Suda Jharkhand Holding Tax: Are you a resident of Jharkhand and wondering how to pay your Holding Tax? Look no further than the suda.jharkhand.gov.in portal! As a highly skilled assistant specializing in digital marketing, I understand the importance of easily accessible and user-friendly government portals.

This article will guide you through the step-by-step process of paying your holding Tax using the suda.jharkhand.gov.in portal. We have covered you from creating an account to selecting the payment method. Plus, we will share some tips on how to ensure a smooth and hassle-free payment experience. So, let’s dive in and make your tax payment process a breeze!

How To Pay Suda Jharkhand Holding Tax Using Suda.Jharkhand.Gov.In Portal?

The property tax service provides a digital interface, allowing citizens to search and download property bills, make payments online, and download the payment receipt. The following are the steps to learn how to pay property tax in Jharkhand.

- To begin with, individuals must access the official website of Jharkhand Municipal, which can be found at https://suda.jharkhand.gov.in/.

- Once on the website’s homepage, users should select the ‘Pay Property Tax’ option under the Property/Holding Tax section.

- Afterward, they will be directed to another page where they need to pick ‘ULB’ and click ‘Go Now.’

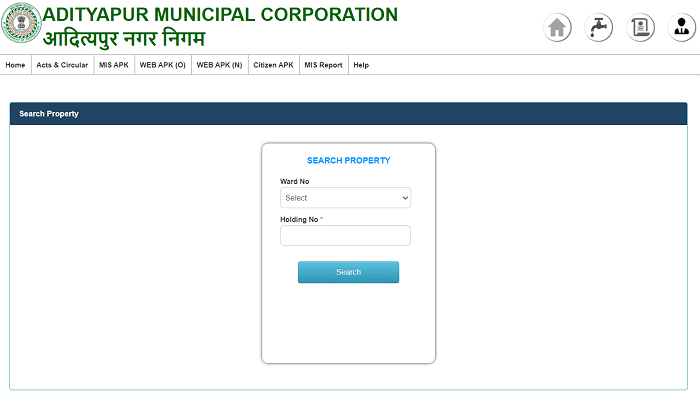

- The Search Property page will then appear, where individuals must enter their ward and hold numbers before clicking the ‘Search’ button.

- Following this step, the property tax bill details will be displayed on the screen, including name, address, year, due date, demand amount, additional tax amount, and total amount.

- Lastly, at the bottom of the page, users will find options such as ‘View Property Details,’ ‘Pay Property Tax,’ and ‘View Payment Details.’

- To pay the property tax, they must select ‘Pay Property Tax.’

- On the following page, you will find tax details such as rebates, penalties, and the total amount owed.

- To pay your property taxes online, you must agree to the terms and conditions and select the desired payment method from credit card, debit card, internet banking, or NEFT/RTGS.

- Once the payment is made, a receipt will be generated automatically for future reference.

This is the process for making online property tax payments in Jharkhand.

How To Calculate Your Holding Tax In Jharkhand Using Suda Jharkhand Portal?

Each property has its value and differs from one to another. Likewise, the holding Tax in Jharkhand also changes from one property to another. To keep it simple, each property in Jharkhand has its own Holding Tax. So to calculate the holding/property, you can use Property/Holding Tax Calculator provided in the Suda Jharkhand Portal.

Follow the simple steps below to calculate Holding Tax for your property in Jharkhand.

- Go to the official portal, i.e., https://suda.jharkhand.gov.in/, under “Property/Holding Tax,” tap on “Tap Calculator.”

- Select the appropriate ULB in which your property is located.

- Click on the “Go Now” button.

