if it’s vacant?

It counts as self-occupied unless someone moves in as a tenant.

What should I pay for BBMP property tax if they demolish my building?

You have to pay property tax as vacant property for the demolished building.

How to avoid the penalty for BBMP Property Tax?

Making the payment before March 31st every year exempts the person from the property tax. The Bangalore has its property tax under the managerial body of BBMP–the municipality of the city. Every citizen in Bangalore, as a duty, owes to pay the annual property tax, which depends on its zone. There are a total of 6 zones for the property tax settlement in Bangalore.The stamps and registration office works out the per square foot value of the property, and the property tax calculation is based on this value. The persons owning the property are also liable to pay tax on his properties which are used by him or he himself occupy and rent them out to other. Tax rates on residential and non-residential properties vary.You can make payments online, manually, or through a challan from banks.