The Sukanya Samriddhi Yojana (SSY) is a small deposit scheme launched by the Ministry of Finance only for a girl child. The Hon’ble Prime Minister introduced it on 22nd January 2015 as part of the Beti Bachavo Beti Padhavo (Save the Girl Child, Educate the Girl Child) campaign. The SSY scheme aims to cover a girl child’s education and marriage expenses.

The Government of India announced this scheme on 14th December 2014 to encourage parents to initiate a fund for their female child’s future education and marriage expenses. You can apply for the Sukanya Samriddhi Yojana scheme through Post offices, public sector bank branches, or the branches of three private sector banks: HDFC Bank, Axis Bank, and ICICI Bank.

The girl child’s parent or legal guardian can open the account. The age of the girl must be below 10 years. For a girl child, only one account is allowed. A family can open only 2 Sukanya Samriddhi Scheme accounts. This article will provide all the information related to the Sukanya Samriddhi Yojana scheme, such as calculator details, necessary documents, benefits, eligibility criteria, interest rates, etc.

Sukanya Samriddhi Yojana Overview:

| Name of the Scheme | Sukanya Samriddhi Yojana |

| Introduced By | Ministry of Finance, Government of India. |

| Launched on | 22nd January 2015. |

| Main Objective | To encourage parents to start an investment in their female child’s future education and marriage expenses. |

| Beneficiaries | A female child and her family. |

| Minimum Investment | Rs. 250/- per annum. |

| Maximum Investment | Rs. 1,50,000 per annum. |

| Maturity Period | 21 Years. |

| Interest Rate | 8 % |

| Application process | Offline. |

Sukanya Samriddhi Yojana Calculator Details:

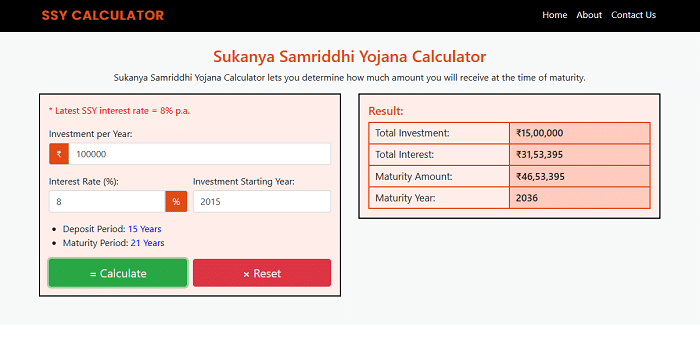

The Sukanya Samriddhi Yojana calculator is a tool that helps individuals calculate the estimated maturity amount of their investments in the Sukanya Samriddhi scheme. The calculator considers factors such as the initial deposit, annual contributions, and the applicable interest rate to provide an approximate value of the maturity amount.

Calculate Sukanya Samriddhi Yojana Account’s Maturity Amount Manually:

The following are the steps to guide you on how to calculate the maturity amount manually.

- Firstly, you have to decide on the amount you want to invest as an initial deposit in the Sukanya Samriddhi Yojana account. The minimum amount is Rs. 250/-.

- Choose the annual contribution you want to make to the account. The minimum annual contribution is Rs. 250/- and the maximum is Rs.1,50,000.

- The Sukanya Samriddhi Scheme account is valid for 21 years from the opening date or, if the girl child marries before that time, until she turns 18 years old.

- Now, find out the current interest rate for the Sukanya Samriddhi scheme. The government announces the interest rate and is subject to change.

- Calculate the maturity amount using the following formula to estimate the maturity amount.

A = P (1+r/n)^ nt

Where:

A = Compound Interest.

P = Principal Amount.

r = Rate of Intreset.

n = Number of times interest compounds in a year.

t = Number of Years.

- By entering the appropriate values into the formula, you can estimate your Sukanya Samriddhi Scheme account’s maturity amount.

