SBI Mini Statement Number By Missed Call: Effective money management has grown more crucial in today’s fast-paced digital environment. The State Bank of India (SBI) provides customers with convenient access to their account information through various services to meet the expectations of modern banking. One such service is the SBI Mini Statement, which allows customers to quickly view their recent transactions and keep track of their financial activities.

The State Bank of India Mini Statement offers a concise summary of a customer’s recent account activity, displaying the five most recent transactions, including dates, amounts, and transaction types. Accessible 24/7 via Internet banking, mobile banking, Missed Calls, and ATMs.

This article will explain how to obtain an SBI Mini Statement using various methods such as Internet Banking, By Missed Call, SMS Banking, WhatsApp banking, and Mobile Banking, through SBI ATMs, and SBI Mini Statement – Mobile Number Registration Procedure,

SBI Mini Statment Through SBI Internet Banking:

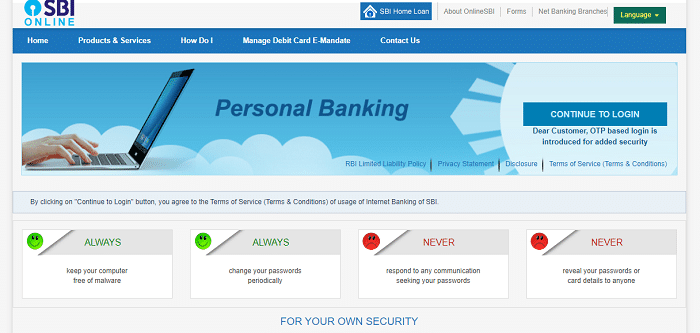

- The customer should visit the official website of SBI Internet Banking at https://www.onlinesbi.sbi.

- The SBI Internet banking home page will appear, here you have to click on the “Login” option under the “Personal Banking” section.

- On the next page, click on the “Continue To Login” button.

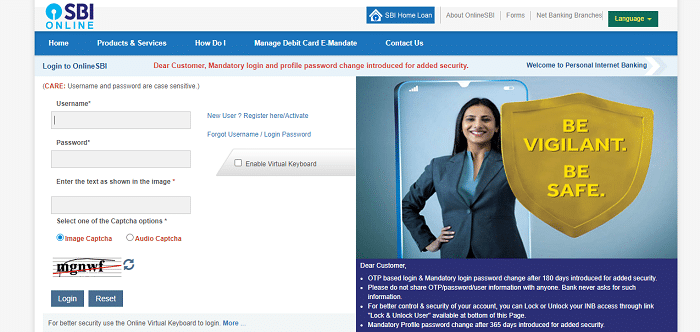

- The login page will appear, here enter your “User Name”, “Password”, and “Captcha Code” and then click on the “Login” button.

- Now, you will receive an OTP to your registered mobile number, you have to enter the “One Time Password (OTP)” on the OTP field and then click on the “Submit” button.

- Then you will be logged into your SBI account and the account dashboard will appear on the screen.

- Now, click on the “Account Statement” option under the “Quick Links” section.

- If you have multiple accounts, all are displayed on the screen, you have to choose the account that you want to view the statement.

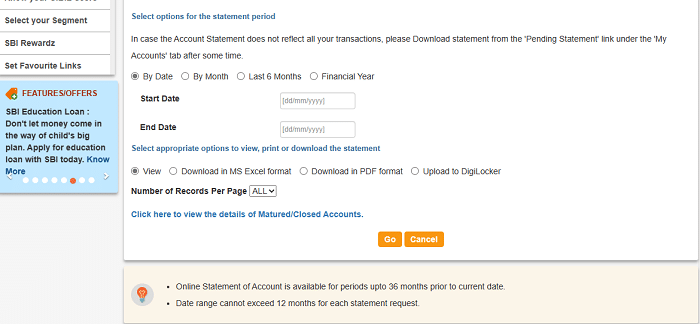

- After that, you must select the option for the statement “By Date”.

- Now, enter the “Start Date” and “End Date” and also select the appropriate options to View, Print, or download the statement.

