CDMA AP Property Tax: Are you a property owner in Andhra Pradesh and tired of the hassle of paying your property taxes? Look no further than cdma.ap.gov.in – the state government’s official portal for all property tax payments. This user-friendly online platform lets you pay your property taxes quickly, securely, and conveniently from the comfort of your home or office. Plus, with its easy-to-use interface and step-by-step instructions, even those who are not tech-savvy can easily navigate the portal.

No more long queues or tedious paperwork – cdma.ap.gov.in simplifies the process and saves you time and energy. Avoid any penalties or legal issues with the timely payment of your property taxes. Make your life easier and pay your taxes with ease thanks to cdma.ap.gov.in.

How To Pay CMDA AP Property Tax From cdma.ap.gov.in?

If you own a residential property in Andhra Pradesh, you can pay your tax online using the official website of the Commissioner and Director of Municipal Administration, Andhra Pradesh Government. If any person wants to pay the Property Tax first, then they should know about Property Tax Dues. The following are the steps to know about property tax dues.

- First, the property owner should visit the official website of the Commissioner and Directorate of Municipal Administration. The official website is https://cdma.ap.gov.in/

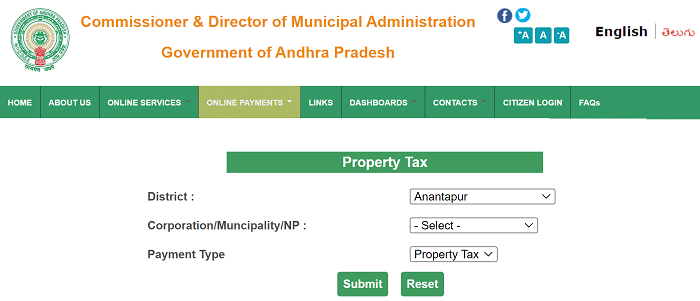

- The home page will appear, here, you must select Property Tax under the Online Payments Tab.

- The Property Tax page will open, here, you have to enter your District Name, and Corporation/Municipality/NP, then select the Payment type as Property tax.

- After entering the details, you have to click on the submit button.

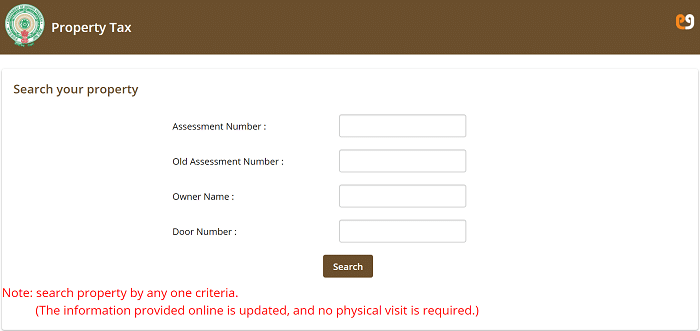

- Then the property search dialogue box will appear. Here you have to enter the required details like Assessment Number, Old Assessment Number, Owner Name, Door number, etc.

- After entering all the details, click the search button redirecting to the payment section.

- Here you have to click on the ‘Pay Tax‘ option then the paid amount will be displayed on the screen.

- After that, you have to make the necessary payment through Internet banking/credit card, then you have to click on the submit button. Before submitting the page, you have to checklist the terms and conditions.

- Finally, on the successful payment, you will get an acknowledgment receipt.

How To Know Property Tax Dues Using cdma.ap.gov.in Portal?

- The Property Owner or the Consumer should visit the official website of the Commissioner and Directorate of Municipal Administration, i.e., https://cdma.ap.gov.in/

- The home page will appear, here, you must select Property Tax under the Online Payments Tab.

- The Property Tax page will open, here, you have to enter your District Name and Corporation / Municipality / NP and then select the Payment type as Property tax.

- After entering the details, you have to click on the submit button.

- Then the property search dialogue box will appear. Here you have to enter the required details like Assessment Number, Old Assessment Number, Owner Name, Door number, etc…

- After entering all the details, click the search button redirecting to the payment section.

- Here you have to click on the ‘Pay Tax‘ option then the paid amount will be displayed on the screen.

- In this process, you can know your Property Tax Dues.

How To Pay Property Tax AP Using Puraseva Mobile Application?

The persons can also pay the property tax using their mobiles. The following are the steps to learn how to pay property tax using Puraseva Mobile Application.

- Firstly, you should visit the Google Play Store

- Then you have to download the ‘Puraseva‘ application

- After installing, you have to open the app, and you have to click on Create an account

- Now, you will get a registration page. Then you must enter the required details like District Name, Full Name, Active Phone Number, and Active email Id. And also you have to create a password and confirm the password

- After registration, you return to the home page and log in with your District, Phone number, and password.

- Here you can make the payment.

- In this way, you can pay the property Tax using Puraseva Mobile Application.

How to Pay CDMA Andhra Pradesh Property Tax Using Citizen Service Center (CSC)?

People can also pay their property tax using Citizen Service Center in their Urban local bodies for availing this service.

How To Calculate CMDA Property Tax In Andhra Pradesh?

- You should visit the official website of the Commissioner and Directorate of Municipal Administration, i.e., https://cdma.ap.gov.in/

- The home page will appear, here you have to select ‘Property Tax Calculator ( to know the tax to be Levied )‘ under ‘Highlights Tab‘

- Here, you have to select ‘Property tax Auto Calculator‘

- The property tax calculator page will open, here you have to enter your District Name and Corporation / Municipality / NP, and you have to click on submit button

- Calculate Property Tax page will open, here you have to enter the required details like Measurements, IGRS Details, Floor number, Building Classification, Nature of usage, IGRS Classification, Construction Date, Plinth area, and Building Plan Plinth area

- After entering all the required information, you have to click on the ‘Calculate‘ button

- Finally, you will get the details. In this way, you can calculate property tax.

Andhra Pradesh Property Tax is calculated based on parameters like the Property’s age, area of the plinth, zonal location of the area, residential or non – residential status, type of construction, and other parameters. If any citizen of Andhra Pradesh can also check the property tax using the property tax calculator available on the official website of the Commissioner and Director of Municipal Administration. i.e., https://cdma.ap.gov.in/. The following are the steps to know about how Andhra Pradesh Property tax is calculated.