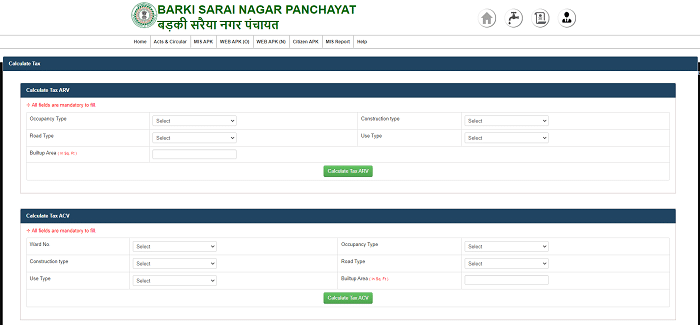

- Fill in all the fields under the “Calculate Tax ARV” section to calculate based on Annual Rental Value.

- After filling in all the fields, tap on the “Calculate Tax ARV” to know your holding tax as per ARV.

- Or if you want to calculate based on Actual Cash Value. Fill all the mandatory fields under the “Calculate Tax ACV” section, and click on the “Calculate Tax ACV” button,

- Now you see your holding/property tax as per ACV.

Know Your Holding Tax Collector In Jharkhand:

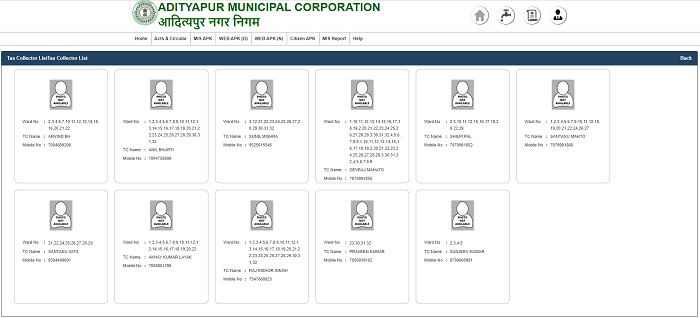

Each Ward/Gram in Jharkhand is allotted with Holding Tax Collectors. If you want to pay your Holding Tax, you can call your Tax collector and tell them to come and collect the payment at your doorstep. To know your ward/gram-holding tax collector, follow below simple steps:

- Visit the Official website of the Suda Jharkhand Portal.

- Select “Know Your Tax Collector” under “Property/Holding Tax.”

- Select your ULB from the drop-down on the new page and click on the “Go Now” button.

- You can see the Tax Collectors’ names and their Contact Numbers.

- Finally, note down your appropriate Holding Tax Collector per your ward number.

FAQs Related To Property Tax In Sudha Jharkhand:

What is the official website of Jharkhand State?

The official website of Jharkhand Municipal is https://suda.jharkhand.gov.in/

What is the procedure for paying property tax in Jharkhand?

Citizens can make payment of their Property tax bill in Jharkhand using the official website of Jharkhand Municipal https://suda.jharkhand.gov.in/ or by visiting the nearest Municipal office of their respective area or the government-recognized service centers.

What is the validity of Property Tax Documents for Property Tax in Jharkhand?

The property tax documents are valid for one year. So, every year it has to be renewed.

Are there any penalty charges for not Paying Property Tax in Jharkhand?

Yes, If a taxpayer does not pay the tax amount within the given period, the concerned department may charge a penalty.

What are the documents required to make property tax payments in Jharkhand?

Aadhaar Card, 15–digit holding number, old property ID, Owner’s name, and Property address are the required documents to make the property tax payment in Jharkhand.

Suda Jharkhand Holding Tax Online – https://suda.jharkhand.gov.in/:

Suda Jharkhand Holding Tax is a significant financial burden for many citizens living in Jharkhand. The state government has therefore taken steps to reduce this burden. suda.jharkhand.gov.in has established an online platform with the intent of creating a more transparent and safeguarded system. This portal offers a calculation tool that can calculate the taxes of a particular property based upon various factors and provides different payment systems, such as debit cards, credit cards, internet banking and NEFT/RTGS. Anyone who wants to protect their financial standing can access this online service and pay off this burden. In addition, the citizens of Jharkhand living in rural areas, urban centers, and semi-urban areas will be able to pay their holding/property taxes through this special portal.