- Once you completed all the details, now click on the “Go” option. Then the SBI dwarf Statement will appear on the screen or be downloaded into your system.

How To Get SBI Mini Statement Through Missed Call?

To obtain an SBI Mini Statement, the account holder can make a missed call from the mobile number registered with the SBI savings account to 0922386666.

To get the SBI Mini Statement using missed call service follow the below-mentioned steps.

- The customer should give a missed call to the SBI Mini Statement number 0922386666 to know about the last 5 transactions.

- After two rings the call will automatically disconnect.

- The customer will get an SMS with the SBI dwarf Statement ie., the recent 5 transactions initiated from the account.

SBI Mini Statement Using SMS Banking:

The SBI Customer can also get SBI Mini Statement with the help of SMS. To get the SBI Mini Statement by SMS, the account holder should follow the below steps.

- The customer should send a type SMS “MSTMT” and send it to “0922386666” from the registered mobile number.

- Then you will receive an SMS of the SBI dwarf Statement containing information on the last 5 transactions.

- In case, an account holder has multiple accounts maintained with SBI, they can register for SBI Quick for only one of the accounts at any point in time.

- If the account holder wants to change the registered account number for the SBI Quick facility, they can de-register SBI Quick from the first account and register for SBI Quick with the other one.

How To Get SBI Mini Statement By Mobile Banking?

The following are the steps to get the SBI Mini Statement using Mobile Banking Services.

- Firstly, the customer should download the “SBI YONO” app from the Google play store or Apple play store.

- After installing the app, log in to the SBI Yono app using your login credentials.

- After logging into your account, click on the “My Accounts” option on the application home page.

- Now, select the “Mini Statement” option on the next page.

- The statement will be instantly available, providing a quick overview of recent transactions.

SBI Mini Statement Through WhatsApp Banking:

The SBI bank has launched a WhatsApp banking feature for its customers to access most of its banking services through WhatsApp. You can view the SBI dwarf statement or the details of the last five transactions instantly using the application. The following are the steps to obtain a mini statement through WhatsApp Banking.

- The account holder must add the SBI WhatsApp Banking number +919022690226 in their contacts.

- Now, you have to select the SBI WhatsApp number in your WhatsApp and send “HI” to the number.

- To check the account balance, send 1, and to get the SBI mini statement to send 2.

- And most importantly you must remember that you have to send a message on WhatsApp using the registered mobile number.

How To Obtain SBI Mini Statement By Visiting SBI ATMs:

If the customer doesn’t know about the online procedures, they can also get the statement from the SBI ATMs. This is one of the most convenient methods of obtaining the State Bank of India Mini Statement. The customer should visit the nearest SBI ATM Center and follow the below steps.

- Visit the nearest ATM center and insert your Debit Card.

- After inserting the debit card, enter your 4-digit PIN and click on the ‘View Mini Statement’ option.

- The ATM will print out a receipt displaying the recent transactions, allowing customers to have a physical copy for reference.

SBI Mini Statement – Mobile Number Registration Procedure:

The registered mobile number is the only one that can access the SBI Mini Statement service. So, it becomes necessary to register a mobile number in order to access the SBI dwarf Statement and activate SMS banking. Generally, the number is registered at the time of opening of the Account. However, if the same was not done, the account holder can register the mobile number by following the steps listed below.

- The account holder needs to write down the account number and simply send an SMS to the bank in order to register the mobile number for SBI Quick’s Mini statement services.

- SBI Quick is a free service that offers missed call banking and SMS banking services. The SMS format is as follows REG<space> Account Number and send it to 09223488888.

- The account holder should send the above SMS to 09223488888. After sending the SMS, the mobile number will be registered with SBI.

- To register for SBI mobile banking services, the account holder will be required to send the following SMS code. <MBSREG> to 9223440000.

The SBI Mini Statement is a valuable tool that empowers customers to stay in control of their finances. With its easy accessibility through Internet banking, mobile banking, WhatsApp banking, SMS banking, and ATMs customers can quickly check their recent transactions and keep track of their account activities. The Mini Statement simplifies financial management, promotes transparency, and enhances security for its customers, making it an essential feature of modern banking.