Sanchaya Tax Payment: Building Tax KeralaAs a property owner in Kerala, paying your building tax is an important responsibility that cannot be overlooked. However, the process can be quite daunting, especially if you’re unfamiliar with the various steps involved. Fortunately, the Sanchaya Tax portal provided by the Local Self Government Department of Kerala has made paying your building tax online easier than ever. With just a few clicks, you can now access this platform and complete your tax payment from the comfort of your home or office.

For those looking to pay their building tax in Kerala, this article will provide the essential information to make the payment quickly and easily using the Sanchaya Tax portal. Whether it is the first time you are paying or you have prior experience, the steps outlined in this guide will help you get it done without any hassle. So, let’s explore the steps on how to pay building tax in Kerala via https://tax.lsgkerala.gov.in/.

Sanchaya Tax Payment: Building Tax Kerala Online Quick Pay Option

The following are the steps to learn how to pay Sanchaya tax in Kerala using the “Quick Pay “option.

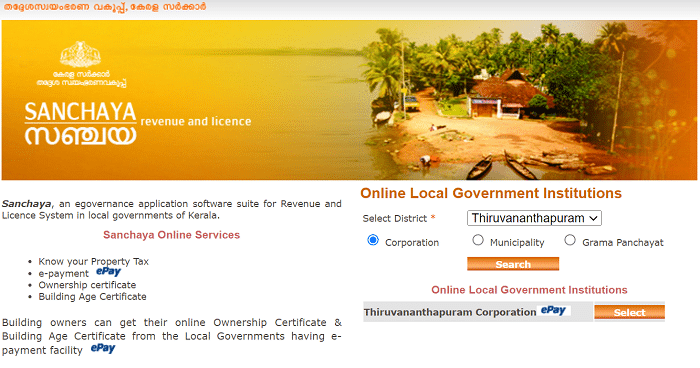

- Visit the Kerala official website tax.lsgkerala.gov.in to pay your building tax using the Quick Pay option.

- On the Sanchaya (Revenue and license) Home page, select your District Name and Local Body Type for the Quick Payment page and tap the “Search” button.

- You can see a list of local government institutions.

- Tap on the “Select” button, i.e., right next to your local body/institute name.

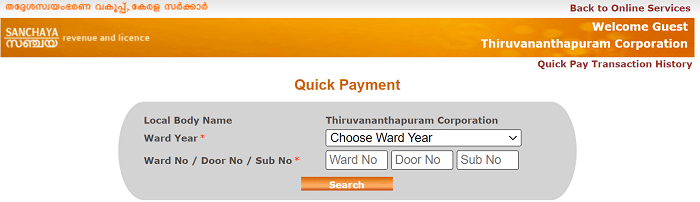

- Enter your Ward No / Door No / Sub No and click the ‘Search’ option.

- Payment details will appear.

- Pay using any payment mode, such as Debit cards, Credit cards, Net Banking Credentials, or e-wallets.

- Your receipt will be generated and sent to your registered mobile number or email ID.

Likewise, pay your building tax in Kerala quickly and easily with the Quick Pay option.

How To Register Sanchaya Tax Account To Pay Monthly Building Tax?

The property tax service provides a digital interface, allowing citizens to search and download building bills, make payments online, and download the payment receipt. The following are the steps to pay property tax in Kerala.

- If you are a citizen of Kerala, you can easily pay your taxes online by visiting the official website of the State – tax.lsgkerala.gov.in.

- OnSelect’ Payment for Registered Users’ on the Sanchaya (Revenue and License) Home page,

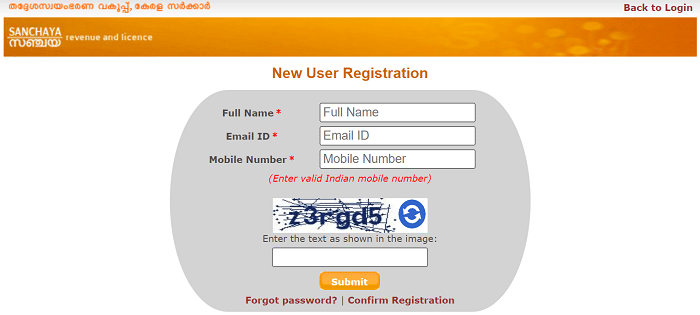

- If you already have an account, enter your Username and Password. Otherwise, you can create a new report by selecting ‘New User Registration.’

- This will open up a registration form where you must enter your Full Name, Active Email Id, Active Mobile number, and the captcha shown on the screen.

- After you have entered all the details, click on the ‘Submit’ button.

- Once the details are submitted, a registration confirmation code will be sent to your email ID.

- Click on the ‘Confirmation Registration Link.’

- You’ll need to enter a registration code on the form displayed.

- After entering the registration and Captcha codes, click submit to complete your registration.

- Once registered, you can log in using the provided login page.

- Upon logging in, you’ll have a list of all the properties registered under your name and pending payment demands.

- After you have checked and confirmed the details, you can proceed to make your online payment.

Once you have completed the payment, a receipt will be generated and sent to your registered mobile number or email address. This way, you can easily and conveniently pay your Sanchaya taxes in Kerala.

How To Get a Building Age Certificate In Kerala Using Sanchaya Tax Payment Portal?

If you’re a property owner in Kerala, you’ll know that obtaining a Building Age Certificate is crucial. This certificate is proof of the age of your building and is essential for various legal and financial purposes. However, navigating the bureaucracy and red tape in obtaining this certificate can be daunting. Thankfully, the Sanchaya Tax Payment Portal has made getting a Building Age Certificate in Kerala much easier. This online platform allows property owners to apply for and receive certificates without visiting government offices.

- Go to the Kerala official website tax.lsgkerala.gov.in to apply for a building age certificate.

- On the Sanchaya (Revenue and license) Home page, under “Online Local Government Institutions,” select your District Name and Local Body Type, and click the Search button.

- Now you will get a list of local government institutions.

- Tap on the “Select” button, i.e., right next to your local body name.

- Now you will be redirected to a new page to see all the Online Services available for your Corporation/Municipality/Panchayat.

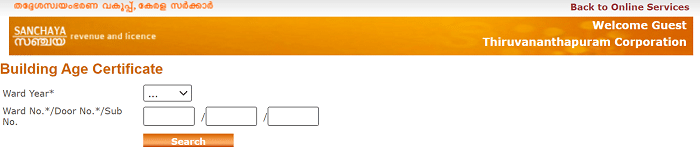

- Click on “Building Age Certificate”

- Enter your Ward No / Door No / Sub No and click the ‘Search’ option.

- Now you will see all the building details with the owner’s name, zonal office, ward year, ward name, and Door No.

- Tap on the Owners name to get brief details of the building like property tax, building category, etc.

- Under it, you can see “Age Certificate.” Click that button to download the “Building Age Certificate” in Kerala using Sanchaya Tax Portal.

Sanchaya Tax Payment – https://tax.lsgkerala.gov.in/

The Local Self Government Department of Kerala runs the Sanchaya Tax Portal. This online payment system enables citizens of India to pay their taxes conveniently through various modes such as e-wallets, debit/credit/net banking, e-cheques, electronic payments, and cash on delivery. In addition, they set up the portal to facilitate easier cost and obtainment of building documents for the citizens of Kerala.