Calculate Sukanya Samriddhi Yojana Account’s Maturity Amount Online:

If you can find the manual process difficult, you can easily calculate the Sukanya Samriddhi Scheme maturity amount using the SSY calculator. The following steps are to calculate the Sukanya Samriddhi Scheme maturity amount online.

- Visit the https://ssycalculator.net website.

- The Sukanya Samriddhi Scheme calculator page will open, here you need to enter the necessary details like “Investment Per Year”, “Intrest Rate”, and ‘Investment Starting Year” and then click on the “Calculate” button.

- Then the result will appear in the “Result” box. It contains “Total Investment”, ‘Total Intrest”, “Maturity Amount” and “Maturity Year”.

- In this way, you can easily calculate the Sukanya Samriddhi Scheme account’s maturity amount using the online calculator.

Sukanya Samriddhi Yojana Interest Rates Details:

The interest rate of Sukanya Samriddhi Yojana is determined by the government and is subject to change. The interest rates have already changed throughout time. The following are the interest rates for Sukanya Samriddhi Scheme.

- Financial year 2014-2015, the interest rate was 9.1% per annum.

- Financial year 2015-2016, the interest rate increased to 9.2% per annum.

- Financial year 2016-2017, the interest rate got reduced to 8.6% per annum.

- In the financial year 2017-2018, the interest rate was 8.3% per annum.

- Financial year 2018-2019, the interest rate was 8.5% per annum.

- Financial year 2019-2020, the interest rate was 8.4% per annum.

- Financial year 2020-2021, the interest rate was 7.6% per annum.

- In the financial year 2021-2022, the interest rate was 7.6% per annum.

- In the financial year 2022-2023, the interest rate was 7.6% per annum.

- In the financial year 2022-2024, the interest rate is 8.0% per annum.

Application Procedure For Sukanya Samriddhi Yojana :

Any participating bank or Post office branch can open a Sukanya Samriddhi Yojana account. The following are the steps to open the Sukanya Samriddhi Scheme account.

- Firstly, you need to visit the bank or post office, where you want to open the account.

- Request for the application form of Sukanya Samriddhi Yojana from the counter.

- Fill out the application form with the necessary details and attach the mandatory documents.

- Make the initial deposit amount required to open a Sukanya Samriddhi Yojana account. The minimum amount is Rs. 250/- and the maximum is 1.5 lakh.

- After completing the application process and verifying documents, you will be issued a passbook for the Sukanya Samriddhi Scheme account.

- The passbook contains the details of the account, such as the account number, name of the account holder, deposits, interest earned, and withdrawals.

- This way, you can complete the Sukanya Samriddhi Scheme account application process.

Sukanya Samriddhi Yojana Eligibility Criteria Details:

- The girl child for whom the account is being opened must be below 10 years of age at the time of account opening.

- The scheme is available only to Indian citizens. Non-resident Indians (NRIs) cannot open a Sukanya Samriddhi Scheme account.

- Only one account can be opened per girl child. In the case of multiple girl children in a family, separate accounts can be opened for each of them, subject to meeting the age criteria.

- The girl child’s parent or legal guardian can open and operate the account. They will be responsible for managing the account until the girl child turns 18 years old.

Sukanya Samriddhi Yojana Document Details:

- Birth certificate of the girl child.

- The applicant’s parent or legal guardian’s Photo ID.

- The applicant’s parent or legal guardian Address proof.

- Other KYC proofs such as PAN, and Voter ID.

- Sukanya Samriddhi Yojana account opening form.

- A medical certificate must be submitted in case multiple children are born under one birth order.

- Any other documents that the bank or post office requests.

The Sukanya Samriddhi Yojana is a special scheme for girls in India. It helps parents save money for their daughter’s future needs like education, marriage, and more. Parents can save regularly and earn interest on their savings, by opening an account. The scheme offers attractive interest rates and tax benefits, making it a good financial option. It aims to empower girls and promote their education and well-being. Sukanya Samriddhi Scheme is a wonderful opportunity for parents to secure a bright and prosperous future for their daughters.